|

Economic growth around the world is gaining momentum as we head into 2014. In several recent articles I made the case that globally oriented cyclical stocks and sectors will outperform in the year ahead.

Last week, I pointed out how basic-materials stocks – metals and mining shares, in particular – offer investors a built-in margin of safety due to historically cheap valuations.

Energy is another one of my favorite sectors today, with strong fundamentals thanks to growing U.S. oil and gas production and also very attractive valuations.

And here’s another sector to add to your “buy” list for 2014: technology. In fact, technology looks like the best bargain in the S&P 500.

|

| Technology stocks have solid balance sheets, strong dividend growth, and high foreign sales exposure to drive earnings gains in 2014 and beyond. |

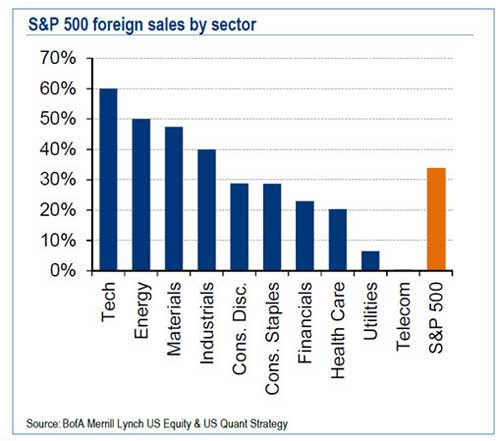

First, technology stocks generate the most international sales than any other industry, as you can see in the chart below. Sixty percent of sales come from overseas, compared with 35 percent for the broader S&P 500.

And for technology stocks, the majority of global sales are sourced in faster-growing Asian markets, instead of slow-growth Europe and the U.S.

If you think iPhones are hot-sellers this holiday season in the U.S., consider that Apple could generate $3 billion in sales – or almost a quarter of this year’s total revenue growth – just from China Mobile, the world’s largest cell-phone carrier with 759 million subscribers.

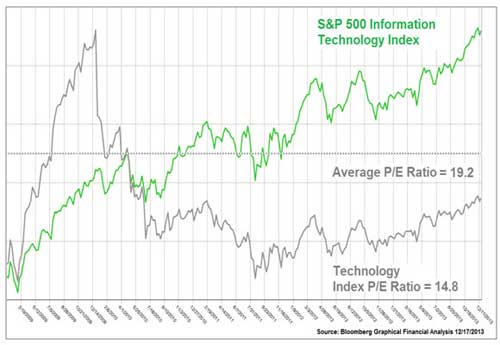

That said, you might think tech stocks would be trading at a premium to the rest of the U.S. stock market. But the opposite is true.

Traditionally, price-to-earnings (P/E) ratios for tech stocks command a steep premium of about 20 percent relative to the S&P 500. Today those same shares trade at a 6 percent discount.

That’s the biggest bargain in more than 20 years and near all-time lows. In fact, based on steeply discounted P/E ratios alone, the implied upside potential is 30 percent for tech stocks just to return to “fair value.”

As shown in the chart above, the S&P 500 Technology Index is priced at 14.8 times expected 2014 earnings per share. That’s a substantial 23 percent discount to the tech sector’s historical P/E ratio of more than 19 times earnings.

By comparison, the S&P 500 Index trades at 16.7 times earnings today, and 15.2 times next year’s estimates. So technology shares are clearly cheap compared with the overall market and every other sector.

In my view, no other industry has the best combination of valuation and strong growth potential in the year ahead.

In fact, technology stocks as a group have solid balance sheets, with more cash on hand than debt (the only sector in the S&P 500 with zero net debt), strong dividend growth, and high foreign sales exposure to drive earnings gains in 2014 and beyond.

As an added bonus, technology has historically outperformed all other stock market sectors when interest rates have been on the rise, as has been the case recently, and is likely to continue next year.

As for the best bets within the tech sector, explore Internet-software, electronics and communications-equipment shares.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 2 comments }

not a member of facebook

not a Pratt grad