|

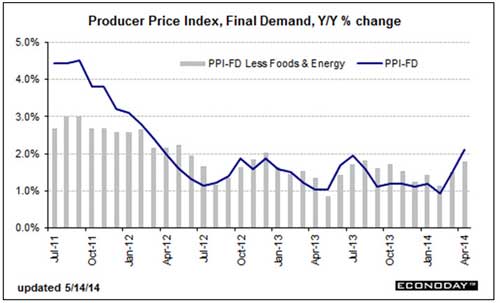

Government reports in the past week show that producer prices increased at a 2.1 percent annual rate in April, a level that hasn’t been seen since early 2012 and marking a clear change of trend from what we’ve seen over the last three years. And that trend of low inflation is what has allowed the Federal Reserve to keep pumping. Suddenly, the calculus has changed.

Even after removing food, energy, and trade services, the “core” measure of PPI still increased at a 1.8 percent annual rate — suggesting the push of higher prices is broadly based and likely to be persistent.

The bulls tried to pooh-pooh the result since the government recently modified the way it measures producer inflation for the first time since the 1970s, adding services and profit margins to the mix in an effort to capture a more complete picture of where inflation stands within the supply chain.

But with food prices driving some of the increase — which makes sense given the epic drought underway in America’s most fertile regions as well as the smallest U.S. cattle herd in generations — as well as the fact core PPI wasn’t far off the headline number — it’s ‘hard to argue that the results are tainted. The food component of final demand jumped 2.7 percent month-over-month, up from the 1.1 percent rate seen in March, the 0.6 percent rise in February, the 0.7 percent rise in January, and the -0.2 percent decline in December.

Bottom line is that the Federal Reserve wanted inflation as a preferable alternative to the deflation threatened during the great financial crisis of 2008, and now it appears to be here. The question then becomes how to contain it, and how much of a negative effect will it have on price/earnings multiples. Those two big questions will be answered over the next three months.

* *

The question of inflation is very salient for technology companies, which would like to raise prices but have largely been stymied.

Look at Netflix (NFLX), which has taken heat over its attempt to lift the price of its video streaming service. The company first said a month ago that it charges new customers more not just to see the back-catalog movies on its roster, but of course its original programming such as “House of Cards” and “Orange Is the New Black.” Netflix prepared for this by testing a one-euro increase in the cost of its service in Ireland. And when there was not much protest, it announced plans to raise prices by $1 to $2 for new streaming customers elsewhere in the world.

The company said it would allow current customers to keep their current prices, remembering that it caused a fiasco when trying to raise prices back in 2011. But it made the increase sound like a benefit, arguing that higher prices would allow the firm to acquire more content and deliver “a better streaming experience.”

Customers should be able to withstand the increase, as streaming entertainment has become one of the most important trends in technology and media. But the point is to observe how gingerly the company has had to approach the question of raising prices, and how it has attempted to tiptoe as if avoiding land mines just to do something that once was considered a normal part of consumers’ lives — being asked to pay more for stuff.

It looks as if this is going to be something consumers will have to get used to, as Amazon.com (AMZN) has announced it plans to start charging more for its Prime service as well. Prime delivers a lot of benefits, such as reduced shipping charges and free access to a lot of recent television programming. Yet the point once again is that the company felt as if it had to practically beg customers to accept a price increase.

It would be better for companies to be able to raise prices fluidly, without embarrassment, if they truly offer a better product or experience. It should in fact be the prize that a company wins for earning the trust of its customers. Looking forward over the next year, we might even consider tech companies that manage to lift prices — and thus margins — as especially capable and worthy of investors’ attention.

Keep an eye on this development, and let me know if you see any noteworthy price increases in the tech products that you regularly purchase, either as consumers or at your jobs.

Best wishes,

Jon Markman

{ 1 comment }

“… tiptoe as if avoiding land mines just to do something that once was considered a normal part of consumers’ lives — being asked to pay more for stuff.”

First, apologies since I have to be very critical of this article. Above is just one quote among several that are bizarre. The hallmark of a growing & productive economy is deflation. For one with a 40 yr debt hangover it’s just inevitable. The only reset is debt destruction. We’ve been on a depression glide path since ’08 and the lost growth is gone forever. The reinflation is merely building a bigger catastrophe. This writer seems to merely want it for risky portfolio growth. Unbelievable. My only strategy is trading. The public largely won’t invest, especially now, since they know a setup is being built for more wealth destruction, plus they’re broke. But most pundits can’t figure that out. Same as it ever was.