|

My “Chaos and War” story last week seems to have struck a chord, prompting a flood of high-quality responses on my blog.

I’ll give you my feedback in a moment. But first, my key point is this:

If our leaders and allies still think they have the power to impose their brand of peace and freedom on the Middle East, they need to check into an insane asylum.

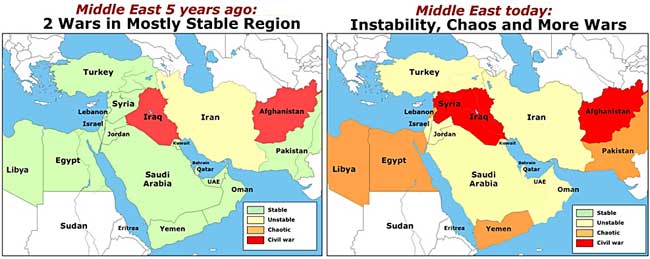

Indeed, five years ago, even with two wars raging, the Middle East was mostly stable.

Today, nearly the entire region is plagued by instability, chaos and wars — seismic shifts with potentially earthshaking consequences for the global economy.

Now on to the next big question: What about Syria?

Unfortunately, it sits right on top of a series of fault lines that split the region along many dimensions.

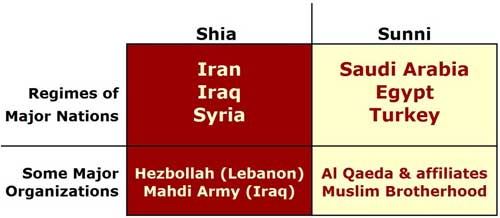

Fault line #1 is the millennial conflict between Shia and Sunni, dating back to the death of Muhammad in the year 632.

Until the last century, it was mostly submerged. Now, it’s exploding into a regional war.

This conflict has been the single largest factor behind 134,000 civilian deaths in the Iraq war and 106,000 deaths so far in the Syrian conflict.

It has engulfed nearly the entire region, pitting neighbor against neighbor, country against country, even terrorist against terrorist.

Regimes of major nations on the Shia side include Iran, Iraq and Syria; and on the Sunni side, Saudi Arabia, Egypt and Turkey. Most terrorist and other organizations also fall into one or the other camp.

Which side is the United States on?

Answer: Neither and both!

In Iraq, the U.S. is on the Shiite side. It deposed the Sunni regime of Saddam Hussein, ultimately throwing the entire nation into the hands of Iran.

In Syria, the Obama administration’s proposal before Congress to bomb Assad plays directly into the hands of Sunni jihadists.

And all over the region, the U.S. supports repressive Sunni regimes, where large Shiite populations are in various stages of revolt.

Fault line #2 is the battle between Muslim fundamentalism and modernism, between those who seek a return to the Middle Ages and those who wish to move forward into the Third Millennium. This fault line is what

- splits the Syrian rebellion between reformists and jihadists and

- tears Egypt apart at the seams.

Fault line #3 is the biggest of all, also cutting through Syria. I’m talking about the West vs. the East, especially the U.S. and Western Europe against Russia and China.

This conflict is not based just on warmed-over memories of the cold war. Nor is it strictly a passing spat among friends with incompatible body language. Instead, it has all the earmarks of a hotter cold war between old powers on the decline and new ones on the rise.

In sum, today’s Syria is both the metaphor and the crossroads for multidimensional political and economic earthquakes that can reverberate across most of the region and much of the world.

On my blog …

Howard D. writes “It is so much easier to start something than to stop it. Why don’t the major powers get together with diplomacy and a big stick to Syria and promote peace?”

From your mouth to God’s ears, Howard! Unfortunately, though, after 25 years of warming since the fall of the Berlin Wall, world powers are back to drawing lines in the sand.

Francis adds that the U.S. is a corporation, and its chief executive must do what he’s told by the nation’s directors.

My response: Your comment reminds me of Eisenhower’s, probably the first and last U.S. president to warn sternly about America’s growing military-industrial complex. Underestimating its influence can be a mistake. But overestimating its long-term staying power can be equally treacherous.

Ron writes: “So here’s the plan. Get busy with a ‘narrow and limited’ bomb-throwing mission at Syria just to teach Assad a lesson. Then do what? Stand down? Meanwhile Syria and Iraq are lobbing scuds into Israel, leaving them to clean up the mess Obama started. Stand back and stay tuned.”

Good questions, Ron!

Richard D. addresses last week’s question — how will energy prices impact inflationary expectations and interest rates? “If we get involved in this war,” he writes, “we can be sure energy prices will rise. This, in turn, will drive up food, clothing, building supply prices, because we move most of our goods by trucks. Interest rates will make money more expensive to borrow, therefore making homes, cars, and appliances, even harder to purchase due to rising prices.”

Well said!

Brian M. writes “This market is at a crossroads. Accordingly, I have gone to the sidelines with much of my funds.” He lists his current allocations as follows: Off-shore equities, 5.5%; international oil and gas companies, 3.2%; precious metals, 11.1%; global currencies, 5.7%; and U.S. dollars in cash awaiting deployment, 74.5%.

Not too far off the mark, Brian!

Francis R. sums it all up this way: “We are truly in the end times — the time when man has lost control of his world. They will commit horrific crimes of hate and violence … and soon cities will burn.”

My comment: Any victim of Assad’s gas attack in the Gouta suburbs of Damascus on August 21st would probably say it’s already happened.

I cannot even begin to recommend a solution. But I can add a few words of hope: Mankind has been through worse before, and we survived. We can survive this time as well.

Good luck and God bless!

Martin

{ 1 comment }

Every argument or comment is a reason for STAYING OUT OF SYRIA and "let Allah sort it out"…

wait… isn't Obama taking his place?