Investors in U.S. equity mutual funds are rushing for the exits as if the house is about to burn down, which will inevitably knock out a key support for the stock market rally … at least that’s the bearish story.

But not so fast.

True, net outflows of domestic stock funds totaled another $4.2 billion in the week ending October 12th, according to industry data. This brings the year-to-date total of fund outflows to a whopping $108 billion, fast approaching last year’s record redemptions of $116 billion … and with two and a half months still to go.

But here’s the rest of the story.

Mutual fund outflows are part of a much larger trend that’s been underway for several years in financial markets. And far from a bearish tale, it’s a story of investors seeking lower fees and better performance in a world of lackluster investment returns.

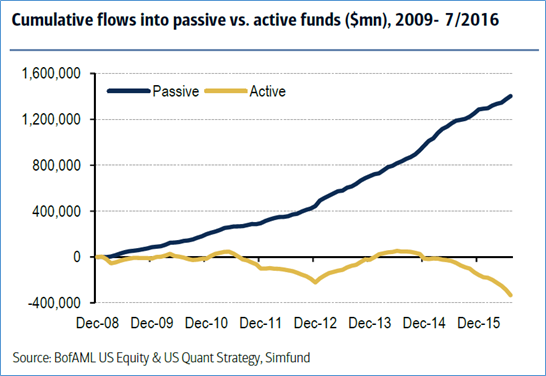

The reality, as you can see illustrated in the graph above, is that these outflows aren’t getting stashed under mattresses. The money is transitioning from actively managed funds into passive, index-tracking investments instead.

And the most notable winners of this flow are exchange-traded funds (ETFs).

Consider that U.S.-listed ETFs attracted $6.8 billion in new money last week, easily covering the $4.2 billion in mutual fund outflows, with a couple billion to spare. Year-to-date, U.S. ETFs have taken in a cool $164 billion, half of which has gone into bond funds.

The astonishing growth in ETFs is at the crest of a tidal wave of investor money that’s moving into passive funds, and it’s easy to see why.

Actively managed stock funds charge management fees of about 1% on average, compared to index-tracking ETFs with fees that are routinely 75% to 80% cheaper!

And to add insult to injury, not only are actively managed funds more expensive, but also their investment returns have routinely lagged the indexes, and index-tracking ETFs.

In other words, for years retail investors paid-up for poor performance in mutual funds, but no more. ETFs and other low-cost index funds are quickly gobbling up market share today.

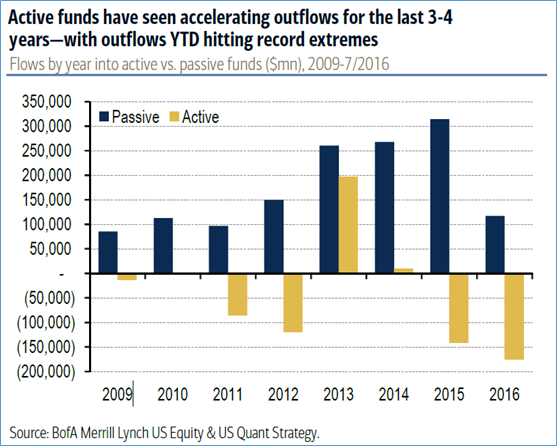

Just look at the scorecard below showing the year-by-year totals of money flowing into passive funds and out of active funds.

The largest player in passive, index-fund management is Vanguard. Over the past year alone, Vanguard has taken in a staggering $234 million in assets for its index-tracking funds and ETFs.

By contrast, some of the largest actively managed mutual fund companies in America are seeing steady outflows.

Boston’s storied Fidelity Investments, the largest active fund management company, had outflows of $40.8 billion over the past year. Rival Franklin Templeton has lost $44.8 billion in assets, while T. Rowe Price had outflows of $15 billion.

Bottom line: Don’t let perma-bears spook you with stories about a coming stock market collapse just because massive amounts of money are flowing out of mutual funds. That money is staying invested in stocks (and bonds). It’s just rationally transitioning into lower-cost and better-performing investment choices, mainly ETFs. What’s more, if you take a closer look at the funds you hold in your own retirement accounts, then you may decide you can save money and boost your returns by joining this trend.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 39 comments }

I’m looking to invest to supplement my income in dividend producing stocks or funds,

but I’m not familiar with the funds. Where would I go to get educated?

Just do an internet search. Search “Dividend stock funds”. It would be safer to invest in funds rather than individual stocks because your money would be spread out over many companies. Do not buy the funds at a bank, due to extra fees of 5 to 7% on top of the fund fees. Buy directly from the mutual fund companies. Search “Mutual fund companies with low fees”.

Hi Kindly confirm how and where I can search and learn about trading ETF’s?

Graham

Mike

What a confused lot at WEISS One newsletter says money moving out another says money moving in ?? Which way or is it both ways?

J

it would help if you put this in layman’s terms

Best ETF to invest.

So what IS the best ETF to invest?

I am currently invested in Vanguard, VGT, and very satisfied..Check it out

ETF’s and individual stocks are the way to go most of the time. I have kept some mutual funds because of performance over similar sector ETF’s and the fees were not much different. Doing one’s homework on a one by one basis is good policy.

Mike — is it $234 Million or Billion from Vanguard? $234 Million wouldn’t be a staggering amount.

Hi Mike

No wonder capital is sitting on a knife edge at the moment. I’m an investor into medium scale projects and I’ve just heard the proposals for economic growth by the two candidates. One wants to cut bureaucracy and taxes and initiate programs for growth and the other wants to do the opposite. So where would you park short term working capital with a rate increase coming? We’ll wait and see.

As one RIA to another, and 40 years as a stockbroker / money manager, you have aroused my interest. In addition, I have an ETF idea you will love. You may “e-mail” me at tekeser@aol.com

The more interesting part of the story would revolve around the problem: Why are active fund managers having a hard time beating the market? Are managers dumber than in the past? Is the market getting skewed by the Fed or other government actions? Is Joe Sixpack smarter about managing his own money? Is an influx of foreign money changing the character of the markets? Or… Or…

I believe it’s all of them. I am Joe Sixpack, or in my case Joe Bourbon. In the past 8 years I have made a decision to become more educated with investing my own money. Thanks to the internet, I have found many people like myself doing the same thing. All I know is by handling most of my investments and performing Due Diligence, I have been staying in the green and also reducing fees that I know longer need to pay out. I only wish I started sooner.

Interesting, Very Interesting. Looks Like “If You Want It, You Got It!”

I divested my mutual fund holdings after the 2000-2001 fiasco and now only hold individual stocks in my portfolio. I have followed and compared my holdings with similar investments in mutual funds and the individual stocks outperformed the funds by a wide

margin for the past 15 years. The mutual funds generally perform considerably poorer

when markets decline and never seem to catch up with individual stocks when the markets rebound.

Be Just As Smart As You Are & Vote For Donald Trump. Please Show Your Interest In America’s Future By Voting For It…

Very interesting presentation-I loved reading about the stronger banks and weaker ones.

The Alaskan banks surprised me the most because my husband and I lived there ( in Delta Junction, AK, 100 miles from Fairbanks). He did some work at Ft. Greely where he worked as a wildlife biologist and we were there for six months. It seems so strange that the Northern bank can be stronger than the Southern.

WRONG MOVE!

Do not vote for Trump!

Hillary is a LIAR and self serving.

Vote TRUMP!

Good report,Mike.

Who is ranked 1& 2 in US ETF’s as you mentioned Vanguard is#3

Sincerely

Ron

Please more info on Vanguard funds

YOUR COMMENTS ARE ON TARGET AND TIMELY.

Fred

“… boost your returns by joining this trend.”

You mean, joining this herd. No, I don’t trade that way. Agree that managed funds are worthless crapshoot ripoffs. They scalp your gains, and in a downtrend, magnify your losses.

I am invested in FASAX what do you think thank you

Do this,do that.What do you think of me cashing in everything and put it in the bank at 10% interest.My part of the world this is still possible – inflation run at 6.1%.What do you think?Sit it out and wait for the wave?

Thanks Mike for a great unbiased report!

Well said Mike and very, very true…… You are becoming the beacon for Weiss!….. :)

Good Report Mike. Maybe you even you worked alongside Jordan Belfort the wolf of wall street back, although that would be going back 30 years according to his book. His book is actually 4 books within the one book.

It’s good to see that more than just a few passive investors are starting to smarten up.

Which Vanguard fund do you recommend?

Trump will make the economy much better by bring new sound ideas & new people.

True, but if he wins the old is out the new will be fresh.

The old guard is sinking. I don’t want to treat water the next four years.

I think many of these ETF’s may not have the money to redeem all the shares in a sell off.

Whats your take?

Brian

The present guard is not going to be showing much to excite our young investors.

I hope you consider & think more about the new technology, ideas(things being kept quiet until new blood is in charge)and restrictions removed on so many things. Vote out the old guard & get them out of our way in both parties.

Do some study…. Millenials want Hillary 68% to 20% for Dump….. What FAUX News did not share that fact?

http://www.aol.com/article/news/2016/10/18/new-poll-shows-who-millennials-want-to-be-the-next-president/21585987/