|

There’s no doubt about it: Gold and silver bulls have been getting hammered lately.

Gold is trading near a four-month low. And silver is trading at levels last seen in April of last year.

Overall, it’s been a lousy stretch for precious metals. And looking at the charts, I’m still cautious. In fact, I am now watching gold and silver tiptoe around key support levels.

But I am willing to stay long and buy these dips as long as the key support levels hold.

So, what sent the price of gold plummeting some $90 from its June high?

The likely culprit is largely the result of rising real yields. Real rates tend to have one of the strongest influences on gold prices.

And the recent sentiment has shifted to more of a hawkish tone among central banks, thus pushing yields higher. U.S. real yields are now at the high for the year.

So, with another interest rate hike still expected later this year, what could be the catalyst that sends gold prices higher again? My take: Overly bearish sentiment.

Here’s what I mean …

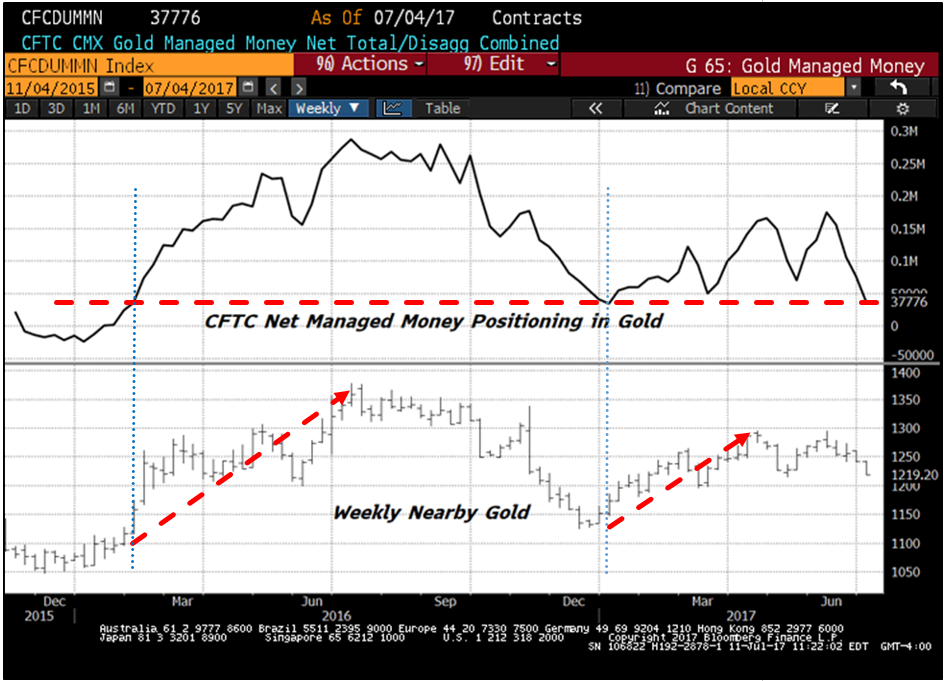

The latest Commodity Futures Trading Commission (CFTC) data showed that money managers cut net-long positioning in gold for a fourth straight week. And they slashed speculative positioning by the largest percentage since the start of the year.

Take a look at the chart above. The net-long positions in gold futures and options dropped 51 percent to 37,776 contracts for the week ended July 3, according to CFTC data. It was the least-bullish holding since January.

The decline in net length means much of the potential long liquidation has already occurred. In fact, the last time we reached these levels gold rallied 11 percent.

What’s even more interesting when looking at the details is that the gross shorts dominated the recent selling. Short positions, or bets on price declines, surged 31 percent to the highest since January 2016.

This tells me that there is not as much downside firepower left in the gold market. So selloffs should become increasingly limited from these levels.

Now, this doesn’t mean that shorts don’t have more room to push prices lower. It just means that it will be more challenging considering that gold has already fallen substantially.

Bottom Line: I like gold and silver at these levels but with a great deal of caution. The Edelson Institute cycle forecast charts also call for plenty of volatility in gold prices over the next few months.

So, while we need to remain cautious, I recommend that you seize this opportunity to add to your gold positions or to start a new position if you are not already investing in gold.

But you should not go “all in” just yet since I suspect there will be additional opportunities to add to your gold holdings over the next few months.

An easy way for gaining exposure to gold in your portfolio is now through ETFs.

You can purchase ETFs – like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) – on dips as gold maintains its bottoming process throughout the summer and into the fall.

Best wishes,

David Dutkewych

{ 9 comments }

THE HOLY GRAIL

Personally, I would rather wait for gold to come to me. Where am I at ? About $850/ounce, and I’m a very patient man. In addition, I prefer physical precious metals ( bullion coins ) not just ETF’s (Paper Gold ). That way, there is zero counterparty risk and I have full control of the asset in hand. So, I can wait nearly forever and if the spot price of gold never again comes that low, then I’m just fine with that outcome.

Not imperative to buy at these prices ( still quite high) unless you are a genuine Gold Bug. The official gold bullion price still on the books of many central banks from the old days when the late President Nixon took us off the gold standard in 1971 is about $49.0/ounce. Gold is subject to market manipulation by futures traders and large Banks alike and probably towards the high end most often. Consequently, there is plenty of market risk built-in to gold at these prices, especially if you buy and hold it rather than trade it.

However, gold makes an excellent hedge for bond fund holdings at a ratio of about 1:10 when used conservatively. Just don’t try to time a volatile asset subclass like gold or silver. Its a crap shoot no matter how you attempt it, even with Larry’s A.I. Program. Its only a best guess. You could just as well throw darts at the board. Just keep looking.

ill consider gold at $900.00 and silver at $11.00 an ounce then its time to back the truck up until then forgettt abouttt ittt

The real reason is the manipulation by the fed, ppt and connected banks. Watching the markets is similar to watching fake news on CNN.

Like to know what special instructions you have to buy Gold & Silver.,whether mine stock or physical gold

Bullion.

Thanks

Y0U WILL NEVER SEE $900 GOLD AND $11 SILVER THE MINERS WOULD GO BELLY -UP THERE ALMOST THERE NOW. BUT RHODIUM THATS A DEAL…

That’s what everyone said about oil.

AG & AU, the Periodic Table symbols for silver and gold. BUT, they are also the ticker symbols for two of my favorite silver and gold stocks. Pull a two-year chart on both and take a look at their action between 12/15 & 8/16. You’ll get some idea of the potential when the metals finally take off for real.

I am willing to wait and consider gold a hedge against unpleasant consequences. It has a better track record than any other tangible safety net. Also, reading about who the bigger hoarders are, I think that is also an indication that keeping the price low is for the benefit of others who are manipulating it down until everyone else has dumped theirs so these few can ride in and reap the product…similar to trying to control silver in England years ago.

Seems like 8 years of increasing supply of dollars(and other currencies) would have to have a weakening effect unless there is another equal demand force; passive 401K investing and other nationals fleeing their own paper money may provide that force, but our U.S. buck is looking weak to me, and I am thinking gold and silver will go the other way(up). That may be starting now. I wish I was a guru and could tell you folks something certain, but I only have a simple, humble opinion; so don’t give it much weight. Thank you.