| MARKET ROUNDUP | |

| Dow | +64.33 to 18,076.27 |

| S&P 500 | +4.47 to 2,114.07 |

| Nasdaq | +22.71 to 5,099.23 |

| 10-YR Yield | +0.10 to 2.366% |

| Gold | -$8.60 to $1,185.80 |

| Crude Oil | -$1.60 to $59.66 |

Wall Street has gotten very used to falling interest rates. But those days are rapidly coming to an end.

Treasuries are tanking in price, while yields are surging right up to key technical levels, amid a slew of fresh reports and data.

They generally point to improving foreign economies, a bottoming out in deflation risk, and a rebound in beaten-down commodities prices.

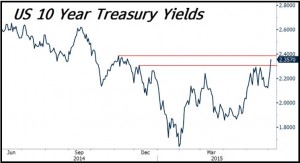

Take a look at this chart of the yield on the benchmark 10-year Treasury Note:

You can see that yields spent most of 2014 and early 2015 falling – to as low as 1.65% from just over 3%. But today, the 10-year yield zoomed as high as 2.39%, testing the six-month high it touched at the beginning of May. A breakout here could lead to a move as high as 2.6%-2.7% in the not-too-distant future — pushing rates on things like long-term mortgages higher.

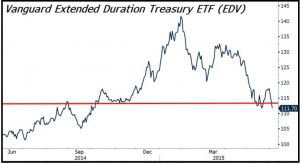

On the flip side, investor losses are piling up in Treasuries and other bonds. Here’s a chart of the Vanguard Extended Duration Treasury ETF (EDV), one of the longest-term, liquid U.S. ETFs.

You can see that it topped out way up around $142 in January … but has since plunged to $112 and change. That’s a loss of around 21% in just five months, on supposedly “safe” U.S. government bonds.

The latest rally in yields got started in Europe yesterday, when May inflation figures came in hotter than expected. News from ADP this morning added more pressure. The private payrolls company said the U.S. economy created 201,000 jobs in May, up from 165,000 in April.

Then European Central Bank President Mario Draghi piled on, saying at a post-meeting press conference that he thinks European inflation is bottoming out and that the European economic outlook is starting to improve.

| “My advice for some time has been to stay the heck away from long-term bonds.” |

The result? Even more bond selling. As a matter of fact, yields on German benchmark bonds are suffering their biggest 48-hour yield surge since 1998.

My advice for some time has been to stay the heck away from long-term bonds. They offer nowhere near the yield cushion you should demand for the price risk they entail.

I also believe that the move in yields could benefit some core bank and financial stocks, as well as cheap, economically sensitive sectors like energy — at the expense of sectors like utilities and REITs. So you may want to adjust your portfolio more in favor of the former and away from the latter.

So what do you think about this move in yields? Is this the start of a sustained rise in interest rates and decline in bond prices? Or is it just another short-term spike? What about inflation and foreign economic growth – picking up … or not? Have you trimmed your long-term bond holdings, or added sectors like financials and energy to benefit from these developments?

The Money and Markets website is your best outlet – post your thoughts there as soon as you can.

| Our Readers Speak |

Should we be encouraged … or worried … about all the M&A out there? And what about the latest debacle at the TSA? Those are a couple of the topics that had you fired up at the website.

Reader Mike P. said he’s encouraged by the latest spat of deal-making, saying: “I see the surge in M&A as a good sign for the future. It’s obvious companies are attempting to take advantage of cheap credit before interest rates rise.

“The fact that they are willing to do so at market highs is telling me they believe the trade-off between cost of credit and valuations favors cost of credit. In other words, they don’t expect valuations to fall significantly when rates do finally start to rise. It is prudent to do the M&A now rather than later.”

But Reader Reality Guy said that spending all this money on M&A is just another way corporations are helping to hollow out the U.S. economy. His take:

“Things won’t get better economically in the United States because corporations want to maximize profit to the managerial class by off-shoring labor to 3rd and 4th world workers in locations where there are no laws against exploitation.

“On top of this, the corporations want to evade U.S. taxes by using offshore havens to stash their profits. This brand of ‘vampire capitalism’ will continue to eviscerate/undermine any real growth to our country. If the majority of Americans have inadequate or stagnant job prospects/wages, how can they afford to support a growing economy?”

Meanwhile, on the airport security front, Reader Jim had the following observation on TSA incompetence: “The TSA has to be the most outrageous multi-billion dollar bill of goods ever sold to the American people. This is government waste at its worst.

“Have the 50,000 agents ever caught a single terrorist? The Israelis have superior security with only a handful of trained observers using standard profiling techniques.”

Thanks for sharing. It’s clear we need to get our airport security situation up to snuff, given the ongoing terrorist threats to the system. If anyone slips through the gantlet, it will have huge costs in terms of lives lost and economic damage.

As for M&A, I agree that it’s a sign of increased CEO confidence. But at the same time, we need to see more corporate wealth invested in workers, plant and equipment if we’re going to see the economic recovery broaden out.

Want to add anything else? Then here’s the link where you can do so!

| Other Developments of the Day |

The brinksmanship in Europe is continuing today, with Greek officials threatening not to ship a 305-million euro payment off to the International Monetary Fund unless creditors relent on certain bailout provisions. That’s the first of a handful of payments totaling 1.6 billion euros – money the Greek government can’t afford to cough up. Negotiations will continue over the next day or two.

Congress took the first step to roll back some of the post-9/11 measures that dramatically expanded the U.S. government’s surveillance powers. Thanks to new legislation, the National Security Agency will soon have to take additional steps to gain access to huge batches of phone call data, following a six-month transition period. Resistance to blanket anti-terrorism actions stemmed from the efforts of Kentucky Senator Rand Paul and others philosophically aligned with him.

On the economic front, the U.S. trade gap shrank to $40.9 billion in April from $50.6 billion a month earlier. Analysts attributed most of the improvement to the end of the West Coast port strike, given the strong dollar’s ongoing depressing effect on U.S. exports.

Boston police and FBI agents shot and killed Usaama Rahim yesterday, after the subject of an active terrorism investigation allegedly refused to put down a knife he was wielding in a threatening manner. A separate suspect, David Wright, was apprehended as part of the investigation.

What do you think of the new NSA restrictions? Will they make a difference? How about the latest phase of the Greek negotiations? How will they turn out? Share your comments over at the website when you have some time.

Until next time,

Mike Larson

{ 33 comments }

Hi,

It appears that everything is in a “state of stagnation” – unwilling to move either front or back, just biding time, for the “big one”

what then? when the big guys “lose their pants” who and what takes over?

the “little people” are broke, so they are no factor – the people with the “loot”, deep pockets people will buy up “good companies” giving them more power than they already have. How does that help the problem? in my opinion it just makes it worse,

“the big just get bigger” – Rothschild secret success – wait until blood is running thru the streets!

the rich just get more powerful – stealing it from the poor of course! one way or another, using government of course!

the fact that “its coming” is nothing new; those that know, know this, the question is how and what then?

everyday trading is not the answer – its meant for the people that like to trade – like playing the horses etc. proves nothing in the short and long of it!

win/lose is a guessing game – find a good psychic and let him/her do the speculating!

Edgar Cayce a renouned psychic was capable of one hundred percent predictions, even for the stock market – how come?

maurice rothman

We are not moving forward or backwards because we are,except the 1%,all sinking together?The rich and powerful today need no army but technologies that are out of reach and not well understood(purposely),by the 99%.Then there will be a world wide revolution in such situation as before,or invasion by the desperate barbarians.

How many police and FBI agents does it take to subdue one man with a knife? Answer: You don’t subdue him, you shoot him. I have an idea for an electronic device that would disable a knife wielding man. Is anybody interested in investing? I think I have name for it. How does Tazer sound?

Seriously Richard, You have a Member of ISIS / ISIL roaming the streets of Boston wielding a Knife. He could have grabbed an innocent bystander and slit his throat!

Apparently, there were plans to Decapitate a Police Officer in Boston.

You sound sympathetic to this Lunatic. Maybe You should have been there to Disarm / Taze him…

Yes, I’m glad they Shot him DEAD… No Trial, No waste of more Tax Dollars on a TERRORIST!!!!

You Libs are all the same. Maybe they should have offered him some chocolates and a meal if he laid down his Machete!!!

Damn!!!

as for rates, they will gradually increase as as the dollar continues continue it’s inevitable

descent as more folks avoid the dollar. Barack and his minions have done their jobs

So if I have an extra $1,000 burning a hole in my pocket I could invest in a 10-year Treasury note and get a 2.4% return… or I could apply it to my 3.625% mortgage and pay it off sooner. No brainer.

Re recent M&A activity and Reality Guy’s claim that corporations are “evading” US taxes. Maybe if the US didn’t tax their profits if they return them to the US after those profits have already been taxed by the country their operations are located in, maybe they would bring some of those profits back to the US and invest it in the plant, equipment and employees that the US economy desperately needs.

The Israelis can do one thing we can’t, which is profiling. The Europeans also do it, more discreetly. This is why TSA is a joke.

As the US is likely to be heading into a recession, rates have nowhere to go but down in the next year, probably reaching lows not seen since 2012, perhaps even lower. The yield curve will eventually invert, with the Fed in a big struggle with the bond market.

Right now, what you’re seeing is low-volume dumb and/or foreign money flowing in and out in a panicky state.

As one of those “little Peoples” out her in the hinterlands with very little extra money to invest, I find myself complelled to stay with the Federally-induced hyper-inflation. I currently have a few bucks in the “one percent” Money Markets at my local bank but all I read is that Big Brother can either order at any time to withhold, confiscate of ignore savings of the poor! All the “advice” I hear are from self-serving orgs that want extra capital to invest in their inside information! Oh for a little honesty in how i can insure the small amount of savings I’ve managed to hang onto for a rainy day! I fear that those days have disappeared with the Dinosaurs?

The Federal (in particular) government has become more and more overbearing in its intrusion into our daily lives. There has been a period of using every crisis real or imagined as the justification for the increased presence in everybody’s business. Suddenly everybody has become suspect. You may remember several years ago at a smaller airport the pilot of charter aircraft was talking to the tower as the passenger boarded. The pilot’s name was Jack something. One of the passenger boarding saw the pilot and greeted him with “Hi Jack”. The airport was shut down for several hours by the local Sheriff’s Swat team. I think it is past time to get the government out of everyday lives. We get more and more regulations. Wear your seat belt, put on your helmet, don’t waste water. When will they declare a toilet paper crisis and try to regulate that? Imagine the Toilet Paper Police crashing through your bathroom door if you use one too many squares. Why does that sound like a Fox Network comedy?

balderdash!

Do you want real jobs and economic growth? Do you really want a solution? Then change the federal tax code that now taxes jobs and wealth growth to a one tax progressive sales/consumption tax system called the Fairtax. It is a bill in Congress HR 25 / S 155. The FairTax bill includes companion legislation to repeal the 16th Amendment to end direct taxation. The 16th Amendment enabled the income tax, the IRS, payroll taxes and tax withholding. Repealing the 16th Amendment will take huge taxing power from the government, lobbyists and special interests and renew our Freedom, Liberty and Civil Rights. Learn more, join the “grass roots” cause and contribute at fairtax.org

Although NSA is being restricted, how about the records they already have. They aren’t restricted from using them. The O’Bama government is an irresponsible government. A more responsible president/government would not have these restrictions on it.

The NSA doesn’t want to know what I’m thinking, and I bet I have a lot of company.

That we haven’t figured out its better to tax consumption rather than labor is really mystifying. That simple change in our approach would automatically erase many of the inequities in our tax system. What could possibly be unfair about the people who spend the money paying the taxes? Thrift is a wonderful American trait that is brutally punished now. Just plain backwards.

About time we learned that a police state with no restrictions eliminates all freedom. Greece needs to implement changes. The rest of us ought to see what unlimited printing of money does to your Nation.

Interest rates have bottomed long term; proving again the markets set interest rates and not the federal reserve. The fed will play catch up in 60-90 days PRETENDING they control interest rates.

Greetings ..Back Again about Federal Reserve Moving on rates… Like I have said since January the Fed will make the move on ” Triple Eve of what people call Halloween” October 28th,2015. Before this during the summer their will be record breaking highs in the stock market !! Hello October the Most Valuable Month of the Year.2015.. Get ready as in September 2015 will this be the month where many will cause a bond collapse ??? What happens to yields!!Get Ready Get Ready , October is coming up quickly… Record Stocks drops in the market. Fed raises Its rate !! Does China join the basket of funds?? Is the IMF going to become in the future the world reserve of Monies … Europe.will hang on by 2020 . Then the game ends .. Get Ready.. The Whirlwind of 2015 to continue. Robots out doing humans in stock picks by favorable margins. Happy Summer to All…

Pure logic,Greece,People there can retire at 55 years old on the full Gov.pension,while here in the UK,Germany,and the rest now have to work till 67-69,and the greeks are demanding the 55 rights and their stoney broke.Stop the bus I want off !.Where are they coming from.

Greece will return to their previous currency, the Drachma, within the next 12 months.

All the current Drama is to just Infuriate / justify the GREXIT.

Greece is like a Welfare State, just mooching of those who try to succeed through hard work.

If they don’t exit the Eurozone by choice, they should be Kicked Out!

They close all their museums at 15.00,for a country that relies on tourists from different time zones.No more island hopping till after April(no precise date).You have to fly back to Athens and out again,even if the journey by boat is just half an hour.However, the private sector do work hard.

Oh and there is a separate man and desk to buy only 3 possible trips tickets to each town such as Delphi;another town another desk.And they make sure that you will arrive in Delphi just as it is closing and run for your return bus.We got there before15.00,but they close the museum 10 minutes before the time scheduled.They say come back again tomorrow.

Losses in the bond market will continue to mount, albeit with volatility. This will eventually lead to a crash in the general stock markets. Only at this point will bond yields drop just as dramatically as they rose. Jmvho.

after getting “shafted” by pro’s over the years, at 81 I just want to get a few hundred $

to buy enough silver to carry me 10 years when social insecurity disappears. bob

As I approach 65 I’ve been giving the SS deal a lot of thought. Despite all the talk we here I don’t think we have a lot to worry about. 75 million baby boomers have paid their dues and expect to be paid. That is a lot of political clout. Social Security can be fixed, it’s just going to take someone with true grit to tackle the problem. Buy the silver anyway and hope you don’t need it.

I am curious about the crazy market in China. On May 26th, 2015 there were quite a lot of articles about China’s ‘A-Shares’ being opened up to foreign investors.

Apparently it will be a gradual opening, over the next 2 or 3 years.

Looking at the ‘China CSI 300 Index’, there has been a 139% gain in the last 12 months.

Most of the gains came since Mid November 2014.

From what I have read, June 9th is the date that foreigners can enter this market.

I currently have 8% of my assets in the Vanguard VEIEX mutual fund (401k), in which Vanguard announced that it will be changing the fund, to include some of these Mainland Class A-Shares.

Just wondering, with the recent run up in that market, whether I should pull out of VEIEX for the time being.

Any thoughts on the CSI 300 Index?

What is going on in the China market reminds me of the U.S. Market in 1928-1929. Lots of new players entering the market using margin. You know how that ended.

Dear Mike, I’m curious as to whether this explosion in bond interest rates recently is the beginning of the mother of all bubbles that you and Martin have been talking up since 2007?

You both have been wrong for 8 yrs regarding interest rates, and 2.39% for 10yrs is hardly worth the effort to park cash for 10yrs.

I predict that rates will fall back again and you and Martin will continue telling us subscribers that rates are poised to explode higher in the next 50yrs

Quote As for M&A, I agree that it’s a sign of increased CEO confidence. Yes they are all standing alone on the top of a high mountain being masters of all they survey. Pockets bulging with money.

What about the great rate implosion of 2011

No way can Greece pay billions to creditors if they are already having a problem with millions; end of story! German workers are NOT going to fund Greek pensions. The best answer is for Greece to take responsibility for it’s own future and drop the EURO and live with the consequences of past over spending. They will be the first of many who have to finally pay the piper one way or another.

Good for the Boston Police. They should have let that P O S marathon bomber bleed to death, saving several million dollars in the cost of prosecuting the S O B.

This country has not seen inflation or deflation for several years now. It looks more like recession to me. What will be the tipping point to go inflation or deflation? Greece default would point to deflation and most likely now the default will be post pone till Oct when China most likely will be in the basket of world reserve currencies. That, along with China opening up for investing will take billions out of the dollar economy and world reserve status for China investments and prosperity. Forcing interest rates to stay low in America and deflation to reign for couple of years. Imports to rise in price and exports exel for America. American oil would be cheaper abroad with the China currency addition forcing the Middle East to fight harder for their share of market. China will then be able to print money, inflate their currency to make it cheaper to export their products and at the same time supply consumers with spending power to excel their economy and import. Welcome to America’s system, China.