|

Last week in Money and Markets, I explained why poorly performing stock markets can experience a dramatic reversal of fortune. Stocks and industries at the back of the pack one year often rise to the top the following years, and vice versa.

That is the time-tested dynamic of mean reversion, which I have seen play out time and again over many decades. So a good question to ask as year-end approaches is: Which stocks and sectors with lackluster returns this year are the best candidates to rebound in 2014?

One sector at the top of my list of potential outperformers is energy.

|

| American energy production is booming. |

In October, for the first time in nearly two decades, the U.S. produced more crude oil than it imported. This is only the most recent milestone along the road to U.S. energy independence as new technology contributes to an ongoing boom in unconventional oil production.

Imports of crude oil peaked at more than 60 percent of total U.S. consumption in 2005. And by the end of next year, foreign oil will account for only 28 percent of consumption. That will be the lowest amount of imported oil since 1985. And within the next 10 years, the U.S. will become the world’s largest oil producer.

This is truly a great American success story that’s still unfolding, because the domestic energy boom is just getting started.

Why Energy Stocks Are Underperforming

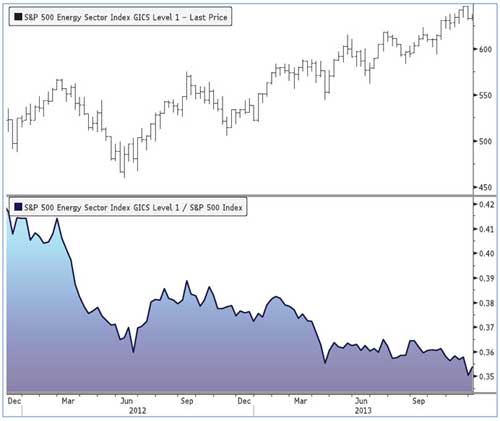

In what seems like a glaring disconnect to the booming domestic energy business, energy stocks have been lagging the broader market, not only in 2013, but for the past several years.

Since December 2011, the S&P Energy Index has advanced only 21.7 percent — just half as much as the 42.6 percent gain in the S&P 500 Index. Concerns about a slow-growth global economy and falling prices for oil, and especially natural gas, have weighed on energy-sector performance. Indeed, since the August high of $112 a barrel, domestic crude oil prices have fallen $20 a barrel.

But this short-term underperformance is creating a great long-term buying opportunity in a key cyclical sector, which looks extremely undervalued today. The S&P Energy Index has a price-to-earnings ratio (P/E) of just 14.2, a discount to a P/E of 16.8 for the S&P 500. Also based on price-to-book value, the energy sector trades at a discount of nearly 20 percent from its average valuation over the past 30 years, implying significant upside potential.

Energy stock valuations already reflect slowing global growth and the recent decline in oil prices. Any positive surprises in the economic data next year, say, faster-than-anticipated growth in the U.S. or emerging markets, could pay off in spades with an upside reversal in energy-sector performance. There are many ways to play the sector, including dozens of ETFs and hundreds of individual stocks large and small.

Big energy producers like Exxon Mobil (XOM), of which Warren Buffett just purchased a notable stake, are more leveraged to the price of oil and economic growth. The big E&P (exploration and production) and major integrated oil stocks see profits rise and fall with the price of crude. The iShares U.S. Oil & Gas Exploration & Production ETF (IEO) is one way to play this part of the oil patch.

Meanwhile, companies that provide drilling rigs, equipment and oil-field services can at times be a less-volatile play on a bounce in energy. Energy-service stocks certainly won’t be immune if oil and gas prices continue to tumble, mind you, but their longer-term contracts can provide these stocks with a steadier revenue stream and more stable profits. One ETF that fits the bill here is the SPDR S&P Oil & Gas Equipment & Services ETF (XES).

Energy stocks have lagged the overall market for the past few years and many oil and gas stocks are now undervalued relative to the S&P 500, which is getting pricier as stocks advance. An upturn in global growth next year makes this sector a great candidate for mean-reversion as energy stocks move from near-worst to first in the performance derby.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 1 comment }

Mike 100 % behind you regarding your view on energy . Have a safe and healthy new year …