|

I’m not trying to brag. But one of the things that gives me great peace of mind is that I don’t owe a nickel to anybody on this planet.

Nada. Zilch. Zip.

I have zero credit-card debt … my vehicles are completely paid for … and I don’t have a mortgage on my home. And let me tell you: It feels fantastic!

Of course, I make a good living, I’m single and in my 60s. So, I’m in a different boat than many Americans.

However, I think the main reason why I’m debt-free is that I live a modest lifestyle. And I have always tried to live within my means.

That’s not true of most Americans …

The Treasury Department reported that U.S. consumer debt hit $13 trillion as of June 1, 2017, an all-time high.

$13,050,826,460,886, to be exact.

That’s double what it was 10 years ago, and a ridiculous 90% of our country’s annual gross domestic product.

There are lots of reasons why Americans are building a mountain of debt, but I think the two main ones are:

- The Federal Reserve’s zero-interest rate policy has temporarily made it cheap to borrow money.

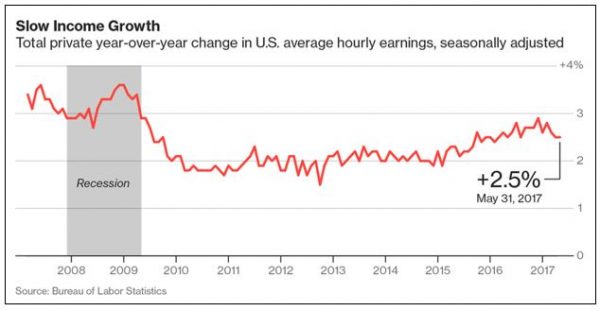

- Incomes have grown so slowly that all the I-want-it-now folks have financed their spending with debt instead of living within their means.

More importantly, the primary purpose of debt is to pull future consumption forward to current consumption. In short, all that debt translates into lower consumer spending in the future.

More importantly, the primary purpose of debt is to pull future consumption forward to current consumption. In short, all that debt translates into lower consumer spending in the future.

This debt is already starting to catch up with our fellow Americans. Example: In the first quarter of 2017, consumer spending grew at the slowest pace since the end of 2009.

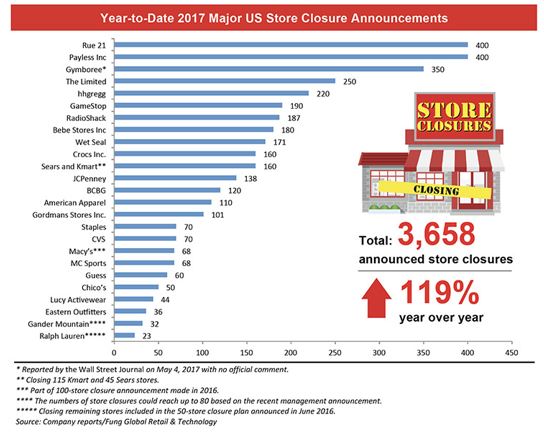

A slew of retailers have coughed up profit hairballs and are closing stores all over the country. This list includes retail stalwarts like Radio Shack, Sears, Macy’s, and J.C. Penney.

And that’s just what we saw in the first half of 2017. By year-end, Credit Suisse says retailers could have shuttered more than 8,600 brick-and-mortar stores.

Now … that sounds awful. But there is money — BIG MONEY — to be made from awful news.

For example, the Commerce Department is set to release the retail sales numbers for May tomorrow, on Wednesday, June 14.

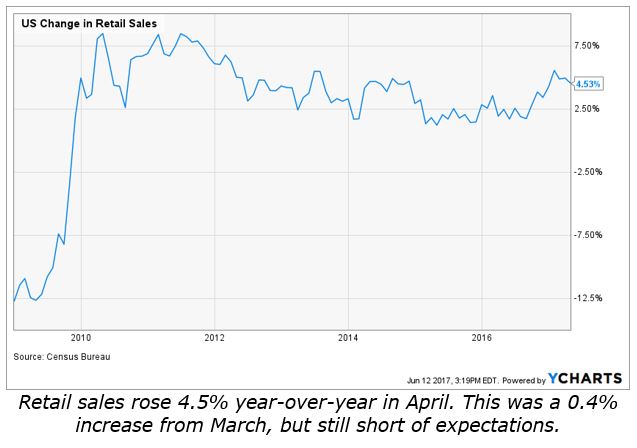

The Wall Street crowd is anticipating a 4.8% year-over-year increase in retail sales. But given the horrendous debt load that Americans are saddled with, along with the crystal-clear trend of falling retail sales, the odds of worse-than-expected numbers are very high.

Last month, the retail sales numbers were reported on May 12. But they came in well-below expectations: 4.5% on a year-over-year basis, while Wall Street was expecting 5.2%.

As a result, the SPDR S&P Retail ETF (XRT) got hammered on those worse-than-expected numbers. XRT fell from $42.91 on May 11 to $40.97 just a week later — a 4.5% decline.

Consider what that means …

You could have made a 4.5% gain in just one week by short-selling XRT ahead of the retail sales numbers release.

If you’re not comfortable with short-selling, you could instead buy shares in an inverse ETF that is designed to profit from falling prices of retail stocks, such as the ProShares UltraShort Consumer Goods ETF (SZK).

However, you could have made HUGE profits with options — as much as 600% and 820%, in fact — if you had instead bought put options on XRT.

Short-selling stocks/ETFs and buying put options isn’t for everyone. But if you’re flexible and have some risk capital, trading ahead of the monthly calendar of economic releases is a good way to make a potential mountain of money.

And by the way, the opposite of better-than-expected numbers is also true.

In either case, there are always opportunities — both bullish and bearish — to be found by following the regular, recurring economic news releases every month of the year.

Best wishes,

Tony Sagami

{ 6 comments }

Hey,

Sorry to not have signed up for the calendar, missed out I guess. Do you have an extra copy you might could email to me? If so, thanks so much.

I am a financial learner follower type of person. My son just took the 2nd exam out of 3 for CFA. I admire his commitment, discipline, consistency

Want to pass on the financial calendar to him.

Bye

Ellie

Hi- Value article!! Thanks much, Tony. RDC

ðŸ›

Any new short sales??

Should’ve, would’ve, could’ve. Any future plans on what we should, would, or could do now???

I may want to sign up for this advisory. What is the cost?