|

Apple (AAPL) launched a cynical attempt to gain some attention last week, committing the corporate equivalent of a “selfie,” by confirming at the Code Conference its widely speculated $3 billion acquisition of privately held Beats Electronics.

There is a lot less here than meets the eye, or ears. The deal will be largely neutral for the business, as the headphones niche is a drop in the bucket for a company the size of Apple, and the streaming music service created by Beats is even less remunerative.

It’s mostly an amazing admission that iTunes Radio has been a failure, which is true. And it is an admission of sorts that the iTunes download business is dying. And finally it amounts to Apple, a square but wealthy company, taking what it considers to be a sexy “trophy wife” in its old age.

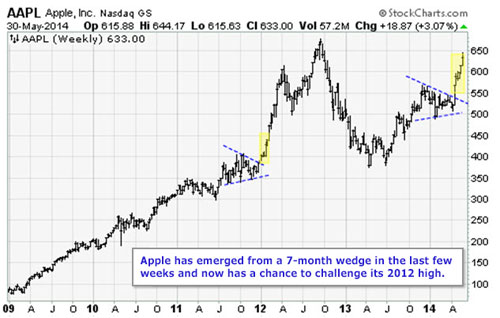

The whole effort would be laughable if it were not for the fact that Apple shares are quite cheap following its recent two years in the wilderness. Investors have largely given up on its ability to truly compete any more, which is why they are only giving the shares a forward price/earnings multiple of 13x. If investors had any real confidence in the company, the P/E multiple would be at least 19x, which would mean the price would be around 50 percent higher, or around $1,000.

|

| Apple shares are quite cheap following its recent two years in the wilderness. |

The shares will probably get there as the company is likely to finally take some steps to win investors’ ardor back. The Beats acquisition, as pointless as it may be, is a first step.

Think about how much the world of music has changed since the original innovation of the iPod and the iTunes store. Back in the early 2000s, it was hard to get digital music, and very few devices were set up to play it. This was the heyday of iTunes, the only good software at the time for the acquisition of songs, and the iPod, which was the best playback device. The world changed when iTunes disintermediated the old logistical chain of artist-producer-label-store, and allowed consumers to buy songs a la carte for 99 cents rather than in album form for $16.

Now music is plentiful for free or cheap from a dozen sources, ranging from Spotify and Pandora to YouTube. Beats and Grooveshark, and music playback has become just a feature of every smartphone and tablet. In short, both music and devices have become commoditized, taking away Apple’s former edge.

Considering this sea change, Apple had to make some kind of change in its business model. It’s going to try to convince people that the Beats music curation service is somehow better than Spotify and Pandora (which it emphatically is not) and that the Beats headphones are special (they’re not).

I really don’t know how this opens a wedge for Apple in the smartphone market share battle in which it is losing ground every day to Android devices, and even Windows.

And thus in my view, this was largely an “acquihire,” in which Beats founders Dr. Dre and Jimmy Iovine become full-time Apple employees. Dre will likely leave, so it’s up to Iovine to be the trophy wife.

Apple chief exec Tim Cook seems to think that this was a coup, but the annals of business history are filled with such deals that don’t turn out well; it is very hard for strong-minded executives to merge their capabilities. They typically end up in divorce court.

Maybe this one will be different, but the bottom line on this deal is that it’s more about image than dollars. Apple is not growing much anymore, and its dated product lineup is in shambles after two years of no innovation. Yet the stock is so cheap and over-hated that it can advance anyway just because it is a good value.

If that makes no sense to you, consider the opposite: There are plenty of great companies whose shares go down, seemingly for no reason, when they are over-loved and thus overvalued. By the same token, non-great companies can see their shares rise, seemingly for no reason, if they are over-hated and thus undervalued.

Investors have been taught for years that they should invest in companies that make their favorite products — i.e., if you like Coke, buy Coca-Cola (KO). But this is too simplistic. If you like a product so much you want to invest in it, then a lot of other people probably like it too, and thus it is likely to be over-loved, over-owned and over-priced.

The better plan is to buy statistically cheap companies that are down on their luck and making a lot of mistakes — but which can return to favor should they take a set of new steps that win investors’ confidence back.

That’s where I believe Apple is now: Moribund, but with a chance to make a comeback. The excellent Parallax Financial model of intrinsic value now pegs Apple shares on a fundamental basis at $1,100. As a result, no matter how much analysts may sniff at the company and snort at the deal, the company’s shares are still worth owning.

Best wishes,

Jon Markman