|

Last Friday’s employment report was shocking. Economists were expecting the creation of at least 200,000 jobs in December, especially after ADP, a private firm, reported that employers added 235,000 jobs.

But what did they get instead? A meager 74,000.

First and foremost, that was terrible news for the economy. Many government officials and investors were just starting to believe that the labor market was picking up steam, and that continued strong job creation would begin to have an impact on the participation rate — the number of people working or actively looking for work. But now, fears are growing that the problem is becoming systemic, and the participation rate will just keep shrinking. That may make the official unemployment rate look better, but at what cost to the real economy, and society as a whole?

A Dramatic Reaction from Commodities and the Dollar

The reaction to the weak employment report was swift and dramatic. The U.S. dollar moved sharply lower, and contra-dollar assets such as gold and crude oil shot up. The surge in oil prices may seem counterintuitive at first. After all, wouldn’t a weaker labor market mean less demand for energy?

|

| A new bull market in commodities requires inflationary pressures, which are still nonexistent. |

That’s probably true, but far outweighing that concern was the anticipated reaction to the jobs data from Washington. Most investors now believe the Federal Reserve won’t continue to taper its quantitative easing program given the anemic numbers.

According to their thinking, weakness in the economy equals a continuation of QE. The liquidity QE provides equals lower interest rates. Lower interest rates equal a weaker dollar. And a weaker dollar equals higher commodity prices.

What Are Commodity Bulls Missing?

However, a new bull market in commodities also requires inflationary pressures, and those are still nonexistent. In fact, the December employment report actually refuels fears of deflation. In order for inflation to arise, hiring must pick up and wages must increase.

You may hear commentators in the financial media claim that the Fed’s QE program will necessarily create inflation. But if $85 billion per month of funny money flooding out of Washington for the past two years hasn’t caused inflation yet, why would another two months, or even another two years of the same, have a different effect?

What the Future Holds for Gold

Given this disinflationary backdrop, gold is going to face continued headwinds. In order for it to break higher, inflation will have to pick up, either due to an erosion of confidence in the U.S. dollar, or a rapid improvement in the U.S. economy.

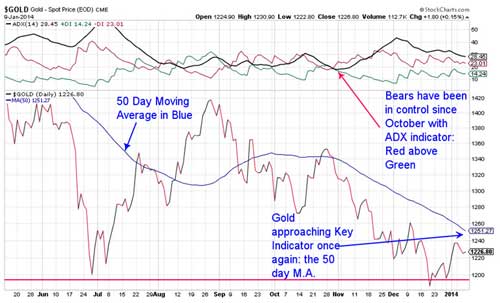

However, gold is starting to show some signs of technical strength.

As you can see, the precious metal is pressing up against its 50-day moving average, a key indicator that most traders watch closely. Gold hasn’t crossed that line since late October, and even then, it only managed to hold its gains for five days before succumbing to another bout of selling.

My guess is that we can expect the same type of tepid trade in the weeks ahead. The ADX indicator backs up this assessment, pointing to a directionless market, with gold bears still in control.

For those reasons, I remain skeptical about gold’s fortunes. Bulls are close to gaining control of the market but they’re not there yet. And until the charts show a clear trend shift, I wouldn’t recommend a move into gold.

Best wishes,

Douglas

{ 1 comment }

waiting for direction to play my PUTS