It’s right there in the Federal Reserve meeting minutes that came out this week, buried thousands of words into the transcript. A passage I couldn’t help but notice, one that reads as follows:

Market Roundup

“In U.S. markets, overall financial vulnerabilities were judged to remain moderate, as nonfinancial debt had continued to increase roughly in line with nominal GDP and valuation pressures were not widespread. However, during the discussion, several participants commented on a few developments, including potential overvaluation in the market for CRE, the elevated level of equity values relative to expected earnings, and the incentives for investors to reach for yield in an environment of continued low interest rates.”

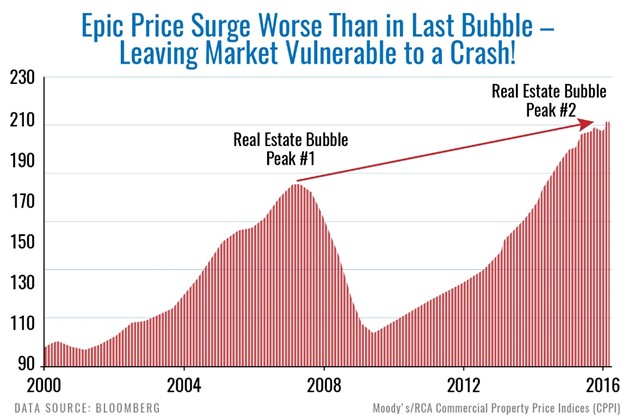

My response: Gee, ya think? Look at the chart below of a benchmark nationwide index that tracks commercial real estate prices:

You don’t need a Ph.D. in economics to see how out of control things have gotten. I did the math, folks. That’s a 95% surge in real estate values from the most recent trough through present day. In the epic 2001-2007 bubble … one that everyone pretty much agrees was the biggest real estate bubble in U.S. history … prices “only” rose 81%.

The sad part is, the Fed (as always) is way, way too late in noticing and talking about this problem. And the really scary part is that the rest of the Fed minutes make it clear that policymakers aren’t going to do anything to fix it! That guarantees this bubble will blow up in all of our faces, just like the housing and dot-com bubbles before it.

Of course, out-of-control real estate speculation is just one of many distortions caused by the policies enacted in the past several years. The Wall Street Journal reported today that investors are so demanding of dividends in today’s yield-starved world, that companies are dishing them out like Halloween candy – even when they don’t have the earnings to pay for them!

Specifically, S&P 500 companies are paying out the largest dividends (relative to profits) since the Great Recession – 38% of net income. Some 44 of the companies in the index paid out more in annual dividends than they managed to earn in the previous year.

|

|

| Dividends are a great way to reward shareholders … if you actually have the money to pay for them. |

Look, dividends are a great way to reward your shareholders. But that’s only true if you actually have the money to pay for them … and if you’re also investing enough money in capital equipment, factories, and R&D.

The latest business investment figures show that just isn’t the case though. Private fixed investment dropped at a 3.2% rate in the second quarter, the worst decline in seven years.

I could go on and on citing examples. But I think you get the picture. This is a gigantic “Everything Bubble” – and the sooner this madness ends, the better off we all will be in the long term, even as the shorter-term pain will be enormous.

What am I doing to help you survive what’s coming? Everything I can.

First, I’ve been issuing some of the direst warnings I have since just before the housing bubble began to pop 11 years ago. That includes my article this week on trouble in hidden corners of the credit market, and my early August piece on tightening lending standards in the banking business.

Second, I’ve been crisscrossing the country (and hitting the high seas!) this year to discuss these looming issues with investors like you, and to make sure you know how to protect and grow your wealth.

I’m traveling to The MoneyShow Toronto next month, for instance, and I’d love for you to join me for my presentations and panel discussions there. It’s scheduled for September 16-17 at the Metro Toronto Convention Centre, and you can register online by clicking here. Or just call 800-970-4355 and mention priority code “041484.”

Looking for something closer to home? Then consider the New Orleans Investment Conference. This blockbuster show is one of the longest-running, most important gatherings focused on metals, mining shares, and the broad markets.

It runs from October 26-29, and I would like nothing more than to see you there. Best of all, you won’t just get the chance to hear from me. The show also features some of the greatest minds in the investment world, including James Grant, Marc Faber, Charles Krauthammer, Peter Schiff, Stephen Moore, Brien Lundin, and more.

I can’t stress enough how perfect the timing is for this conference, given the incredible opportunities opening up in the metals markets – and the wild volatility we’re seeing in the markets overall. So if you have an opening on your calendar, and would like to learn more about the New Orleans Investment Conference, just click here. Or give our staff a buzz at 800-648-8411 for more details, and mention that you’re calling on my invitation.

Bottom line: This isn’t the time to be complacent, to sit on your hands, and to ignore the rising risks behind the scenes. It’s the time to educate yourself about all the ways you can survive – and thrive – in the coming turmoil.

Until next time,

Mike

|

Is there ever a time to buy negative-yielding bonds, or are they the worst investment in history? Is the stock market rampage going to continue, or is a comeuppance right around the corner? Those were just a couple of the important issues you’ve been discussing at the website.

Reader Chuck B. said the following with regarda to bonds that pay nothing: “An investor is a fool if he/she buys bonds that pay hardly any interest, or even cost money to hold (negative interest). A bond is a bit like an auto, which loses value when you drive it out the door. If you need to sell it before maturity, it sells for less than face value. But at least it should pay interest while you hold it, and be redeemed for face value at maturity.

“If it doesn’t pay a reasonable interest rate, greater than the rate of inflation, it is not worth buying, and should have no market. Government bonds may have some element of safety. But if they cost you money to hold them, they are not worth buying.”

On the overall market outlook, Reader Nels said: “The one huge advantage that individual investors have over institutional investors is that we don’t have to be in the financial markets. When there are no good investments, we don’t have to invest.

“The old rule of successful investing is to buy low and sell high. New market highs are no time to establish new positions. When everything is high, it’s time to start averaging out of your investments, and try to sell everything before the top. Eventually, if the bubble goes on long enough, you will wind up 100% in cash.”

On the other hand, Reader Ragnar1 said it’s tough to identify a catalyst that might cause a major stock market decline: “What will be the trigger for the ‘run for the hills’? Everyone will decide one morning to do so? The market is quiet now.”

But Reader Joe S. offered these words of caution, based on his decades of experience as an investor: “I have been investing in the market for 50+ years. I have never seen the world financial picture as convoluted as it is today. I think most people will agree that the 2008 meltdown was a large part of what is happening today. Overall, Bernanke did a good job to keep the financial world from a complete collapse.

“However, the stimulus package never went to Main Street. Then zero interest rates for the past eight years. Nobody on Main Street was making any headway to invigorate the economy. But now, the market is at an all-time high, riding the wave of cheap money.

“There’s a big storm brewing – but no one knows when it will blow the house down. All you can do is sit on your nest egg and wait for better times. Good luck.”

Thanks for those insights. I believe the markets are all coiling up for some potentially large moves, moves that could cause total chaos in stocks, bonds, currencies, and more. The timing is tricky, of course. But given where we are in the economic cycle, I do NOT think now is a good time to take on inordinate amounts of risk in all of our portfolios.

I’d love to hear what else you have to say on these topics over the weekend. So please hit up the comment section when you have a moment.

|

![]() Companies that operate correctional institutions on behalf of state and federal governments got crushed yesterday after the Federal Bureau of Prisons said it would shift back to government-operated facilities over time. It decided to take the step after determining that private facilities didn’t save enough in cost or provide the level of service required. Corrections Corp. of America (CXW) and GEO Group (GEO) plunged as much as 40% on the ruling, even though it only impacts federal institutions (rather than state prisons).

Companies that operate correctional institutions on behalf of state and federal governments got crushed yesterday after the Federal Bureau of Prisons said it would shift back to government-operated facilities over time. It decided to take the step after determining that private facilities didn’t save enough in cost or provide the level of service required. Corrections Corp. of America (CXW) and GEO Group (GEO) plunged as much as 40% on the ruling, even though it only impacts federal institutions (rather than state prisons).

![]() Interest rates are soaring, the currency is plunging, and investors are running for the hills … in Mongolia! The nation is in financial crisis because its currency reserves have dried up, debts racked up in good times are crushing its financing, and its resource-oriented economy suffers due to the slowdown in neighboring China. Some kind of International Monetary Fund bailout or debt default seems likely.

Interest rates are soaring, the currency is plunging, and investors are running for the hills … in Mongolia! The nation is in financial crisis because its currency reserves have dried up, debts racked up in good times are crushing its financing, and its resource-oriented economy suffers due to the slowdown in neighboring China. Some kind of International Monetary Fund bailout or debt default seems likely.

![]() That whole mugging thing, where four U.S. swimmers were allegedly held up at gunpoint by rogue Brazilian criminals posing as police officers? Turns out it may have been a made up and/or embellished story, at least according to Brazilian officials.

That whole mugging thing, where four U.S. swimmers were allegedly held up at gunpoint by rogue Brazilian criminals posing as police officers? Turns out it may have been a made up and/or embellished story, at least according to Brazilian officials.

They say Ryan Lochte and the other three swimmers actually showed up drunk at a gas station, vandalized a bathroom, and otherwise embarrassed themselves. Who knows where the truth lies, but clearly the back-and-forth has put a bit of a cloud over the Rio Olympics.

What do you think of the push by government to re-take control of correctional institutions? How about Mongolia joining the long list of emerging market nations in crisis? Will the swimming shenanigans prove to be just a footnote, or tarnish the world’s view of the Rio Olympics? Let me know what you’re thinking on these or other topics in the comment section.

Until next time,

Mike Larson

{ 28 comments }

I was glad to see that the Federal Government is moving toward taking back operation of prison facilities. I hope the States do the same thing. Prisons were never meant to be investments for profit. Far too many problems have arisen in privately run prisons. It was bad idea from the outset and I hope this is the beginning of the end for private prisons.

“Far too many problems have arisen in privately run prisons. It was bad idea from the outset and I hope this is the beginning of the end for private prisons.”

And there are no problems with Government run prisons? Just thinking of the catastrophe involving the Veterans hospitals. Isn’t it possible that the same corruptive management practices that have plagued the VA are also present in the Government prison system?

The S&P 500 companies aren’t concerned because they always benefit from Fed actions, whether the be taxing, regulating, and punishing Mom & Pops out of competition, or by tax payer bailouts; otherwise known as privatizing gains and socializing losses.

The vast majority of individuals responsible for past insider transgressions went unpunished before, obviously they do not fear prosecution this coming round either. Someone needs to be made to pay, but the Fed always sells out the little guy to save the Big Fish and Fat Cats!

the last metric, industrial production, has finally turn the corner. a good sign.

Stupid interest rates,but surely they cant afford to raise them,thats the mess we are in with fiat money plus the bubbles are everywhere,please dont start me off.

There may indeed be a major storm coming and, if it comes, I will be right in the middle of it with my IRA retirement savings. Oh well, who needs an IRA anyway with a large enough cash flow stream coming in. That’s me. Cheers!

Last September, retired after 53 years,

having been associated with investment

firms as a research analyst and portfolio

manager and senior management responsibilities. During that time, was

exposed to cycles of extreme market

volatility. Learned early on that longer

term investments in companies with

superior prospects for continued growth

in earnings provided far higher returns

than relying on the shorter term challenge

of attempting to forecast financial

market volatility shorter term in either

stocks and/or bonds. Clearly in my

opinion many “growth stocks” appear

fully valued short term, but will again

provide above average returns longer

term.

I could not agree more on your take of the fed and the horrible distortions in interest rates. Insurance companies, retirees, pension plans and a host of others have suffered and in many cases, the full price has yet to be paid. Not only is the fed raising in small increments, it is doing it slowly to increase, not ameliorate, the pain. One would almost think these actions are deliberately designed to cover bad fiscal policy. This will not end well.

Government retaking control of correctional institutions is a good move.

I agree this should not be controled by profit seeking corp,

, indicent!!!

The American swimmers may well have been involved in something they should have been. . . but why the reflex reaction to just run with the story by or MSM and accept at face value the info released by the Rio police.

Corruption and bribes are a way of life in Latin countries, plus making American’s look worse than they would have just doing the deed, is a bonus for countries that don’t like us that much anyway.

I read that the PE of the markets has risen to 25.1, versus a historical average of 15.6. This seems highly dangerous when S&P500 earnings have slipped 18% from their peak of $106/share over the last two years, while the S&P average has risen from 1950 to 2180. Other figures show business sales of $15.7 Trillion in June, 2016, down 3.4% from their peak in September 2014. Insurance companies are starting to complain about the low interest levels of safe(?) government investments, and are beginning to raise premiums to preserve their profits. These seem to be signs of an economy in trouble. Something will have to give, somewhere, at some time.

The 2008 bubble was created by individuals working inside large banks and brokerage houses who promoted and accepted mortgages made to people that were financially not good risks. The feds had to put out big money to rescue the economy. That is not what is going on now. Adequate down payments are required to get a mortgage unlike the 2008 bubble there will be less mortgage defaults or foreclosures. Low interest rates are creating more housing demands and causing houses to rise in price. As long as mortgages are based on sufficient down payments there shouldn’t be the same collapse that the 2008 crisis created.

It is getting to the point that finally people are now at long last listening less to the FED, except of course for the media; but that does not mean the FED will raise interest rates any time soon, certainly not before Election Day. And should they raise rates in December then there would be one hell of a political backlash to raising rates after the election rather than before, so don’t expect any rate raise this year. The FED’s real problem is that now their actions (in this case inactions) are starting to speak much louder than their words. This is also the media’s problem; so it will be interesting to see if the media will eventually wake up to what Mike and others have been saying for some time now.

Get the Republicans who are owned by the wealthiest 3%, out of the majority in Congress and our economy will begin to prosper again as it did during Obama’s first administration… It really is that simple…… America does best WHEN ALL AMERICANS DO BETTER and that NEVER happens during Republican Majority Congresses……

Mr. Eagle, is your memory so short that you don’t remember the growth in our economy when Newt and the Repub Congress forced Bill Clinton to take some common sense actions with federal spending? Are you actually pleased with Obama doubling our national debt in his 7 1/2 years in office? The Repubs have been unable to stop his brand of insanity because they are labeled “racist” if they try. Somewhere around 70% of the people say America is heading in the wrong direction. Who among us is so blind that they cannot see this?!

I sincerely hope your New Orleans investment conference is not under water like a lot of the state is today. I like your line up of guests except one Charles Krauthammer. I think this guy is nothing but a Fox News paid shill trying to get more than 15 minutes of fame. What a jerk. As someone now 78 years old and having lived many years and looking back I must say we have lost our way in this world mostly morally. I agree with the gentleman above in my 40 years of investing I have never seen the investment world so upside down. Its like a 3 ring circus with the Fed as its ringmaster. Sadly by now people should see through the Fed but they have not. Investors still make investment decisions based on Fed speak spin. Every 2 or 3 days one of its members is out there baying or braying about the economy because this is the only old weapon that they have left fear plain and simple. They are being disingenuous to investors and financial markets. They keep acting like the Gods on Mount Olympus but in essence they are really emperors with no cloths laid bare for all the world to see. As a footnote I see the SEC is finally sending out letters to companies telling well recommending that they us GAAP figures first in their financial reports before throwing reams of BS at you the investor interested in their company. What a joke the SEC is a tiger with no teeth. Companies ignore them and ride roughshod over them. So dear investor do you now realize that you have no friends on the government/big business side of the room.

charles krauthammer has a extremely high I.Q. do you

Leave it to the mainstream media to put this in the forefront and blew it out of proportion, not concentrating on the reason we’re really there which is the Olympics .

Continued investment in an overvalued stock market doesn’t make sense. Buying bonds at zero or negative rates doesn’t make sense. Our trade policies don’t make sense . The Fed doesn’t make sense. Holding large sums of cash within a fiat money system that prints trillions doesn’t make sense. The competency of our elected political leaders doesn’t make sense. Unelected bureaucrats controlling our businesses and our lives doesn’t make sense. The direction of our country doesn’t make sense. I’m finding it difficult to make sense out of anything anymore. Maybe I’m just not smart enough.

On another subject, Britain may never actually leave the EU. British voters have already begun to feel some of the costs of doing so, and the politicians will hem and haw forever about the details of leaving, so that it may never happen. A long, long, lloonnngggg goodbye,… until they miss the flight.

Chuck,

Just came back from there… I think they are gong to force a different agenda. One that keeps trading agreements without being tied to Brussel’s fored, “my way or the highway” policy…. England wnts to be free of the manditory decisions made in Bussels…. I think it will work….

most prisons are over crowded and underfunded ,hard to keep staff to work there

for those who want to close the private ones good luck to you

the killers, muggers etc will have no place to go and kill your families,when they are either released due to overcrowding or being non violent then know they can harm our friends and families with no risk of prision

Interest rates will begin to rise when the economy begins to improve more…… The economy WILL NOT begin to improve until the, last of the sold our to the wealthiest 3%, Republican members of Congress are thrown out of office……

The 3% has ALWAYS profitted when the Conservatives rule Congresss and the 97% have always won when the Cemocrates have the Majority……. 1932-1981: The 97% Won when led by Liberal Progressives….. 1981-2009: the 3% Won (and the 97% lost) under Conservative Domination…. It never changes, ecept the volume of Attack Ads from the Right Wing Conservatives since they got Citizens United by a Conservative Majority Supreme Court…..

When will we EVER LEARN…… :(

A well Eagle495, I would hope that you would eventually learn from all of the Democratic goings-on, but I hold not much hope it will happen.

Richard,

It is called Economic History of the United States and it is taught on most every reputable American College Campus… Those that do not learn history are doomed to lose…… For a kid who spent his younger years dirt poor, I’ve done extremely well since college……

thanku richard

The best sporting event ever held was the 2010 World Cup in South Africa. All the other African Nations are just military juntas propped up by hyperinflation. If you find the kitchen too hot and can’t pay your debts get out of the kitchen.