|

The U.S. Labor Department said Thursday that U.S. employers added 288,000 workers in June, exceeding economist forecasts, causing the unemployment rate to fall to an almost six-year low of 6.1 percent. That’s good news because the average monthly job gain over the past year has been about 231,000.

What’s more, adding 288,000 jobs is closing in on the monthly job gain target of 300,000 that most economists forecast is required to propel the U.S. economy forward at a more normal 3.5 percent clip. And that’s important because, as I have previously emphasized, the world needs growth to pay down the massive debt overhang that still plagues the global economy.

Indeed, it’s been a long time since the jobless rate in the U.S. was as low as 6.1 percent. In fact, you have to go back to September 2008 to find a month when unemployment was as low as it is today.

That’s significant because September 2008 was when Lehman Brothers collapsed. Lehman’s bankruptcy was the event that pushed the world to the brink of financial meltdown and forced central banks into emergency action to prevent a second Great Depression.

In the six years since the onset of the financial crisis, the Federal Reserve has had its foot to the floor setting key interest rates barely above zero and creating trillions of dollars through a massive quantitative easing process.

Does the creation of 288,000 new jobs in June and an unemployment rate of 6.1 percent mean that we can expect a change in the Fed’s policy stance? Probably not!

That’s because there are still some troubling signs that the employment issues in the U.S. are far from resolved. And in an economy that is driven 70 percent by consumer spending, putting people back to work in high-paying jobs is a necessity.

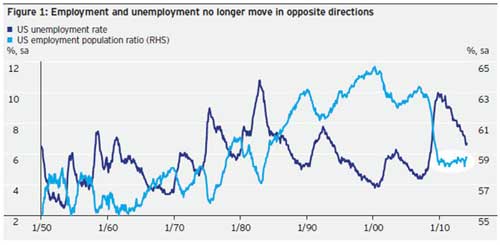

First, take a look at the chart below that shows that the traditional measures of employment and unemployment no longer move in opposite directions for the first time since the 1950s.

Sources: US Bureau of Labor Statistics, Bloomberg

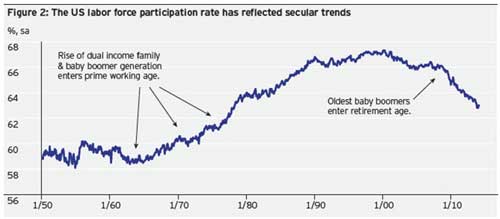

That’s primarily because, as I pointed out in a previous, Money and Markets column, the baby boomers have entered their retirement years, drastically changing the composition of the U.S. work force.

That’s why it’s become increasingly important to pay attention to the labor participation rate when assessing the U.S. employment outlook. As this chart shows, the current labor participation rate is at 62.8 percent … its lowest level since 1978.

Sources: US Bureau of Labor Statistics, Bloomberg.

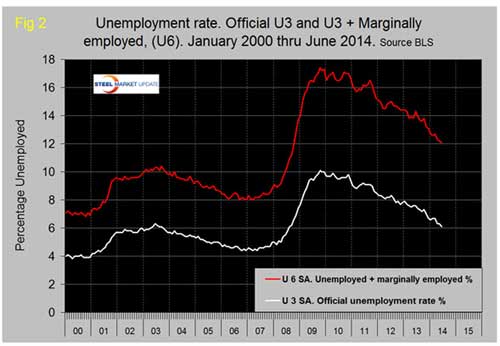

And in an environment where the traditional relationships between employment and unemployment don’t tell the whole story, I prefer to look past the “main” unemployment rate (or “U3” as the government refers to it) to a different figure the Bureau of Labor Statistics calls “U-6.” That’s the rate for the unemployed, the underemployed and the discouraged, and it currently stands at 12.1 percent.

Sources: US Bureau of Labor Statistics, Bloomberg.

Further muddling Thursday’s jobs number was the report that the number of people in part-time jobs jumped by more than 1 million in June to 27 million, according to the government’s data. What’s more, the ranks of people working part-time — even though they would like more hours — increased by more than 250,000.

Thursday’s data also showed that although average hourly earnings rose by 0.2 percent, to $24.45 per hour, and have increased 2 percent during the past 12 months, the annualized growth rate in wages was a tick down from last month’s annualized rate of 2.1 percent.

All in all, last week’s Department of Labor announcement on the U.S. jobs market was a mixed bag containing both good and bad economic news.

[Editor’s note: Bill has uncovered four secrets the rich use to grow even richer. And he reveals them in a FREE report that you can have right here.]

In assessing the data, I agree with Pacific Investment Management Co.’s Bill Gross who said “It’s actually the wage number that is critical and the number of jobs created takes a backseat.”

That’s because slow wage growth is keeping inflation below the Federal Reserve’s target and will keep the central bank on course for slow and below-average interest-rate rises.

Why is this important to investors?

It’s because as Gross said: “In order to get to the Fed’s 2 percent inflation target, assuming a 1 percent productivity number, you are going to have to see wages at 3 percent plus. So the Fed is willing to stay put at current interest rate levels.”

That’s why, like Gross, I am planning on a “new neutral” investment environment where short-term interest rates remain at historically low levels — meaning zero — and government debt levels remain high.

For investors, it’s an environment where the risk of a policy error is high; so be careful when reaching for yield. In an upside down world where savers are punished — with low rates — and risk taking is rewarded, high-quality global franchise companies such as Oracle (ORCL) continue to be my preferred investment of choice.

Best wishes,

Bill Hall

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 2 comments }

I have read that if the unemployment rate were measured as it was during the 1930″s, the rate would be near 23%. Why does the fed base their policies off of their ridiculous numbers on unemployment and inflation? People are smart enough to look beyond these false economic reports. To work policy based upon false economic indicators boarders on insanity. Could this be the reason why fed’s policies never work? From what I have studied a centrally planned command and control economy is not possible. What is your opinion?

Sadly, a large majority of people are NOT smart enough to look past these intentionally misleading reports. Many people cannot name the vice-president. Those who are interested at all just hear what the media reports to them. A majority think that a thriving Stock Market means the economy is roaring along. And yet they go and vote.