Earnings season is pretty much in the books, as 98% of S&P 500 companies have already reported second-quarter numbers.

Market Roundup

The results: Profits declined 3.2% overall for the index. That’s the fifth quarter in a row of falling profits. The last losing streak of this magnitude was during the financial crisis of 2008-2009!

This is one of the prime reasons why investors are so nervous about the stock market at such lofty levels today:

The key support of profit growth is conspicuously absent!

And the story doesn’t get much better going forward, either.

Wall Street analysts have penciled in an S&P earnings decline of 2.1% for the third quarter … which would be the sixth straight quarter of falling corporate profits.

This has rarely happened outside of a U.S. economic contraction.

However, there is cause for some guarded optimism for a corporate profit recovery ahead. Last month in Money and Markets I wrote: “It pays to look more closely at the movement in earnings and sales estimates over the last several months…”<

To read the rest of Mike Burnick’s Afternoon Edition, click here …

[/eo]

In other words, I put more faith in the trend of forward earnings estimates, than in the actual results from looking backward, and you should, too.

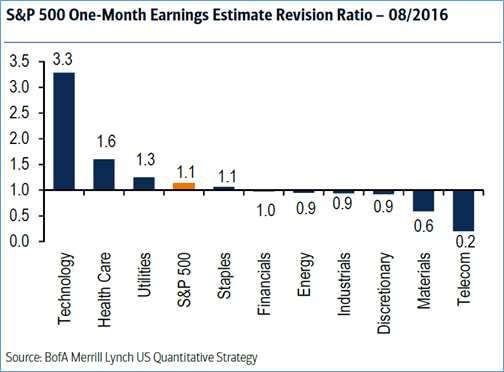

Here’s where the story turns more bullish, especially for certain sectors of the stock market. The earnings revision ratio (ERR) for the S&P 500 has been in an uptrend recently.

This simply means more upward profit-estimate revisions as compared with downward revisions among S&P companies.

The one-month ERR improved to 1.13 in August, according to Merrill Lynch data, a sign of more upward than downward revision for the first time since May.

The technology sector of the S&P 500 was “most-improved” in terms of upside earnings forecasts last month (see chart above), with three-times more upward revisions versus cuts in August. That was the highest reading in six years!

It’s no wonder technology is also the best-performing sector over the past two months.

Healthcare, financial and utility stocks are likewise posting nice positive trends in profit forecasts. Also, multinational stocks that do big business in overseas markets are scoring the best upward revisions of all, compared with domestic-oriented stocks.

In fact, the one-month revision ratio for multinationals surged to 1.49 last month – meaning 3 upward profit forecasts for every 2 estimate cuts – that’s the highest since mid-2014.

The recovery in emerging markets plays a big role here, since these are some of the best customers for U.S. multinational companies. Technology, healthcare, energy and industrial companies all earn a large share of sales and profits from overseas.

The uptrend in earnings revisions is a bullish sign for corporate profitability going forward. Still, many investors are asking: When will the earnings recession ever end?

It’s a perfect excuse for sticking to the sidelines and staying out of the stock market, but perhaps the earnings recession is already coming to an end.

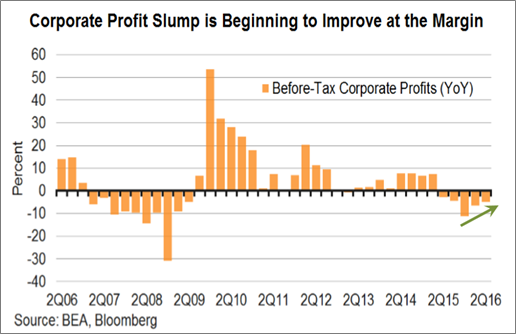

The government maintains an alternate calculation of corporate profits. It’s part of the quarterly gross domestic product (GDP) report.

And according to this data, we passed the low point in corporate red ink back in late 2015 (see chart above), with profits down more than 10% year-over year. Since then, it has improved.

True, profits are still in the red, according to the GDP data, but they’ve gotten progressively less-bad recently. The uptrend in Wall Street forecasts for S&P 500 profits is strong, confirming evidence of this improvement.

And what often matters most to financial markets is that things are improving (or getting less-bad) at the margin.

|

![]() Handicapping the Fed: Want the inside scoop on what the Fed will do at their next policy meeting September 21? The key may be tomorrow’s non-farm payroll report at 8:30 a.m. Eastern Time. According to Bloomberg: “An overlooked line in Federal Reserve Chair Janet Yellen’s speech last week could hold the key to whether Friday’s U.S. jobs report clinches an interest-rate increase this month.”

Handicapping the Fed: Want the inside scoop on what the Fed will do at their next policy meeting September 21? The key may be tomorrow’s non-farm payroll report at 8:30 a.m. Eastern Time. According to Bloomberg: “An overlooked line in Federal Reserve Chair Janet Yellen’s speech last week could hold the key to whether Friday’s U.S. jobs report clinches an interest-rate increase this month.”

Specifically, Yellen indicated that the decision to hike rates hinges on whether fresh data “continues to confirm” the economic outlook. In other words, we may not need a blowout jobs number tomorrow to seal the deal on a September rate hike, just an average gain will do.

The consensus forecast expects that 180,000 new jobs were added in August. That’s close to the average of 186,000 so far this year. Anything in the ballpark means rates could rise. And it will take a big swing-and-a-miss for the Fed to blink.

![]() Factory funk: Speaking of misses, the U.S. Purchasing Managers Index (PMI) for August missed expectations by falling to 52 from 52.9 last month, indicating a very slow-growing American manufacturing sector. Slow growth in new orders and in employment were among the biggest drags.

Factory funk: Speaking of misses, the U.S. Purchasing Managers Index (PMI) for August missed expectations by falling to 52 from 52.9 last month, indicating a very slow-growing American manufacturing sector. Slow growth in new orders and in employment were among the biggest drags.

![]() China rising: Meanwhile, manufacturing activity in China picked up at a surprising pace last month. China’s PMI rose to 50.4 in August, the highest level in almost two years, and ahead of expectations.

China rising: Meanwhile, manufacturing activity in China picked up at a surprising pace last month. China’s PMI rose to 50.4 in August, the highest level in almost two years, and ahead of expectations.

Not only is China’s factory production outperforming the U.S., so is its stock market. Since July 1, the iShares China Large Cap ETF (FXI) is up 8.7% compared with a gain of just 3.2% for the S&P 500 Index.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 20 comments }

As long as there is such political insecurity, the consumer spending trend will stay stagnant. Political stability and economic growth is closely correlated. No sales, no growth! An interest rate rise will only exacerbate stagflation at this juncture. The average household debt is also facing trouble as the rise in real income is still at an all-time low! Voodoo economics and QE alchemy have locked in a barrier against healthy growth! I therefor cannot share your optimism Mike!

I agree entirely….of course you also left out double-digit inflation (11-12%) and high unemployment (37.2%) and people have less money to spend. I saw this at a garage sale recently where people were struggling over whether or not they could afford to spend a few dollars on clothes for their kids! (both are much higher than how the government calculates them). From “Tradingeconomics.com”: The Labor Force Participation Rate in the United States remained unchanged at 62.80 percent in August from 62.80 percent in July of 2016. This is just unbelievable awful! Add in higher healthcare costs thanks to “Obama-don’t-care” and I really don’t see the grounds for optimism anytime soon….

Some of us out here are evaluating income funds and are wondering what your comments might be.

Things are going to get much worse before they get any better.

Actually, I think the stock market in the US is fine. All of Europe is in a tailspin. The Arab countries are in a complete disaster, between the war, the loss of oil revenue, etc. And drop Brexit on top of that and the European Common market is a total disaster as well.

Could the US stockmarket go down? You know the answer to that! Of Course it can go down, but I doubt it. The US Market bad news with Apple being hit with a $10 Billion settlement is already factored in, yet the market has been relatively stable.

So, sure it can go down. But show me a better market, with the possible haven of precious metals, Gold, Platinum, etc. But why risk it. Just buy some AT&T stock and wait it out, while collecting the 5% Dividend! That would be my opinion, in fact I have already done it. Now, it all depends on the Presidential Election.

If Trump wins, sell it all fast, because Trump is completely clueless and then I might sell every equity I own. I have not been able to find a major party candidate in the last 100 years in the USA that is more UNINFORMED than Trump. If he wins, we all better get out fast!

Thank You,

Jon Linden, MBA

It doesnt matter who wins the election. The sovereign default big bang is already baked in the cake. The only question that remains is how aggressively govt will dig in its heels to save itself. In that regard, the answer is very clear. Hitlary will launch the totalitarian lifeboat, while Trump is much more likely to hold on to freedom and the constitution. BTW, Trump has more business savvy in his little pinky than Hitlary has in her entire cushy body.

If you mean knowing how to file bankruptcy better tan any other business man then Donald Trump is a business genius

Anyone that tries to start and grow a business will fail a time or two, or more, and if the free market works, it means bankruptcy. Only in the corrupt world of govt, where Hitlary has spent her life, are business donor bailed out and not be forced into bankruptcy. It’s those that dont give up after failures that succeed and learn. Stop taking your talking points from idiots with no practical experience. You might survive the coming economic reset.

Judging by your last paragraph, China’s markets are the best place to invest. FXI, ASHR, etc., would be good ETFs, if one doesn’t trust the US listed stocks.

Good information for investment consideration

Hi Mike

As an investor, why would you buy stock for say 3 to 5 percent yield when you face a capital loss of 30 to 50 plus percent of capital in the near future?

Where else is global capital going to park when the govt bond bubble parks?

Govt bond bubble POPS

Fundamentals matter little when capital is seeking a safe haven, which will only get worse in the years ahead, as a rising dollar destroys the balance sheets of foreign govts, companies, and individuals holding way too much US-based debt.

Can some investor in car manufacturing help me here. Your buying shares in American made auto manufacturers that build factories and compete against Chinese made products. 7 out of 8 Chinese car manufacturers made money in the first half due to government subsidies. Seems like a loaded game to me. Might be time to invest in something else where there is a level playing field. How can one invest in China with the government being “Bobs your uncle”

Yes I read all your glowing reports on China is rising rising on what may I ask? Government subsidies of course. China is playing with a loaded deck backing up everybody and their uncle in business. Tell how can foreign companies compete. I thought under all these trade pacts that subsidies were not allowed. If they were allowed somebody in Washington was doing nothing to protect American workers and investors. Yes all is well in the land of Chinese dragon till one day its not.

Yes the new financial terminology “less bad” is that the same as “less good” Yes charts charts and more charts yet life seems to fall off of the chart at times. Be careful.

Listen to the doom, the pervasive bearish rhetoric. This market is going wayyyy higher. Higher than anyone here could ever, Ever have imagined in a thousand lifetimes. It will make the ’99 blow off top look like 50 year bond yields.

There is a measurement in economics called velocity of money. Simply put it is the rate at which funds move through the economy. During times of lack of confidence at the prospect of a return on these funds, money moves more slowly and much of it sits uselessly in banks, not even paying interest. What is causing this lack of confidence? Over regulation, government policies that are erratic, counter productive, unpredictable or all of the above. Even under Jimmy Carter the economy grew at 3% per year; now it’s racing toward 1%. Regardless of how the election turns out, some serious changes in direction are needed.

Why are all the good people in the world called Mike? Like Kits owner in Knightrider.