|

Russia is the world’s largest producer of palladium, a key component of exhaust filters that keep our cars running cleanly.

Some investors are betting that fears about the potential interruption of Russian palladium shipments will keep prices high in the $3.2-billion futures market if the dispute over Ukraine drags on.

Russia holds the greatest sway over the global palladium market, with about 42 percent of global output. The Kremlin amassed a large hoard of palladium during the Soviet era, which it has gradually sold off.

|

| 77 percent of the demand for palladium is driven by the automotive sector. |

Sales have declined in recent years, and some traders and analysts worry the reserve is running out.

Russian officials have maintained that stockpile levels are a state secret.

Some palladium is used in jewelry, but 77 percent of the demand for this precious metal is driven by the automotive sector, according to specialty-metals company Johnson Matthey.

Palladium is used in gasoline-burning vehicles that dominate the world’s biggest car markets in both China and the U.S.

There is no easy way to boost production from other sources to make up for a shortfall from Russia.

Mine workers have been on strike in South Africa, which supplies about 37 percent of global production, since January 23, and that is expected to lower the country’s palladium output by 280,000 ounces this year.

This is the equivalent of 4 percent of last year’s 6.5-million ounces of palladium mined globally.

Russia and South Africa accounted for nearly 80 percent of global palladium supply last year.

Analysts at HSBC predict palladium supply will trail demand by 1.06-million ounces this year, double last year’s shortfall. The largest global supplier of palladium, Russia’s Norilsk, said last summer that the gap between supply and demand was widening and may reach 60 metric tons by 2020.

Norilsk also gave insight on what has been bridging the gap between supply and demand for years: secret Russian government stockpiles of the metal.

Norilsk believes that these once-mountainous stockpiles may disappear altogether in 2014, tightening supplies even further.

Let’s not forget, either, that against that dwindling supply situation, you have rising demand.

The two largest vehicle markets — the United States and China — are dominated by gasoline-powered vehicles. Not only is the U.S. vehicle market growing nicely, at an annualized rate of 16 million autos, but China (now the biggest vehicle market) also saw growth of more than 14 percent last year to about 22 million vehicles.

And another double-digit sales gain is expected in China this year. If Europe or the U.S. places economic sanctions on Russia for interfering in Ukraine, traders are worried that the Kremlin might withhold much-needed supplies of the metal.

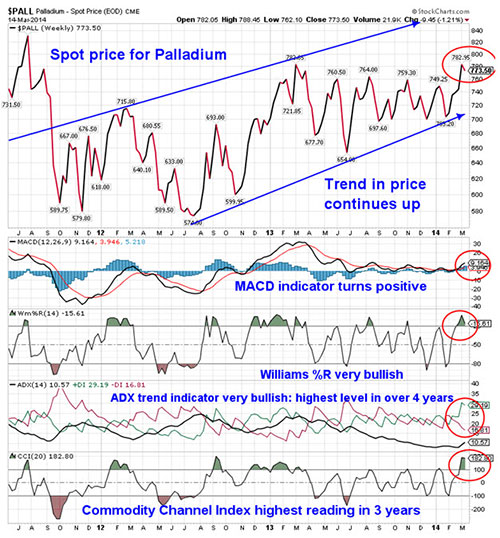

Either way, palladium exports from Russia could be in jeopardy, and could trigger a panic buying spree, lifting palladium to as high as $1,000 /oz, from around $775 today.

One can buy the palladium ETF, symbol PALL, on the New York Stock Exchange.

Best wishes,

Douglas Davenport