|

I was raised on a vegetable farm in western Washington, and my father worked like a madman to feed his family of five. Some years were better than others. And unfortunately, it seemed like the bad years outnumbered the good.

One of the crops my father grew was potatoes. And one of the biggest challenges my father faced in the bad years was the temptation to sell that portion of the last crop of the year that would be used as seed potatoes for the next year.

When my father’s bank account was empty, it must have been very tempting to sell the seed crop to put food on the table to feed his three children.

But he never did. Never.

There are a lot of simple but ironclad rules — “Don’t eat your seed corn,” or potatoes, in my family — that apply to investing as well as farming.

If you’re interested in technology (and tech stocks), then there’s one metric that you should be paying close attention to …

That is, to companies’ research and development (R&D) spending.

It is no accident that many of the most-profitable tech companies are those that spend the most on R&D.

It’s also why today’s Apple (AAPL) event — where the company unveiled its shiny new iPhone and operating system from its shiny new Apple Park “spaceship” campus — attracted more than a million sets of eyeballs. Even at a time when some 8 million people in Hurricane Irma’s path are without power!

That’s because great companies invest in innovation.

Now, R&D spending by itself doesn’t guarantee profitability and strong stock performance. But a Goldman Sachs report, “The Search for Creative Destruction,” shows a strong connection between R&D spending … and revenue growth and stock returns.

“We review technology, internet and biotech names currently in the Nasdaq-100 and find a strong correlation between R&D and sales growth and between the latter and stock price returns.”

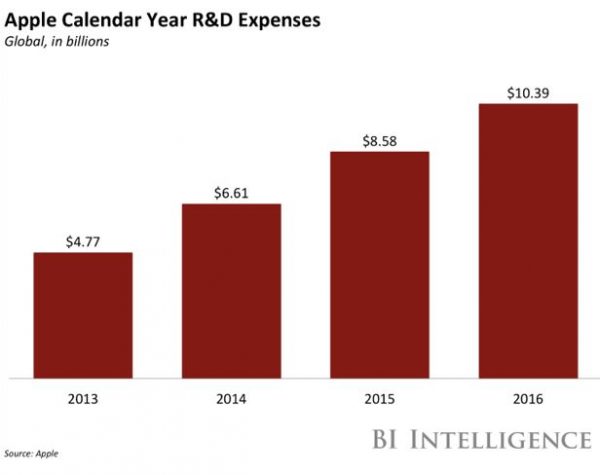

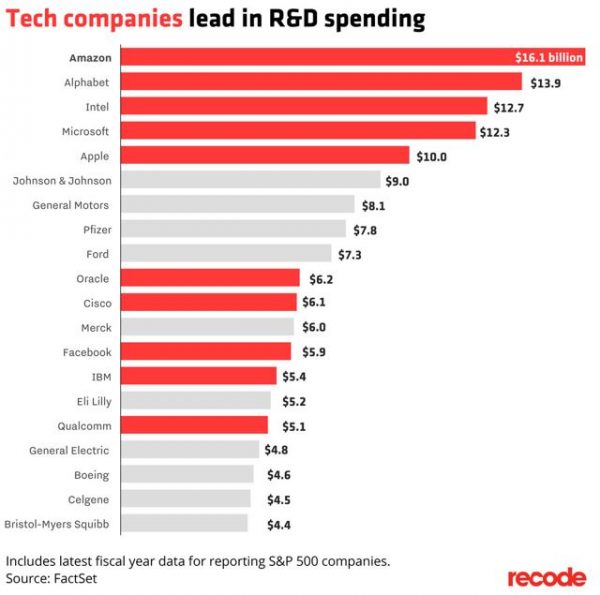

In short, tech companies that spend a lot on R&D also see the best stock returns. Apple, for example, spent a whopping $10.4 billion on R&D in 2016.

$10 billon is a mountain of money. But there were four other companies — Amazon (AMZN), Alphabet (GOOGL), Intel (INTC) and Microsoft (MSFT) — that spent even more on R&D last year.

It will take a little work, but I suggest that you look at how much every tech company in your stock portfolio spends on R&D.

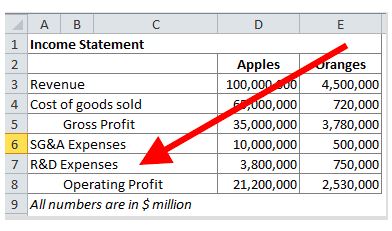

R&D appears as an expense item on a company’s income statement. But two things are even more important than the dollar amount:

- The percentage of revenues spent on R&D, and

- Whether that percentage number is increasing or decreasing.

Moreover, my experience is that large R&D budgets are a reliable indicator of financial health.

But for a company in trouble, one of the first places that short-sighted CEOs cut expenses is R&D.

To me, that is the equivalent of eating your seed corn.

R&D’s role as an engine of growth is as important as ever. That’s because it creates new products, increases market share and powers high rates of growth.

And it creates great value for shareholders that you can’t afford to ignore.

Best wishes,

Tony Sagami

{ 2 comments }

Tony – I agree with your analysis and appreciate your solid & thoughtful financial advice. Keep up the good work. Your Dad would/is be proud of you! A PNW follower of your advice. H.

I just became a life time member of Real Wealth Report and have quick reviewed some issues and could not readily see the recommendations to cover the world problems that you described. It would be nice to have references to reports covering specific stocks recommended.