Over the long haul, there’s one specific kind of stock that outperforms all others.

It all comes down to all dividends …

Yes, buying companies that pay dividends will serve you better than buying companies that don’t pay dividends.

But for the most-important factor — and to achieve the highest returns over a long time — you need to take it one step further …

The determining factor is whether a company GROWS its dividend.Â

Dividend-growth stocks beat all other types of stocks over time.

If you want to get rich by investing in the stock market over multiple decades, your best bet is to buy companies that consistently grow their dividends.

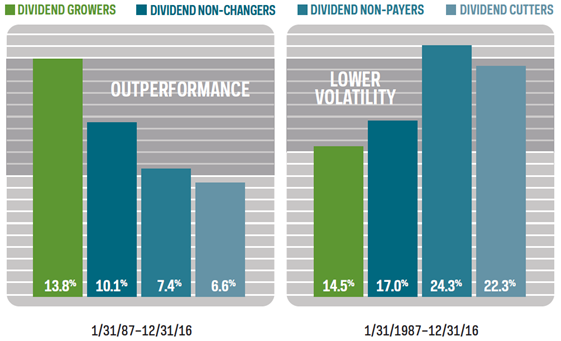

A recent Ned Davis Research study on Russell 3000 stocks (representing approximately 98% of the investable U.S. equity market) proves it …

“Dividend Growers” have clobbered all other types of stocks over the last 30 years. (See the 13.8% annualized returns on the left.)

Not only that, they’ve done it with fewer ups and downs. (See the 14.5% annualized volatility on the right.)

These results should make sense …

Companies that routinely grow their dividends tend to be financially healthy, high-quality businesses. They often possess strong fundamentals, stable earnings and management teams that thrive as adept capital allocators.

|

The Single-Most Promising Sector … Extremely juicy, market-crushing dividend yields … of up to 10.8% (or more)! Huge, handsome capital gains potential on top of that. Attractive leverage to an improving economy … and a balance sheet “secret” that helps them make even more money every time the Fed hikes interest rates? This sector offers all of that — and my brand new special report The 10.8% Solution: Five High-Yield Stocks for a Rising Rate World gives you everything you need to get started investing in it. Click here or call 877-934-7778 to reserve your copy today! |

The growth differential in dollars really illustrates the case …

A $25,000 investment in each strategy, three decades ago, would have grown to the following rounded amounts:

- “Dividend Cutters” … $170,000

- “Dividend Non-Payers” … $213,000

- “Dividend Non-Changers” … $448,000

- “Dividend Growers” … $1,200,000

A focus on dividend growth could have made you a millionaire while enjoying the smoothest ride along the way!

This Ned Davis study illustrates a key principle of investing …

For a long-term investor, buying companies that grow their dividends is the most-decisive factor for getting rich in the stock market.

So, how can you put this data to work?

One method is to take a “buy and hold” approach by utilizing one of the 100-plus U.S. dividend growth ETFs in the marketplace. Here’s a shortlist of five of my favorites (each one requires unbroken, long-term dividend growth):

Source: Morningstar (returns through 8/31/17)

Option No. 1: The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) tracks the S&P 500 Dividend Aristocrats Index. NOBL is the only ETF that concentrates on the S&P 500 Dividend Aristocrats, those companies with the longest track records of year-over-year dividend growth. (With dividend increases every year for at least 25 consecutive years.) Over half of NOBL’s well-known holdings have grown their dividends for an impressive 40 years or more.

Option No. 2: The ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) tracks the S&P MidCap 400 Dividend Aristocrats Index. REGL is a “younger” version of NOBL. REGL focuses on S&P MidCap 400 companies that have increased dividend payouts for at least 15 straight years.

Option No. 3: The ProShares Russell 2000 Dividend Growers ETF (SMDV) tracks the Russell 2000 Dividend Growth Index. SMDV is the “youngest” version of NOBL. This ETF lasers in on Russell 2000 companies (small caps) that have grown dividends for at least 10 consecutive years.

Option No. 4: The SPDR S&P Dividend ETF (SDY) tracks the S&P High Yield Dividend Aristocrats Index. The index screens for companies that have consistently raised dividends for at least 20 years in a row and weights the stocks by yield.

Option No. 5: The Vanguard Dividend Appreciation ETF (VIG) tracks the Nasdaq U.S. Dividend Achievers Index. Formerly known as the “Dividend Achievers Select Index,” this index is comprised of companies with at least 10 years of increasing annual regular dividend payments. VIG is super-cheap with an expense ratio of just 0.08%.

Any of these dividend growth ETFs would make a fine addition to an equity portfolio. You can learn more about each one here: NOBL, REGL, SMDV, SDY and VIG.

Best,

Grant Wasylik

{ 4 comments }

Thank you so much!

GROWTH & INCOME WITHOUT THE FEES

You will get even better long term performance and without ANY management Fees at all by buying some quality dividend paying stocks directly. Then hold them for 20 years and collect the dividends (reinvested), along with capital appreciation and stock splits ( e.g. Altria ). Its definitely a better way to build wealth. You don’t need ETF’s or Mutual Funds to do the picking for you. Keep all the winnings and don’t share with the Brokerage Firm. Be selfish.

I’m interested

What would be the strategy for these in each phase of the Countdown to Armageddon?

Thanks