|

Three-and-a-half months into 2014, stocks — as measured by the Dow Jones Industrial Average — are down about 1 percent for the year, leaving investors disappointed, especially after 2013’s 32-percent rise.

But think about it: U.S. stocks have gained more than 170 percent from lows five years ago.

Indeed, it’s been a great five years to be in the stock market.

Investors frustrated with the lack of price advances in 2014 need to take a closer look at how the extraordinary returns of the past five years were achieved. There is a major transition occurring on Wall Street as the factors that have propelled stock prices higher and higher over this period are running out of steam.

Recall that there are only three components of stock returns: Dividends, earnings growth and the change in the price-to-earnings ratio.

Drilling deeper into 2013’s amazing return, we can see that 2 percent was from dividends; about 5 percent was earnings growth; and 25 percent was from a change in the price-to-earnings ratio.

|

| In 2013, investors were willing to pay a lot more for stocks at the end of the year than they were at the beginning of the year. |

Yes, that’s right: Most of 2013’s return was attributable to the willingness of investors to simply pay more — a significant amount more — for stocks at the end of 2013 than they were at the beginning of the year. So it was a change in pricing that was the primary reason stocks soared in 2013, not a dramatic improvement in the underlying fundamentals of their businesses.

Moreover, a careful look back to the bottom of the financial crisis reveals that earnings growth over this period has relied heavily on profit margin expansion — meaning making the assets work harder — rather than on sales growth, which has been at best lackluster. As a result, corporate profit margins remain at record levels, and their cash piles have burgeoned as they have been reluctant to make significant purchases of property, plant and equipment.

Thus, stock market returns over the past five years have been turbo-charged by price-to-earnings multiple expansion and extraordinarily high corporate profit margins, both of which are now reaching the upper limits of historical ranges.

What’s next?

For stocks to go higher, it’s time for the world’s leading companies to show some real, honest-to-goodness earnings growth led by top-line sales increases. But in a debt-laden world where the consumer is struggling, growth is hard to find.

That’s why stock prices have been relatively flat so far this year. There has been no sign of any sustainable earnings growth.

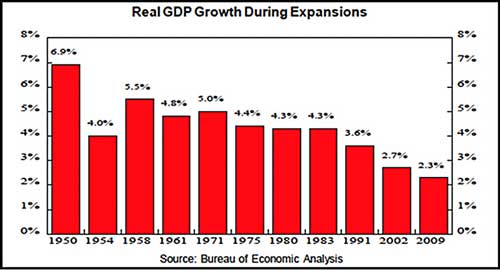

In fact, the GDP numbers as presented in the chart below show this to be the slowest recovery in post-World War II history.

On the other hand, the Bernanke-Yellen put is firmly in place, providing a floor under the stock market’s downside as the Fed continues to promote the most massive liquidity policies ever undertaken. Rest assured that normal monetary conditions are not coming back anytime soon, because central bankers around the world are concerned that normalization would blow away any hope for corporate growth prospects.

The last five years have seen a dramatic recovery from a very bad place. Growth prospects across a large part of the developed world are improving modestly; interest rates remain low; and most importantly, central bankers cannot afford stock market wobbles that destroy confidence and wealth.

Recall that bull markets are never derailed by high valuations alone. A withdrawal of liquidity is a prerequisite, and that’s nowhere on the near-term horizon.

That’s why market expert Gary Shilling recently said that the current environment for stocks can best summed up as: Risk on Regardless! And I agree.

Best wishes,

Bill

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 3 comments }

Summing up.The Bernanke put is now the Yellen put.Until inflation becomes the nation's number #1 problem,the Fed will continue to supply the ammunition for higher stock,housing,asset,and everything else,prices to appreciate,in fiat Dollar terms.Going to be interesting,when higher inflation,Dollar decline,finally hits.May be happening today.Seeing beef,bananas,gas,food,rentals prices all rising fast.Then the something for nothing,from the Fed,will come to an end and we will pay the price.

So we should continue to buy stocks, not for fundamentally sound reasons but because the Fed is creating a credit/debt bubble?

Obviously, if you believe that the Fed is creating a bubble you should not buy stocks at these prices. On the other hand, if you believe we are in an extended period of low interest rates engineered by the Fed and the ECB, then stocks look inexpensive when priced against the alternatives. — Bill Hall