|

Stocks have been under pressure in the past couple of weeks over concerns that central banks around the world are backing away from their commitment to monetary stimulus at a time when the global economy has still not sufficiently recovered from the 2008 financial crisis.

You kind of have to piece it all together on your own, because the mainstream media has not provided a clean narrative.

But it starts with:

- The Federal Reserve winding down its quantitative easing program over the next four months.

- Then it rolls on to the European Central Bank deciding against stimulus last week despite ample evidence of deflation.

- It continues on to the People’s Bank of China, which has shown it wants to stand firm against property speculation even if the country’s shadow banking system fails.

- And it ends up at the Bank of Japan, which is as wimpy as ever.

|

| The recent pullback in tech and biotech stocks should provide many opportunities to profit in coming weeks and months. |

The result in U.S. and euro-zone stock markets has been a decision among fund managers to back away, temporarily at least, from high-growth stocks that tend to depend the most upon cheap money flowing through the financial system. The first and most graphic casualty has been many recent tech and biotech IPOs, which have been shot from the sky — seemingly mortally wounded.

This fear that less stimulus and higher rates will blunt high-growth tech stocks would be funny if it were not so misguided. It flies in the face of everything we know about how investors allocate capital.

If you have been reading my columns here for the past two months, you know that it is completely common for new techs and biotechs to be cut down by 25 percent or 50 percent or more from their initial offering price. It’s part of the game. People who are surprised have just not been paying attention.

Not much more than a year ago, Facebook (FB) sank more than 50 percent from its IPO pricing before recovering to double and triple from the angst-filled lows. More than a decade ago, Amazon.com (AMZN) was slaughtered by more than half after its 1999 IPO. I could go on and list a dozen more examples. It’s part of the game, and it is simply incumbent upon cagey private investors to be aware of how institutions create these cycles of greed and fear for their own advantage, and learn to lean against them.

Even if the rest of the market crumbles in the months ahead, you can be sure that there will be plenty of high growth, deserving tech and biotech companies that will catch the attention of brave, savvy investors who do their homework and have the patience to accept some volatility. For this reason the recent shakedown of the Nasdaq has been a blessing. It’s like seeing all your favorite Armani suits go on half-off sales, and you don’t even need to wait until after the holidays.

At times like this, we always like to turn to the statistical databases to check for precedents. Here were a couple of observations from sentiment expert Jason Goepfert of Sundial Capital that apply:

— In a show of a relative lack of concern about heightened volatility, Goepfert reports that Thursday was the first time in at least 30 years that the S&P 500 sold off more than 2 percent on a day the VIX “fear gauge” rose less than 15 percent and was under 16. If you check for jumps of less than 20 percent when the VIX was below 20, then there were seven occurrences, six of which led to positive returns a month later.

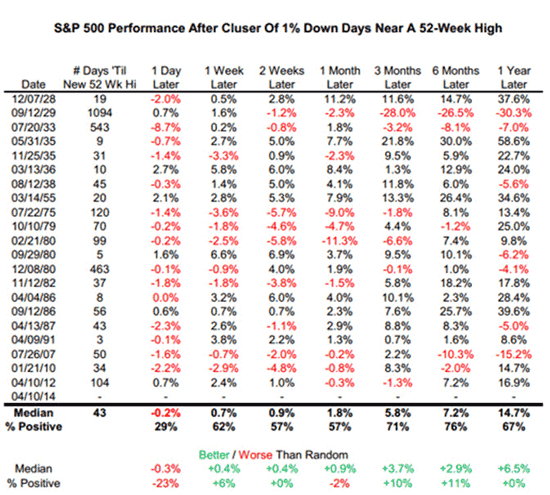

— Whenever you get clusters of big down days, concerns arise about the possibility of this stretch being “the big one,” i.e. that it is just a precursor to even more volatility ahead. The concern is understandable. When there have been fast runs to new highs, Goepfert notes, you don’t often see large down days, so a quick cluster of them comes as a shock that guts confidence. To be more specific, the S&P 500 through Thursday suffered three losses of more than -1 percent in the past seven days, despite setting a 52-week high within that time frame. That has occurred twice since the 2009 bottom, once in January 2010 and the other in April 2012 (exactly two years ago today). While stocks struggled to hold steady for the next month in those circumstances, quite obviously neither of them sabotaged the bull market.

— Looking back farther, to 1928, Goepfert notes that this has occurred 21 times, and the same scenario jumps out. Only three of the occurrences led to major losses of another -10 percent or more during the next three months. The main point is that in 62 percent of precedents, there were no declines of greater than 10 percent in the next year, which means volatility was normal.

The bottom line on this data then is that while these kinds of clusters are not overly bullish, they also generally aren’t long-term bearish. The follow-on result set is in line with random in the next few weeks, and actually returns were pretty good in the intermediate to long term, as you can see in the table above, created by Goepfert.

A study like this confirms my view that the recent volatility is more of a gift than a curse, and should provide many opportunities for us to profit in deserving tech and biotech stocks in coming weeks and months.

Best wishes,

Jon

{ 2 comments }

Jon – at no point in history have we had the same QE that caused the pump. We are living in extraordinary times – Yellen.

Ok, this is a buy the dip article. But the Fed is phasing out QE so we'll see if the market can stand on its own three feet now.