|

We are moving in the right direction, but we aren’t out of the woods yet. And as each day goes by, I become more concerned.

Recent news, this time coming from the Department of Labor and the European Central Bank, confirms that deflation remains the primary factor that investors should focus on when thinking about their investment portfolio.

That’s because — as I have previously said — the world has to have growth for the financial markets to sustain their record levels. And we received a little help — but not much — from the Department of Labor’s latest jobs report which shows that there are now more jobs in the U.S. than ever before.

The last time we were near this point was January 2008, just before the financial crisis caused massive layoffs to sweep through the US, leading the unemployment rate to spike to 10 percent.

Indeed, it took two years to wipe out 8.7 million American jobs, but more than four years to gain them all back. And the economy still needs more jobs to truly return to a healthy place.

How many more? As much as an eye popping 7 million more, calculate a number of economists.

|

| Despite the ECB’s best efforts, we are going to fall into a deflationary spiral. |

Overall, this has been the longest, slowest jobs recovery since the Department of Labor started tracking jobs data in 1939.

The unemployment rate was flat at 6.2 percent. It would have been even higher but for the fact that a significantly smaller percentage of the working-age population is still participating in the labor force, by actually working or by seeking a job. In 2007, the labor-force participation rate averaged 66 percent; last month, it was 62.8 percent, the lowest level since 1979, and trending downward.

The European Central Bank’s actions last week — including lowering one interest rate into negative territory — confirmed that the world’s central bankers continue to be concerned about deflationary pressures on the global economy that threaten to tip the world into recession.

The ECB set a negative 0.1 percent rate on funds that banks deposit over night at the central bank. That means they will charge banks to keep money at the ECB, with the hope that the banks would instead lend that money out to get the economy in gear again.

The central bank also cut the benchmark rate to 0.15 percent from 0.25 percent, and set other moves designed to spur the economy and prevent super-low inflation from turning into staggering deflation, something I have been warning about for some time now.

[Editor’s note: To help you become a more profitable investor, Bill has a FREE report for you. Once you’ve read it, you’ll know four secrets super-wealthy investors use to make money on nine out of 10 trades and how to begin tapping those strategies to grow your wealth in record time. Click here to get your copy now.]

ECB President Mario Draghi told the post-cut news conference that the central bank was prepared to take further “unconventional” measures in the event that the moves don’t get the job done. “We think it is a significant package. Are we finished? The answer is no. If need be, within our mandate, we aren’t finished here,” he said.

Some pundits interpreted the ECB’s moves and Draghi’s message as meaning that the bank’s next move could be quantitative easing, following in the bond-buying footsteps of the Fed. Phase after phase of QE in the U.S. has lifted equity prices to ever new records, but it hasn’t brought the growth hoped for.

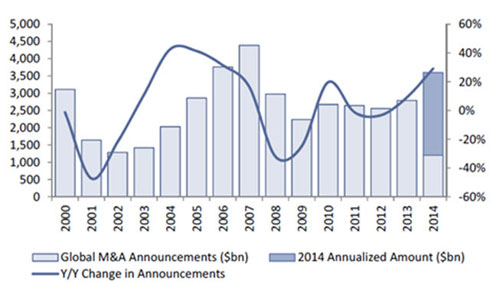

At this point, there’s only so much the policymakers can do. One helpful move would be to ease the requirements on home mortgages in the U.S. that were put in place as a knee-jerk reaction to the sub-prime crisis. But in the end, things won’t improve substantially until the corporate world increases hiring and capital spending. And corporate acquisitions don’t count as capital spending. Although M&A activity is on the increase because of large corporate cash hoards, companies are acquiring because growth is hard to come by. And it’s cheaper to buy what little growth there is and then engage in cost-cutting instead of making direct investment in property, plant, equipment and human capital.

I still don’t think we have fallen out of the sweet spot for investors, but as each day goes by, as I said, my concern is growing.

Sooner, rather than later, we are going to need to see some signs of growth or despite the recent jobs gains and the ECB’s best efforts, we are going to fall into a deflationary spiral.

I am watching corporate earnings announcements closely. If they show signs of a real softening, it will be time to head for the exits.

For now, stick with high-quality investments. But get your parachute packed because we could be headed for a sharp deflationary-induced decline. I suggest reviewing your portfolio carefully and consider selling any low-quality cyclical or speculative positions that you are not comfortable holding in the event of a market pull back.

Best wishes,

Bill Hall

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 2 comments }

Can’t have deflation.Look at what a disaster deflation has been,for cell phones and other consumer electronics.No one I know, owns or is buying a cell phone,since they know that prices will decline,in the future.The U.S.,when it was the world’s fastest growing economy,during the later 1880’s and early 1900’s had decades of deflation.What nonsense this article is.Are you an advisor to Obama?These fiat currencies have taken so much abuse,I’m afraid you are going to get what you want,when they collapse.

Any one know the labour figures are made up by throwing darts at a chart and x by 2

United Arab has just cancelled a 18B order for A380’s this is just the start of a global deep depression ecah day will be more bad news and low rates are here to stay for decades.