|

I talk to a lot of investors. And one of the most common investing mistakes I’ve seen is the lack — usually the complete absence — of any allocation to non-U.S. markets.

The world is getting smaller by the day, and that’s especially true for investing. In the “old days,” when I first got into the investment business, it was both difficult and expensive to invest in international stocks.

That’s not true today. Most brokerage firms permit their customers to invest in most major foreign stock markets. Like Germany, England and Japan.

Plus, there are thousands of foreign stocks that trade right here in the U.S. Like Toyota (TM) in Japan, China Mobile (CHZ) in Hong Kong, and Unilever (UL) in the Netherlands.

And if you’re more of an ETF investor, there are more foreign-focused ETFs than you can shake a stick at.

Speaking of ETFs, get a load of this headline from last Friday:

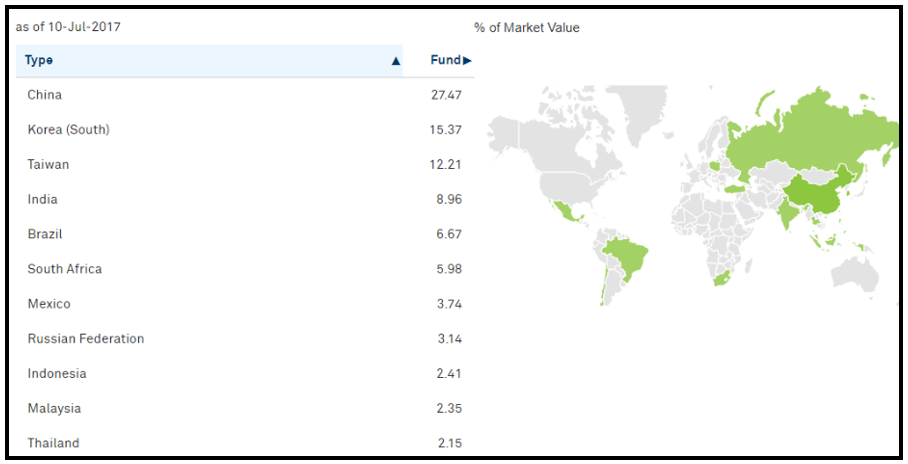

The iShares MSCI Emerging Markets ETF (EEM) hit a new 52-week high on Friday. And it scored a whopping 31.5% gain from its December lows. It’s still up about 26% so far this year. Even after some profit-taking earlier this week.

EEM isn’t the only beneficiary of investors’ interest in diversifying overseas. The emerging-market prosperity is widespread. Check out how some emerging-market ETFs have climbed this year …

- iShares Latin America 40 ETF (ILF) +27%.

- iShares MSCI Mexico Capped ETF (EWW) +31%.

- iShares MSCI Emerging Markets Asia ETF (EEMA) +32%.

- iShares MSCI China ETF (MCHI) +41%

- PowerShares Golden Dragon China Portfolio (PGJ) +50%.

Disclosure: My Disruptors & Dominators subscribers own Emerging Markets Internet and Ecommerce ETF (EMQQ), and they are sitting on a fat, double-digit gain.

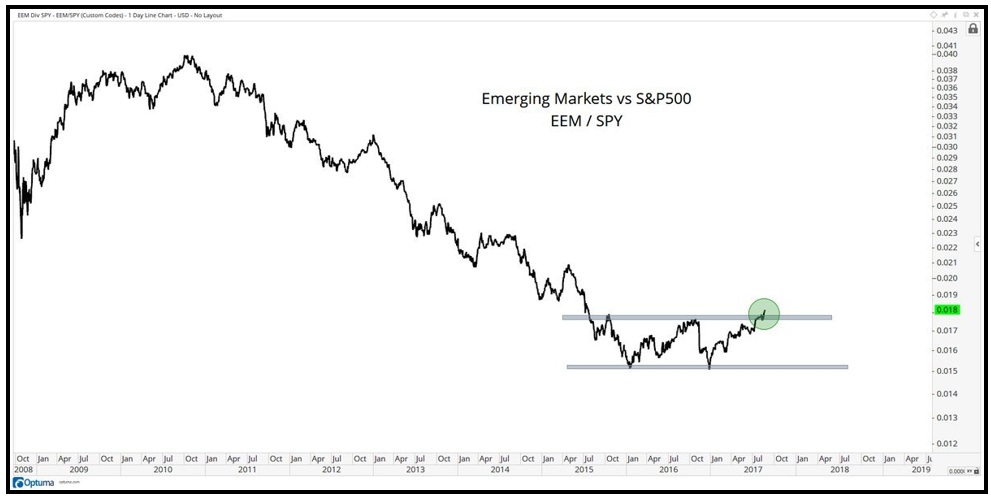

The S&P 500, by comparison, is up roughly 10% for the year. So emerging markets have been beating the pants off of U.S. stocks. Moreover, that outperformance may be about to get even more pronounced.

There isn’t any shortage of emerging-market investment options. There are almost 100 emerging-market ETFs to choose from. Here is a link to a complete list:

The emerging-market bull run could last a lot longer. The International Monetary Fund, in its July 2017 World Economic Outlook, forecast that the GDP of the emerging markets will grow by 4.6% this year and 4.8% in 2018.

And emerging markets are dirt-cheap compared to U.S. stocks.

The price-to-book ratio for the emerging markets is 1.66. Meanwhile, the P/B for the S&P 500 is 3.11.

Book value gives you an idea of what a company is worth if it were liquidated today. And lower numbers can indicate an asset that’s undervalued.

Meanwhile, the emerging markets’ cyclically adjusted price-to-earnings ratio is 16. That’s well below 29.79 for the U.S. and roughly 23 for Europe.

Faster growth and lower valuations are a compelling combination.

That doesn’t mean, however, that you should rush out and throw money into the emerging markets tomorrow morning.

I would instead wait for a pullback before investing new money. But definitely plan to invest in emerging markets sooner rather than later. After all, you can’t call your portfolio diversified if all of it is invested in the U.S.

Best wishes,

Tony Sagami

{ 4 comments }

RISK MANAGEMENT

Its all about risk tolerance (volatility), allocations, and risk management. Understand and be comfortable with what you own and be informed.

Where is the link for a complete list of emerging market ETFs?

not sure if this could be his link, but try this: http://etfdb.com/etfdb-category/emerging-markets-equities/

Name some rember mutual funds