I have a very simple and IMPORTANT question from readers, just one of MANY that are pouring into my office right now: “Exactly WHY are oil prices heading higher and HOW can I profit from the rise?”

I’ll give you the answer to this particular question in this issue.

But for answers to ALL your questions, just come to the marathon Q&A session Martin Weiss and I are holding next week. It’s free. You can ask ANYTHING you like. And from the quality of questions we’re already getting, it’s obvious that it’s going to be one heck of an exciting event.Â

Important: You do have to register. Otherwise, we can’t plan the bandwidth we need and you won’t get your instructions for attending. Just go to this quick-and-easy registration page.

Now for today’s question: Yes, oil prices are definitely going higher. No question about it. Do you know why?

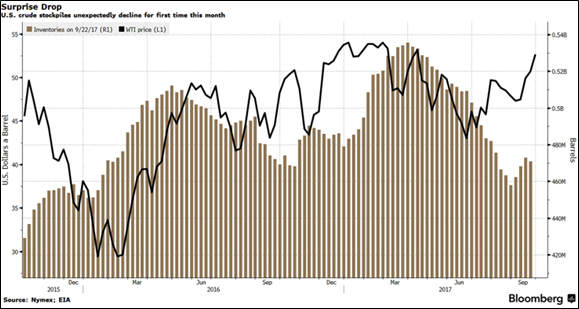

The quick-and dirty-answer is that oil prices are up because U.S. oil stockpiles are down. Here’s a chart from Bloomberg that illustrates that.

|

|

| Source: NYMEX/EIA/Bloomberg |

You can see that U.S. oil stockpiles (the brown columns) have been trending down since the beginning of April. By June, alarm bells started to ring. That’s when oil prices (the black line) began to zig-zag higher again.

Why did stockpiles go down? Usage is going up. Miles driven in the U.S. are rising. The economy is growing. And refineries are guzzling raw oil to turn into refined products. They’re doing that as fast as they can.

So even though U.S. oil production is rising, U.S. stockpiles fell.

And in the latest report, crude inventories dropped big time. Down 1.8 million barrels in the week to Sept. 22. That was a big surprise for analysts, who expected an increase of 3.4 million barrels.

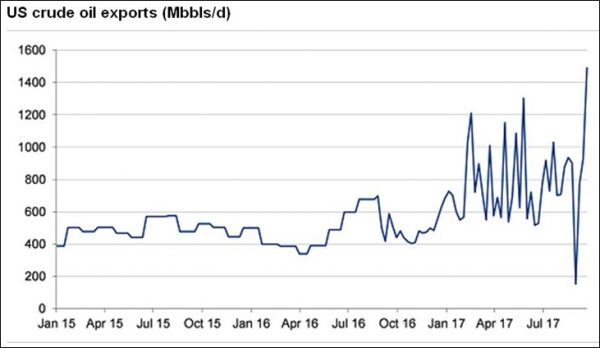

Why were analysts so wrong? The reason is crude oil exports. Look at this next chart.

|

|

| Source: Reuters |

Look at that! U.S. crude oil exports surged to a weekly record of nearly 1.5 million barrels per day.

And this is due in part to the steep U.S. discount on U.S. crude oil compared to the international benchmark, Brent. The U.S. benchmark, West Texas Intermediate, is currently trading at about a $6-per-barrel discount to Brent. So OF COURSE foreigners are going to line up to buy our oil.

What does this mean for future prices? Well, if foreigners can buy our oil at a steep discount, they’ll likely keep buying it until the discount no longer exists.

Even if prices met in the middle, that would drive U.S. crude to nearly $55.

But here’s something else: The big overseas oil producers that have surpluses — Saudi Arabia and Russia — are toeing the line on production and export quotas to push prices higher.

And by hook or crook, they’re able to enforce those quotas in their respective oil-soaked cabals …

That means prices can go higher still.

How You Can Play This Trend

The bottom line is you should prepare for higher prices. I talked more about this big bullish cycle, and gave a pick to help you play it, in a column I wrote for the Edelson Institute on Wednesday: “OPEC’s Secret Weapon Will Shock You.”

Whatever you do, don’t sit this one out. We’re looking at a great, tradeable rally in oil and oil-leveraged stocks. There are fortunes to be made.

All the best,

Sean Brodrick