|

As I noted last week, 2016 was a volatile year for equity investors, considering the sharp twists and turns of the stock market during the year.

And we can expect more of the same for stocks in 2017.

Commodity investors also endured a roller-coaster ride in 2016, with crude oil plunging to start the year. But crude bottomed at $34 a barrel in February and enjoyed a spectacular rebound, ending the year above $53 a barrel.

Meanwhile, gold was also on a roller-coaster ride … in a different direction.

The yellow metal enjoyed a spectacular rally to begin 2016, with spot gold surging 28% higher through early July. Alas, gold soon lost its luster, falling 16% from early July through year-end.

Still, as an asset class, commodities posted their first positive returns last year for the first time in six long years, and investors are keen to know if this upside reversal will continue into 2017.

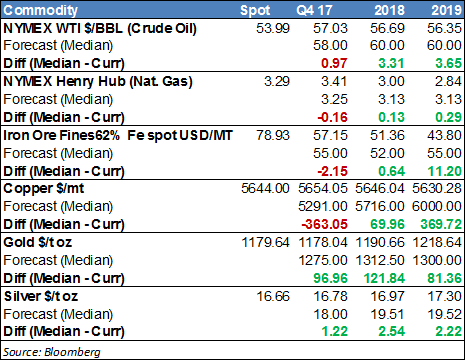

Judging from analysts’ estimates (see table below), it could be a mixed bag for commodity investors this year.

The table above shows the spot price for several key commodities, and what the current futures curves indicate the prices will be for the fourth-quarter of this year, plus for 2018 and 2019.

The middle line for each commodity shows the consensus analysts’ forecast for price, and the third line for each commodity shows the difference between the futures and the forecast.

Let’s take a closer look at the fearless forecasts for some interesting insights …

* Energy: After a robust rally of 50% in 2016, oil is expected to tread water between $54 and $58 a barrel for most of 2017, ending the year at $58. In other words, a flat trading range digesting last year’s big gains, and oil is only expected to move $2 a barrel higher next year.

* Base Metals: Iron was the biggest commodity winner in 2016, more than doubling in price. This year analysts are looking for a modest pullback in ore, along with other industrial metals including copper prices, before the base metals move higher again next year and beyond.

* Precious Metals: Gold lagged most commodities last year. Despite its big rally early in 2016, gold’s second-half slump left the yellow metal up just 8% for the full year, but here’s where the analysts’ outlook gets a lot more upbeat …

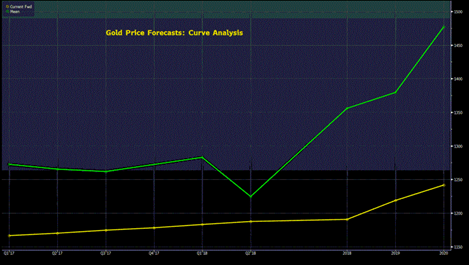

The forecast calls for more gains, and if correct, it means a big profit opportunity for gold investors in 2017.

Analysts’ see gold glittering again in 2017, with prices rising above $1,178 by year end, and still higher over the next two years, above $1,218 by 2019!

Bottom line: Futures market investors AND analysts’ forecasts both point to higher gold prices this year and beyond. After a roller-coaster 2016, gold looks poised to resume a new bull market to the upside in 2017, outperforming other commodities in the process.

Good investing,

Mike Burnick

Director of Research

Money and Markets

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 6 comments }

Are you sure you mean above $1,218 for gold by 2019. Maybe you meant $2,118. Gold only to $1,218 is not much of a gain from where it is now.

I think the metals will do much better than this. There are many things that could certainly happen that are not figured into these estimates.

Hi Fred. I came across this article just a few minutes ago. I thought you would be interested in it. Remember, this is just an opinion.

Steve Molinelli

Gold started at $1152 on the FIRST TRADING DAY of JANUARY 2017. According to your article Mike that means Gold will only be up:

(i) $26 or 2.2% by END of 2017(quoting above, ” Analysts’ see gold glittering again in 2017, with prices rising above $1,178 by year end…)

(ii) $66 or 5.7% for almost the next 3 years from now (quoting above, “…and still higher over the next two years, above $1,218 by 2019! )

These meager returns counter your statement, quote “big profit opportunity for gold investors in 2017” .

I think the state of the Italian banking system and their connection to the German banks might end in grief for them soon and boost the gold price. I don’t really like to say I hope so but it would improve the value of my limited share portfolio.

good article I trade in pvg heavily and did well in 2016