|

There is no doubt about it: We have experienced one of the great bull runs in history — already 5¼-years old. On March 6, 2009, the S&P 500 was 676.53; on May 31, 2014, it was 1,923.57. Total price appreciation: 284 percent. Compounded annual price appreciation: 22 percent!

These are astonishing numbers for any era, for any market, but especially for a big, developed market like the United States.

Never in the past few hundred years — and we can start with the founding of the Bank of England in 1694 — has any equity market rally been accompanied by as massive and long-lived a monetary stimulus as this one. Said another way, never in the past few hundred years has an economic recovery and stock market boom been as clearly attributable to the stimulative actions of monetary authorities, starting with our own Federal Reserve.

When trying to size up this bull market in the context of previous bull markets, we find ourselves in uncharted territory. There has simply never been a bull so pumped up with adrenalin injected by monetary authorities.

|

| There has never been a bull so pumped up with adrenalin injected by monetary authorities as this one. |

Indeed, thanks to the Federal Reserve’s experimental monetary policies, it’s been a great five years to be in the stock market.

However, there is a major transition occurring on Wall Street as the factors that have propelled stock prices higher and higher over this period are running out of steam. As an example, let’s take a look at how 2013’s amazing 32 percent return on U.S. stocks was achieved …

Recall that there are only three components of stock returns: Dividends, earnings growth and the change in the price-to-earnings ratio.

Drilling deeper into 2013’s eye-popping returns, we can see that 2 percent was from dividends; about 5 percent was earnings growth; and 25 percent was from a change in the price-to-earnings ratio. This means that in 2013, investors were willing to pay a lot more for stocks at the end of the year than they were at the beginning of the year.

Yes, that’s right: Most of 2013’s return was attributable to the willingness of investors to simply pay more — a significant amount more — for stocks at the end of 2013 than they were at the beginning of the year. So it was a change in pricing that was the primary reason stocks soared in 2013, not a dramatic improvement in the underlying fundamentals of their businesses.

What’s more, a careful look back to the bottom of the financial crisis reveals that earnings growth over this period has relied heavily on profit margin expansion — meaning making the assets work harder — rather than on sales growth, which has been at best lackluster. As a result, corporate profit margins remain at record levels, and their cash piles have burgeoned as they have been reluctant to make significant purchases of property, plant and equipment.

Thus, stock market returns over the past five years have been turbo-charged by price-to-earnings multiple expansion and extraordinarily high corporate profit margins, both of which are now reaching the upper limits of historical ranges.

What’s next?

For stocks to go higher, it’s time for the world’s leading companies to show some real, honest-to-goodness earnings growth led by top-line sales increases. But in a debt-laden world where the consumer is struggling, growth is hard to find.

That’s why stock prices have advanced only about 5 percent this year. There has been no sign of any sustainable earnings growth.

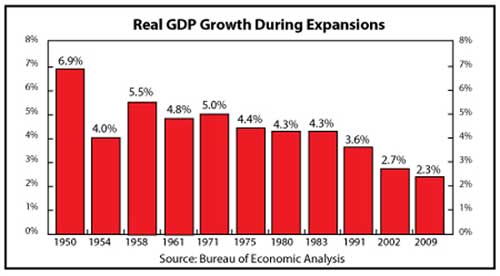

Take a look at the chart below. It measures GDP growth since the technical start of each economic recovery period. And the current one began in 2009. As you can see, the most recent numbers show this to be the slowest recovery in post-World War II history.

If we are indeed in a slow growth world, what investments should you consider adding to your portfolio beyond traditional global franchise companies and emerging market stocks that I have suggested in previous Money and Market columns?

If it’s cash-on-cash yield that you are seeking — and who isn’t in this low-yield environment — I suggest you think about adding business development companies (BDCs) to your investment portfolio. That’s because the average BDC currently yields about 9.6 percent.

BDCs are publicly traded private equities, made possible by Congress in a 1980 amendment to the Investment Company Act of 1940. BDCs invest primarily in the debt of private companies. Different BDCs specialize in different kinds of debt. But their mainstay has been mezzanine debt (debt that the holders may convert into equity if not repaid) and collateralized loan obligations (pools of leveraged loans). This debt is often issued in connection with private equity buyouts and can be risky.

If you don’t understand BDCs at first glance, you’re not alone. Typical BDC investors are sophisticated and have done their homework.

That’s why the Financial Regulatory Authority placed business development companies on its list of potentially unsuitable investments for 2013. That said, all investing is a matter of weighing risk and return, and in my view BDCs provide a superior risk-return profile to many other specialty investments.

What’s more, BDCs have had an impressive track record through the financial crisis. Oppenheimer & Co. recently reported that BDCs have generated a 59 percent positive return since 2007 compared with other financial intermediaries, which as a group still have a cumulative negative return of about 25 percent depending on which financial services index you use as a benchmark.

However, BDCs take significant credit risks to generate their high yields. Leveraging a portfolio to invest in illiquid-debt securities issued by private companies is bound to be risky. But no BDC went bankrupt during the 2009 financial crisis, although many were forced into workouts with their lenders. And it’s likely that they would come under similar liquidity pressure in the event of another recession.

In a slow-growth environment, BDC’s — because of their high yields — are well-positioned to generate strong relative returns for the remainder of 2014. If your risk profile permits, you should consider adding them to your portfolio.

Have you had success investing in the BDCs? I welcome your comments — click here to participate in the discussion.

Check back next week and I’ll tell you which BDCs I am currently recommending.

Best wishes,

Bill

P.S. The wealthy investors I work with take the road less travelled. Plus there are a few other secrets that set the wealthy apart from average investors. Here is how you can use them to grow your wealth in record time.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 24 comments }

BDC’s are of interest to improve the return. We have invested in 12 month opportunities returning 10% however given our tax bracket the net return is less than 6%. If these are higher returns with increased risk it would be of interest to know risk involved, minimum investment and how long the cash is tied up. Thanks.

Have been in Prospect Capital for several years. Was fortunate to get in at discount to nav- stock usually trades + or – 5-10% of nav. Dividend 12-13% paid monthly. Nice income!

Do BDC’s activate K-1’s at tax time?

Your Real GDP growth chart was a real eye opener for me, not because of the lackluster growth this cycle that we are all very much aware of, but the statistically very significant downward sloping trend of real GDP growth in the recovery cycles since WWII. If that current trend continues, real growth in the next cycle will be 2% or less. Population growth alone should account for more than what we have recently experienced. I have some thoughts on the trend (increasing levels of regulation and governmental control, a highly developed mature economy,) but I am interested in your thoughts.

I doubt increased regulation is as important to decreased GDP growth as rising income inequality (the very wealthy have accrued almost all the increased income over the past few years, for ex). wage stagnation among the vast majority of US consumers puts a damper on consumption which is at least 2/3 of US economy, Thus less GDP growth i the recent cycle. Not to mention that China and Europe are growing much slower as well, so there is less global demand for US products

as for BDC’s its worth mentioning there are two classes- internally managed (low fees) and externally managed (high fees). I own BDC;s in both classes- internally managed like MAIN and HTGC for growth(they tend to have rising share price but lower yield) and externally managed like PSEC (higher yield but little long-term capital appreciation)

there are alos ETF’s that invest in BDC’s- BDCL is a 2x levered one that yields about 15%

BDC Buzz on seeking alpha offers a lot of research ideas

Like Jim, I’ve been in PSEC (Prospect Capital) for a while already. Doing well with it. Nothing like seeing money appear on your account every month to put a smile on your face!

Holding PSEC and FSC here. Yet Weiss does not hold ratings on either currently. Lack of transparency? Same goes for PNNT, which I sold to lessen exposure to riskier business loans.

For real GDP growth I refer to Shadow Stats.

Am holding GLAD . Was up 5% until earnings miss . Now even after 9% drop and 50% recovery. Pays 8-9%

I have been investing in TAXI for several years. They loan money to taxi drivers to purchase the medallions required to do business in NYC. They also do mezzanine loans to a variety of small businesses. I got in at around 6 and the stock has been as high as 15+. It bounces around but the trend is up. The yield is well over what is available in CDs, bonds, and money markets.

I’ve been in PSEC for several years, with a cost of about 11, so it is slightly below what I paid, after taking a big hit over accounting methods controversy with the SEC. However, I’ve been earning a steady 12 to 13% dividend, so not a bad investment. I like the fact that nearly all of their lebt is at fixed rates of around 4 to 5%, while they lend at about 13%, almost all variable rate loans, so if interest rates do head up (which may cause some of their loans to go bad), their interest rate spread should benefit, so it seems to be a reasonable way to hedge against rate increases — at least against moderate rate increases.

With hyperinflation and hyper interest rates, of course, all bets are off — on everything.

Also have been in PSEC for several years & like it. Sometimes write higher priced target covered calls if sufficient premium or stock has dipped.

I also own and like PSEC, also BX. They are steady growth and great income producers, when they drop 5% buy more and cost average for the long haul.

I also invest in PSEC, and in TICC and HRZN. All great investment companies.

PSEC, ARCC, AINV, ABR, BKCC

BDC Index ETNs: BDCS BDCL

I own a few, but the best performing of the lot is PSEC. It’s up 7.07% since I bought it in May and it yields a 13.80% dividend distributed monthly.

$MAIN

I consider BDC’s my fallback/safety position when I feel the market is due for adjustment, and regularly hold FSC, PSEC, AINV, MCC, MAIN and the relatively new one FSIC. I also like BDCL, an ETF investing in BDC’s. BDC’s sell for around Net Asset Value(NAV) and should be monitored, not just buy and forget. They regularly issue new shares thereby diluting the current share value, as MCC just did, but recover fairly quickly as they put the new capital to work. They are also sensitive to interest rate changes, some more so than others due to a combination of lending and borrowing practices. For those who follow closely I recommend an analyst/contributor in “Seeking Alpha.com” named “BDC Buzz”, who does regular, excellent in depth analysis of BDC’s.

Bill,

You recommended UTX about Jun. 11th. I bought some at $118.33. It’s been going down ever since, and today it was 108.60. What do you rec. now??

Bill, you rec. UTX about Jun 11th. I bought some at $118.33. It has been going down ever since and is now $108.60 today. What do you rec. now for UTX ??

I have been reading your articles A High-Yield Investment for You to Consider — Money and Markets – Financial Advice | Financial Investment Newsletter and they are too much useful for me to know something new and special. And You can also visit our web also high yield investment program http://hyipreward.com.

How can I have a comment until I know something about what you are recommending???

How can I have a comment until I know something about what you are recommending???No.,. I have never submitted a comment to this web site,. I am trying one more time and then I move on too someone else.

Abu Dhabi Investment – ROI 5000% in a week

Abu Dhabi is currently experiencing an incredible real estate and oil production advantage. This is creating incredible wealth for the emirate and for investors, in addition to its already powerful financial services.

Our Investments

Abu Dhabi Stock Market;Domestic Products;Abu Dhabi & Dubai Oil Reserves;Abu Dhabi Real Estate;And: Forex, Equities, Fixed Income, Private Equity, Hedge Funds, Commodity Trading

100% Guaranteed Money Back,No chance to lose money in our program.

We Hope that you find our investment company to be beneficial for your needs and that together we can make profits long into the future.

Please invest responsibly.

http://www.abudhabifund.net