|

To listen to the opinion-makers poring over this season’s results of retailers, you might think that the sector is a third-rail industry to invest in right now. But I remain sanguine about the near-term future, and see some opportunities developing in the area. And I have some pretty strong names highlighted by their elevated Weiss Ratings to choose from.

A big part of why the industry is enjoying such attention is because of their reporting schedule. Many retailers close their fiscal-year books later than most public firms (January as opposed to December, due to the holiday-shopping season — its biggest of the year). So, in the absence of really substantive news on the earnings front, the media have had a lot of grist for the mill in dissecting somewhat disappointing second-quarter results from this corner of the economy to highlight challenges faced by the 70 percent of U.S. GDP classified as “consumption.”

The gist of the headline analysis seems to be that second-quarter results were not anything to write home about, and that risks to investing in shares of retailers have escalated as a result of the continued plodding pace of economic recovery the past several years. I agree. However, even in tumultuous times, we can find shares of the most financially solid firms falling back due to negative sentiment, and therein lies investment opportunity.

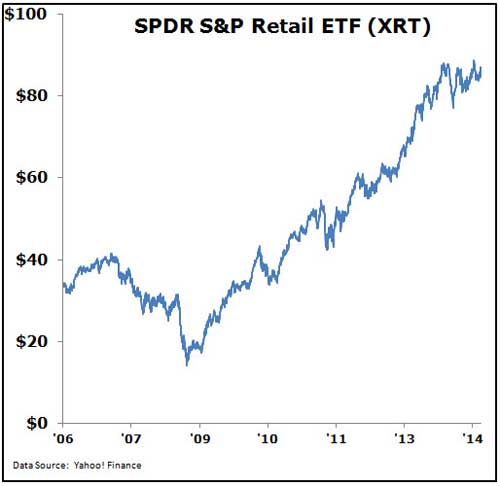

Take a look at the chart of the XRT — the retailers’ SPDR ETF — which displays clear investor bullishness over time, even overcoming the hard times expected during the financial crisis of 2008:

The reason we have seen shares of retailers rebound despite the almost overwhelming cloud of global economic uncertainty, both following this past crisis, as well as in economic crises past, is that investors doubt, then reaffirm, their faith in the determination of U.S. consumers to consume. I don’t want that comment to come off as cynical; on the contrary, I participate personally in keeping that large part of the economy humming along with my own discretionary purchases.

Discretionary consumer spending is most conspicuous in the results of retailers, and after a bad-weather winter affected early 2014 results, the market was ready to hear about a sizeable rebound in the second quarter that didn’t seem to come. However, the quarter we’re in right now contains a good deal of back-to-school spending. So perhaps we’ll see newly lowered expectations, like those for our Weiss Ratings Portfolio holding, Macys’ (M, — Rated B+) set the stage for a strong end of the year for retailers.

|

| The quarter we’re in right now contains a good deal of back-to-school spending, which should bolster firms in the retail sector. |

My own channel checks, as well as those of several of my colleagues, suggest continued strong traffic in all types of retail environment (mall, outlet, free-standing, etc.), which should lead to increased sales for firms in the industry. Apart from our holding in M, the Weiss Ratings (source of my M pick for the Portfolio) are highlighting several other stocks that you may want to consider if you see some weakness in the near term:

- Auto-parts retailers Genuine Parts (GPC, — Rated A-) and LKQ (LKQ, — Rated B+) have been highlighted for some time, as their financial results and shareholder value have steadily increased over time. There are others in the industry you may want to check out, but these would be my area of focus.

- Home Depot (HD, — Rated A-) may be of interest, unless you’re concerned about a possible slowdown in housing turnover in the US. I would consider it, but prefer to get a good price on a home-products specialist like Williams-Sonoma (WSM, — Rated A-) to participate in the dynamics of housing right now.

- Perennial favorite of the Weiss Ratings, Foot Locker (FL, — Rated A), is a strong consideration on my Watch List, but seems very difficult to trade in practice.

- I still like two old-school concept-retailers as considerations for investment, too: Gap (GPS, — Rated B+) and TJX (TJX, — Rated B+). However, our allocation to this theme is now with Macy’s.

If you are more adventurous, you might consider stocks on my Watch List that do not completely qualify for a Buy-level Weiss Rating. And in retailing, I have several, not least of which is Target (TGT, — Rated C). I’ve made money with the stock in the past, and it may yet overcome its data-breach related weakness by a successful foray into Canada. I cannot buy the stock because of its Rating, but I will continue to monitor the company’s and the Rating’s progress.

Best,

Don Lucek

{ 1 comment }

In my opinion Target is a buy at this moment.