|

Stocks finished higher over the past week after a set of sessions so choppy they should have been sponsored by Dramamine. Large caps pushed to a new record high, which is awesome to see and could represent a breakout from the five-month range that the market has been locked into.

But there are a few blemishes to mention. Small caps didn’t play along, resulting in one of the widest divergences between large- and small-cap stocks on record. Moreover, participation in the run to new record highs has been narrow, with only TWO individual Dow 30 components notching new 52-week highs, which is kind of bizarre considering that the index as a whole hit a record high.

As for the techs, the tone was set by Twitter (TWTR), which reported revenues that were slightly better than expected, but user growth was a disappointment. I like Twitter, and think that its management team is doing a good job of helping to build out the site to work better for advertisers, but overall the site is a hard sell to consumers.

If you are just coming to the site fresh, it’s hard to know where to start or how to get the most out of it. I am afraid that in broadening the appeal they will end up ruining its essence, making it more like a short-form magazine site than the quirky, personal, one-to-many, what’s-happening-right-now microblogging site it has been so far.

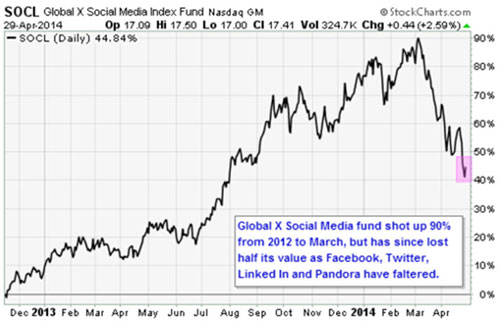

The bloom is off the rose for social media stocks, but that is typical of the second stage of an investment frenzy. But in time, it will produce a bumper crop of new buying opportunities.

First you have new technology hyped by early adopters, then a few of the best companies in the space go public way too early, and they are bid to the moon despite the lack of real earnings support.

This is followed by disappointment, and then despair, and then, after awhile, apathy. Finally, the best companies will gather enough business to support reasonable valuations, and then investor interest picks up again and a new frenzy begins.

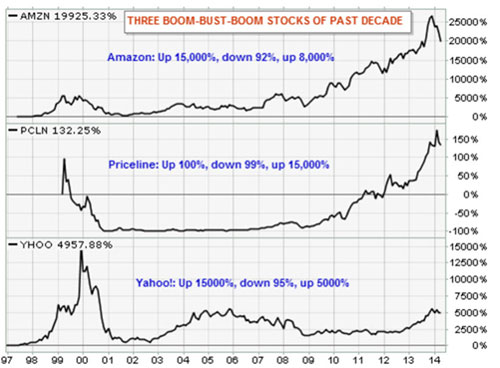

If you want to see this scene play out in real life, just review the charts below of Amazon.com (AMZN) and Priceline.com (PCLN). Both screamed higher initially, then lost more than 90 percent of their value, then were forgotten about, but then ultimately rose again by 10-fold!

I am sure that it will be the same with the social media companies; some will grow to be outstanding, strong stocks, but it’s way too early to make big long-term bets on them. You can date them; just don’t marry them. Join New Technology Superstars to find which stocks have the best long-term profit potential and are worth your attention.

* * *

Now here are a few valuable notes directly from the playbook at boutique research firm Cornerstone Macro this week:

— A fascinating divergence has emerged between sales of heavy equipment in North America and Asia. Engine maker Cummins (CMI) reported revenue from its North American operations was up 25 percent in the past quarter, while international sales were flat. Likewise Caterpillar (CAT) reported that its North American machinery sales were up 6 percent while its Asia/Pacific sales were down 20 percent. Quite a switch from a couple years back.

— Small businesses are contributing mightily to the U.S. strength. Employment at small firms rose 82,000 in April to a record high. Medium-sized businesses added 81,000, while jobs large businesses rose only 57,000. The edge in hiring of small/medium businesses over large businesses probably reflects the strength in the U.S. economy vs. the weakness overseas that depresses large company labor demand.

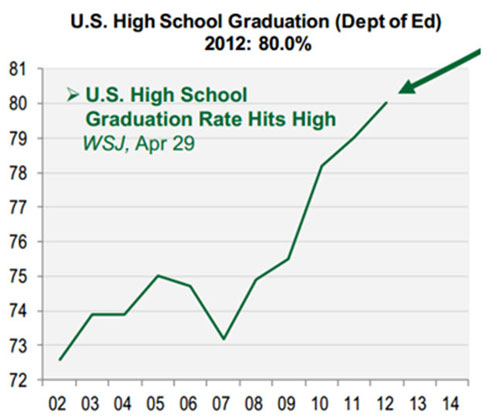

— One impulse behind the U.S. jobs renaissance is the rise in the high school graduation rate. It has reached 80 percent in the past month. The unemployment rate for high school graduates has declined from 11 percent a few years ago to 6 percent now. This is a major drive of rising consumer wealth and well-being.

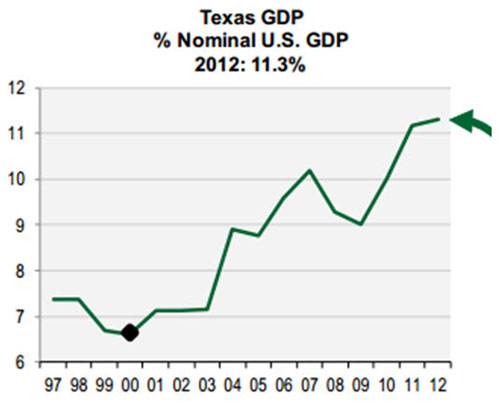

— Over the past 15 years, Texas’ share of U.S. GDP has increased from less than 7 percent to more than 11 percent, reflecting the swelling of demand for energy. It’s not just oil and gas exploration, as it is considered a “business friendly” state.

— Bloomberg reported this week that Toyota is moving a large part of its U.S. headquarters operation to suburban Dallas from Torrance, Calif., as it seeks savings.

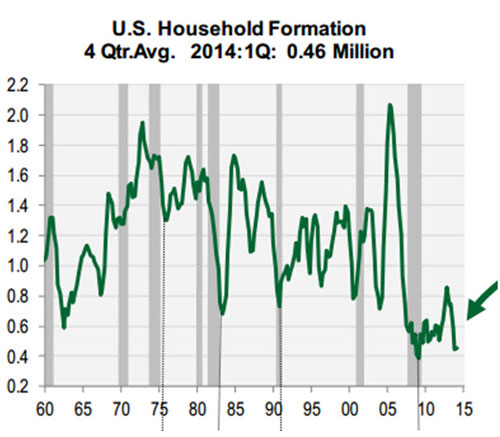

— After increasing in 2012, household formations declined to just 460,000 per year. This sluggish level of household formations helps explain why housing starts remain historically sluggish. Cornerstone analysts expect housing starts to increase to 1.1m units by 4Q of 2014, but sluggish household formation presents downside risk to that forecast. Headwinds for household formations include excessive student loan debt burden, relatively tight mortgage lending standards, and lagged effects of the credit unwind. One potential tailwind for household formations is the prospect of higher labor force participation.

All told, it was a solid week for stocks and the economy in which it certainly appears as if a decent recovery from the harrowing April momentum slide has begun.

Best wishes,

Jon Markman