|

There’s an epic battle going on — one that will determine what happens to YOUR wealth.

I’m talking about the “Stocks vs. Bonds” fight.

Okay, so it doesn’t exactly have the same cache or intrigue as, say, Foreman versus Ali … Coke versus Pepsi … or even Cubs versus Cardinals! But it is the hottest topic on Wall Street right now.

On CNBC today, the headline blares: “What’s really scaring stock traders,” and the first line notes that “The bond market is giving the stock market angst.”

Yesterday, it was Reuters that asked the question: “Bond, stock investors making hay; can both be right?” And right off the bat, the story sums up what many investors are struggling with:

“With U.S. stocks near record highs and Treasury bond yields near multi-month lows, the disconnect between equity and debt investors has rarely been as stark. Over the coming months, the economy is likely to show one of the groups has bet wrong.”

|

| Why are stock market traders scared right now? |

It’s easy to see why the question is repeatedly popping up. We had a lousy GDP reading for the first quarter at just 0.1 percent. And we’ve had data on employment that raises some questions about the underlying strength of the labor market. But all in all, we’re not seeing the kind of stuff we’d be seeing heading into a broad recession.

That’s true for overseas markets in addition to ours, by the way. The U.K. is booming, the euro zone is doing okay, and outside of China, things are generally humming along. Those are key reasons why the Dow Jones Industrial Average just hit an all-time record high, and why the Standard & Poor’s 500 Index is only 20 points or so from doing the same thing.

Yet when you look at bond yields, you get an entirely different message. The yield on the 30-year Treasury bond just hit 3.35 percent, down from almost 4 percent at the beginning of the year. Not only that, but 3.35 percent was also the lowest level since last June.

To throw even more confusion into the mix, the prices of gold and silver are basically going nowhere fast. Gold is stuck in a range of about $1,275 to $1,330, while silver is just sitting around $19-$20 per ounce twiddling its thumbs.

| “Either stocks or bonds will have to gain the upper hand. And the longer the indecision lasts, the greater the market dislocations will be when one or the other market finally breaks.” |

And the dollar? It’s not benefitting from the improved tone of economic data or the strong U.S. market. Instead, it’s sinking against pretty much every currency out there!

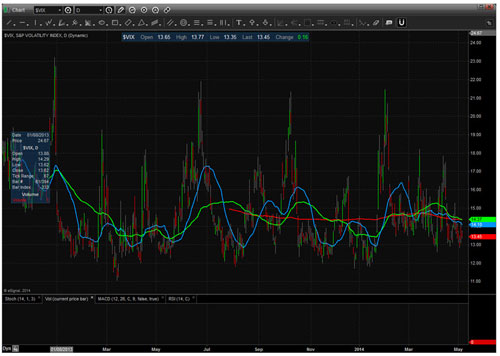

Finally, look at a chart of the S&P Volatility Index or VIX. The VIX is typically a good indicator of market “fear.” When bond yields fall, and recession fears rise, the VIX usually picks up. But it’s flat as a pancake, and has been for the better part of the past year.

Again, the capital markets don’t usually send out these kinds of mixed messages. You would typically expect to see stocks rise, yields rise, the dollar rise, volatility fall, and precious metals fall in a normal, expansionary economic environment. And in a recessionary environment, you’d typically see stocks fall, yields fall, the dollar fall, volatility rise, and precious metals rise.

So what the heck is going on? Well, I think one reason market signals are so messed up is that we have unprecedented central bank meddling in the market. The Bank of Japan, the European Central Bank, and the U.S. Federal Reserve have inserted themselves into the capital markets like never before — through QE money printing, rock-bottom interest rates, purchases of everything from REITs to asset-backed bonds, and more.

That’s having plenty of unintended consequences, and distorting market signals. There’s no telling how these bankers and bureaucrats will extract themselves from the markets. But based on their historical track record, you can bet it won’t happen without plenty of turmoil!

Another factor is the China syndrome. The Chinese economic data we’ve seen is pretty depressing, with stories about a real estate collapse, a manufacturing sector slump, and a sharp GDP slowdown becoming a near-daily occurrence. That’s coloring the trading in bonds, despite the relatively healthy economic data we’re getting from the developed market economies I mentioned earlier.

Sooner or later — and I’m betting on sooner — this battle will have to come to a logical conclusion. Either stocks or bonds will have to gain the upper hand. And the longer the indecision lasts, the greater the market dislocations will be when one or the other market finally “breaks!”

I’ve been expecting select high quality stocks to do well, and bonds to suffer as things improve. I believe the bond market is THE bubble of this era, just like real estate was in the mid-2000s and dot-coms were in the late 1990s. But it’s the market itself that will render a decision at some point — with one likely to take the golden belt and the other down for the count.

| OUR READERS SPEAK |

Meanwhile, yesterday’s column about debit and credit card fraud really touched a nerve. Many readers like you have suffered data breaches, had your card numbers stolen, or otherwise been victimized, though encouragingly, most of you also said your financial institutions made things right.

EZEV said “I used a credit card at a self service pump in southern New Mexico. Within 20 minutes my credit card company called to see if I had purchased $300 in fuel. I had not. They cancelled my card and sent me a new one. There was not a soul around me when I ran my card.”

The likely culprit? Some kind of scanning apparatus inserted into the pump’s card reader, a popular theft tactic. EZEV advises you to check the scanner for anything that looks out of place so you don’t get ripped off!

Randy also says he tends to “use cash as much as possible when on the road and limit using my debit card as much as possible.” He also said he has alerts set up with his bank so he gets texts immediately notifying him of any charges, and he recommends a Bank of America application called “ShopSafe.” You can find out more information about how it works here.

Finally, Rosalindr suggests looking into identity theft protection programs provided by the likes of Farmers Insurance or the credit bureaus like Experian. The verdict? “It’s worth the $250 a year I pay for the peace of mind.”

| MARKET ROUNDUP |

Here’s a quick recap of the OTHER important news of the day …

Stocks couldn’t get much going early on today, then they faded sharply into the close, despite it being Tuesday. I know, it sounds ridiculous. But investing in stocks on a Tuesday — versus paying attention to any other fundamental or technical indicator — has paid off very well lately. Fifteen of the last 17 Tuesdays were “up” days for stocks. Today though? Not so much!

In other market news, the Dollar Index got clubbed — falling to as low as 79.06. That’s within a whisker of a two-year low. Gold and silver were doing nothing of interest, while interest rates were down a basis point or two.

More “Big Pharma” merger news today. Bayer AG (BAYRY) of Germany is shelling out $14.2 billion for the consumer products division of Merck & Co. (MRK). Bayer will become the second-biggest maker of drugs sold over the counter, and Merck will get billions of dollars to … well, who knows?

Office Depot (ODP) is still having a tough time selling office products, despite my best efforts to bolster its business by purchasing a dry erase board yesterday and a desk for my stepson a few weeks ago. The company said it would shutter 400 stores or more in the U.S. now that it has finalized its purchase of OfficeMax.

Investment banks sure are having a hard time making money from, well, investment banking! Barclays (BCS) was just the latest firm to announce dismal results from its fixed income, commodities, and currency trading business. The firm that absorbed the old Lehman Brothers reported that revenue plunged 41 percent in its “FICC” business thanks to subdued interest rates and subdued volatility.

That report comes on the heels of similarly dismal news from JPMorgan Chase(JPM).The bank just warned that trading revenue will plunge 20 percent in the second quarter.

It’s the four-year anniversary of the “Flash Crash” folks! Not for nothing, but I don’t think anyone REALLY has an idea about what caused the market to break that day even now. But boy did it ever break! I remember frantically trying to figure out why the Dow was plunging 900 points … and coming up empty!

Reminder: If you have any thoughts to share on these market events, don’t hesitate to use this link to put them on our blog.

Until next time,

Mike Larson