|

What gives?

The Dow Jones industrial average closed at a new record high last Wednesday, the same day it was reported that first-quarter GDP grew at just a 0.1 percent annual pace, down from 2.6 percent in the fourth quarter of 2013. That was the weakest pace since the fourth quarter of 2012.

That was also the day the Fed announced it would continue its measured tapering program and cut another $10 billion from its monthly stimulus program.

It was the Dow’s first record close of 2014, beating its previous all-time closing high of 16,576. The Dow’s last peak occurred on December 31, so there’s something to be said for finally reaching a new level in 2014. The S&P 500 ended April just shy of a record close, and the technology-laden Nasdaq also ended April higher.

But why would Wall Street push stocks up in the face of such disappointing economic news, especially given the fact that the Fed was continuing to withdraw liquidity from the financial markets?

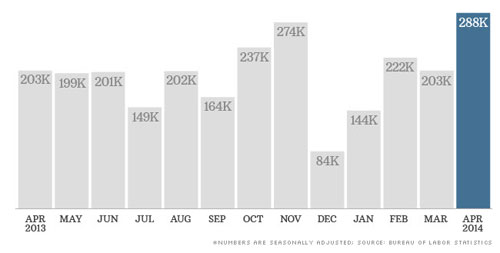

On Friday, we got the answer as the Labor Department’s April jobs report beat expectations with U.S. companies adding 288,000 new jobs, which was much stronger than the 218,000 expected by economists. This was the most jobs added during any month since January 2012, and the unemployment rate fell to 6.3 percent, marking its lowest level since 2008, from 6.7 percent.

But these statistics only tell part of the story.

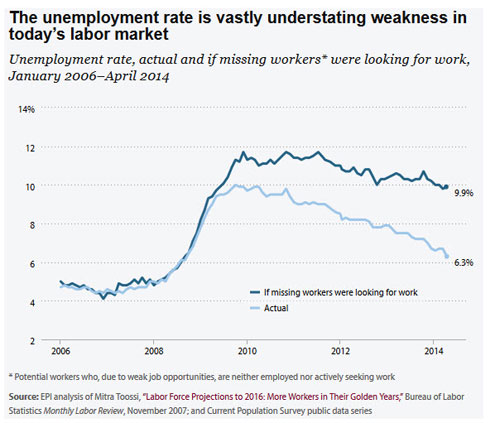

Drilling deeper into the numbers reveals that the labor force participation rate (as shown in the chart below), which measures the share of Americans older than 16 who are actively looking for work or who have a job, declined to 62.8 percent, the lowest level since 1978, from 63.2 percent in March. That’s because 800,000 people — yes, 800,000 — withdrew from the work force, meaning they stopped looking for work.

An 800,000 person decrease is a HUGE monthly decline in the number of people looking for work!

Some economists say that the decrease in the work force is to be expected and is in line with America’s aging demographics, while others point to a “jobless recovery.” No matter which side of the fence you find yourself on, the trend is disturbing in an economy that is growing at less than 2 percent.

The extent to which the declining Labor Force Participation Rate is structural (a result of demographics and a changing society) or cyclical (a result of a weak economy and people just “dropping out”) is something that’s been debated furiously for years now. And as long as we keep getting reports like Friday’s, we’ll keep having this debate.

But in the short run, as I have pointed out in previous Money and Markets columns, we are in uniquely unusual times and the economic reality of slow growth with price stability results in experimental Fed policies that reward investors who are willing and able to take on risk.

That’s why you should evaluate your personal financial circumstances carefully. And if you have the right risk profile, you should consider adding high-quality mid-cap U.S. stocks to your portfolio now.

Go to the Money and Markets Facebook page to see the mid-cap ETF that I am recommending.

Best wishes,

Bill Hall

P.S. Don’t miss Mike Larson’s afternoon edition of Money and Markets for the most up-to-date news on the economy, the markets, and much more. Check your inbox shortly after the market closes each business day.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 1 comment }

finally. someone realizes there 880,000 people looking for work which they can not find and have quit looking…….