|

New global conflicts are spreading so rapidly, and these can have such a dramatic impact on your investments, that I have completely set aside my earlier plans for this month’s articles to focus exclusively on what’s happening right now.

Long ago, Larry Edelson warned you about the rising cycle of war.

Last week, in “Drums of War,” I showed you how important it is.

And just yesterday, Mike Larson gave you a critical update on Putin’s pivot to China.

What you still may not see, however, is how big — and impactful — this truly is. So let me show you with a series of three maps …

|

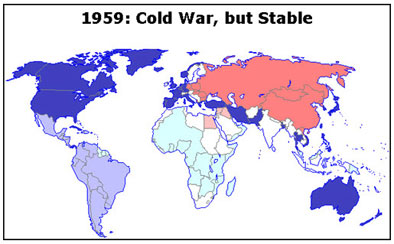

This is the world in 1959, before Fidel Castro came to power in Cuba and before communist forces penetrated Indochina.

The Northern Hemisphere was roughly equally divided between the capitalist West plus Japan (blue areas in map) and the communist world (peach color). Most of the rest of the world was up for grabs.

Yes, that cold war was tense, and the dangers were blatantly obvious. But ultimately, the potential for mutual self-destruction emerged as a powerful deterrent to bloody conflict.

|

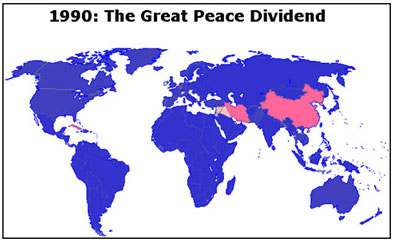

Unexpectedly, it came to an abrupt end — not with the explosion of nuclear bombs but with the collapse of the Berlin Wall.

The Iron Curtain dividing Europe melted away. The Bamboo Curtain isolating China largely faded.

And for investors, a Great Peace Dividend was declared, freeing up trillions of dollars in resources for development. Emerging markets took off and soared.

Yes, North Korea, Cuba, China and Vietnam remained communist, but  only the first two remained isolated. With few exceptions, nearly all nations shifted their alliance toward the great global enterprise of capital markets, corporate profits and economic growth.

|

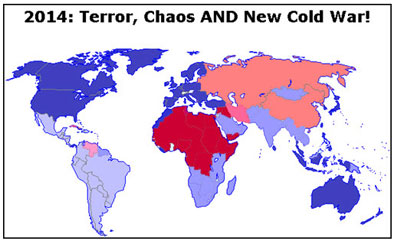

But now look! Suddenly, terror and chaos have spread from the Middle East to Central Asia and much of Africa (red areas in map.)

Suddenly, the old cold-war divide between East and West has burst onto the scene, with new fault lines appearing very near where the old ones were before.

And now, with equal speed, emerging market countries are backing off from unbridled support of Western democratic principles, many shifting back into a neutral zone (gray areas.)

Like lightning, the world has been transformed.

For investors, the biggest and most immediate impact will come from flight capital — massive amounts of money seeking what’s perceived to be the most stable regions, the safest companies and the countries least threatened by their own desperate governments.

The $64,000 question: How do you make money and build your wealth during this transformation?

Larry and I have been meeting frequently in recent weeks to prepare the answers for you. Some of our conclusions will come as no surprise. Some will shock you. But in either case, you must not miss them, misunderstand them or underestimate their impact.

Next week, be sure to watch your inbox for updates — from me, from Larry and from our entire team. Then, get ready to join us at our next major online video.

Don’t worry. We will be sure to send you an invitation and give you all the instructions you need to attend. For now, just be sure to stay tuned.

Good luck and God bless!

Martin

|

EDITOR’S PICKS

Use the summertime lull to FIRE UP your portfolio! by Don Lucek Summer traditionally was a period when investors could take some time to mull over emergent themes coming into play for the back half of the year, and that’s why we have the adage “sell in May and go away.” Obamacare? For Insurers, it Could be “Obama-Bail” by Mike Larson The newspaper reported that the Obama administration modified certain provisions in the Affordable Care Act to allow for a backdoor, multi-billion dollar bailout of insurance companies! Specifically, insurers will potentially be able to collect billions of dollars from Uncle Sam if they agree to keep near-term premium increases tame … This Trend Shift BULLISH for Tech Sector! by Jon Markman Government reports in the past week show that producer prices increased at a 2.1 percent annual rate in April, a level that hasn’t been seen since early 2012 and marking a clear change of trend from what we’ve seen over the last three years. |

THIS WEEK’S TOP STORIES

They Saved the Economy (But Have You Been to the Grocery Store?) by Charles Goyette A week ago, the Consumer Price Index numbers for April were reported. They showed that over 12 months, the CPI had climbed 2 percent. But food prices were the attention getter, reported to have risen 0.4 percent for the month. The BIGGEST FACTOR in the platinum and palladium markets by Larry Edelson Last week I told you how platinum and palladium are now preparing to blast off to the upside. This week, I want to tell you more about them, and why the Putin factor is so important in these markets. Can stocks go higher when growth is so weak? by Bill Hall FrMany market experts got a big surprise last week. The reason? While they have been forecasting since New Year’s that interest rates would go up, the yield on the benchmark 10-year Treasury tumbled below 2.5 percent for the first time since Halloween. |