|

MARKET ROUNDUP

It’s a holiday weekend folks … and that means light volume is the name of the game.

|

I’ve been a football guy practically since birth. But we also like baseball in my household — a lot.

My wife is a die-hard Chicago Cubs fan, being from the North side of that city, while I’m a Boston Red Sox guy.

My stepson plays baseball every season for the local town league.

And we all love going as a family to the Single-A Advanced baseball games at the minor league stadium down the street. Here’s a video of my youngest daughter Zoey racing the “Hammerheads” mascot in between innings (Yes, that’s dad doing all the yelling!) … and a picture of Kim and me enjoying a spring training game last year.

Now the other day, my stepson wanted to know what the guys playing at our field typically make in salary. They’re pretty far down the Minor League totem pole, with AA and AAA teams above them, and the Majors at the top.

|

“When you earn rock-bottom yields, you’re not getting the compensation you deserve for the risk of default you’re taking on.” |

|

Turns out it’s only about $1,000 to $1,500 a month, and only during the five or so months they play ball. Sure, they get a shot at moving up the pay scale over time — and maybe even hit the big time. But that’s pretty rare. Salaries are so low that some minor leaguers have filed lawsuits over their paltry pay.

But you know what? Baseball teams aren’t going to hand out $10,000 a month paychecks or $1 million signing bonuses to every Tom, Dick, and Harry in the farm system! It just wouldn’t make sense because they’d go broke paying too much money for too many high-risk players — with too few “payoffs” in the form of future stars.

Which brings me to the bond market. It didn’t make sense to pay top dollar for super high-risk mortgage bonds backed by subprime loans back in the mid-2000s. The relatively paltry yields offered at the time were nowhere near enough to offset the risk of those bonds defaulting. Sure enough, the bet blew up in investors’ faces. Those bonds plunged in value — to dimes or pennies on the dollar.

It doesn’t make any more sense today to pay extremely high prices for super-risky corporate bonds. When you do, it drives down the yield you earn to rock-bottom levels. Remember, yields and prices move in opposite directions.

When you earn rock-bottom yields, you’re not getting the compensation you deserve for the risk of default you’re taking on. After all, the average cumulative default rate for corporate bonds rated CCC to C (at the bottom of the ratings scale) is north of 40 percent to 50 percent over a multi-year time horizon!

With that in mind, take a look at this chart. It shows the typical yield you can earn today by purchasing CCC-rated bonds. You can see that they’re offering the lowest yields in the history of the data.

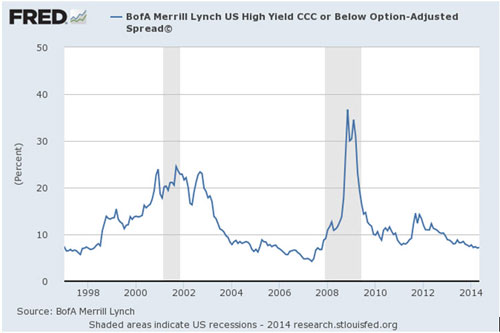

Instead of looking at yields, you can also look at yield “spreads” to gauge whether people are paying way too much for risky bonds. The spread is simply a measure of how much “extra” yield you get buying a high-risk junk bond versus an underlying, credit risk-free Treasury.

Guess what? Those spreads are also basically at all-time record lows, as you can see here:

One analyst at AllianceBernstein Holding LP told Bloomberg said that investors are “throwing money into the asset class rather blindly.” Another analyst at Lehmann, Livian, Fridson Advisors LLC said, “Investors are told, ‘Here’s the deal, take it or leave it'” — and they’re buying anyway just to get a few extra scraps in yield.

You wouldn’t want to root for any baseball team doing this kind of garbage, because chances are they’d end up in bankruptcy court, right? So why would you as an investor want to load up on junk bonds here? Answer: You wouldn’t!

Bottom line: I believe it’s time to get much more cautious in your bond holdings. I’d also consider paring back your exposure to higher-risk stocks with complacency running high.

What about you? Are you so starved for yield, that you’re buying risky bonds? Where else do you like to seek out yield safely? Is this yet-another Fed-fueled bubble that’s destined to pop … or can it go on for a few more years? Let me know at the blog.

| OUR READERS SPEAK |

In other news, Reader David K. weighed in on the mega-deal I wrote about yesterday. He said that it’s no surprise Putin and China are teaming up in light of our foreign policy over the past few years, adding:

“The renewed relationship between Russia and China is a no-brainer: it comes on the heels of the U.S.A. and NATO’s hand in Ukraine which included sanctions against Russian interests, and also the warning to China concerning China’s off-shore disputes.

“I don’t think that oil supply will be significantly hurt; but if Russia and China represent a trend to exit trade in dollars, it could seriously hurt the U.S.A.”

On the other hand, Reader Tom isn’t all that worried about the deal. He equated it to a fictional deal between the U.S. and the Man in the Moon to supply a “trillion billion dollars” in green cheese — all talk and no concrete action behind it. Nice metaphor there Tom. He added:

“It is likely that the U.S. will attain energy independence long before the deal between Russia and China bears fruit. It is also obvious that there will be ever increasing demands for fossil fuels worldwide. I am not worried about the deal between two dysfunctional partners. I continue to buy energy stocks.”

Me? I believe firmly in the maxim: “You reap what you sow.” Our foreign policy has been largely adrift the past few years, and that’s why countries like China and Russia are flexing their muscles. They know that for now, there’s not much we can do to counter them.

Any other thoughts? Share ’em on the blog.

| OTHER DEVELOPMENTS OF THE DAY |

Where else are investors underpricing risk? How about in stocks! The Wall Street Journal reported today about the collapse in the Chicago Board Options Exchange Volatility Index, or “VIX.” We’re at near-record levels of market complacency, with one investor quoted by the Journal saying “We’re not going to be wasting money on a hedge.” Hmmm.

Hewlett-Packard became the latest company to announced large job cuts — anywhere from 11,000 to 16,000 ON TOP of previously announced cuts of around 34,000. But like other companies, it’s shoveling a huge chunk of the money it’s not paying workers into stock buybacks for shareholders. Double-hmmm.

So now, Barclays (BCS) of the U.K. is getting fined $43.8 million for allegedly fixing gold prices. This would follow other multi-million and multi-billion dollar investigations, fines, and penalties against the world’s largest banks.

All told, they have (allegedly) sold shoddy mortgage securities … rigged the energy market … manipulated the all-important LIBOR rate … and colluded to fix the value of global currencies. I just have to ask: Are these guys doing anything in a legal or moral fashion? Yikes!

Reminder: If you have any thoughts to share on these market events, all you have to do is hop on over to the blog and leave your comments.

Until next time,

Mike Larson

Â The S&P rose 0.42 percent and the Nasdaq ticked up 0.76 percent even as most traders headed for the beach.

The S&P rose 0.42 percent and the Nasdaq ticked up 0.76 percent even as most traders headed for the beach.  Among individual names, housing stocks like D.R. Horton (DHI,

Among individual names, housing stocks like D.R. Horton (DHI,