|

With the 10-year Treasury yield still hovering below 2.4%, money continues to pour into equities, aligning perfectly with my bullish long-term view on the stock market.

Here at the Edelson Institute we have been warning for years that as the global sovereign debt crisis begins to play itself out, it will send a tidal wave of capital into U.S equities — driving the Dow to at least 31,000, but potentially even higher.

Even Nobel Prize-winning economist Robert Shiller agrees.

Last week, Shiller went on record saying that he believes investors should continue to own stocks because the bull market may continue for years — and could go up 50% from here.

Overall, companies in the S&P 500 are on pace to see 14% earnings growth for the first quarter of 2017, the most since the third quarter of 2011. That marks the third straight quarter of earnings growth for the S&P 500.

Bullish sign? You bet: Earnings growth has historically been the biggest contributor to share-price appreciation, and it has proven itself to be one of the best predictors for U.S. stocks.

|

|

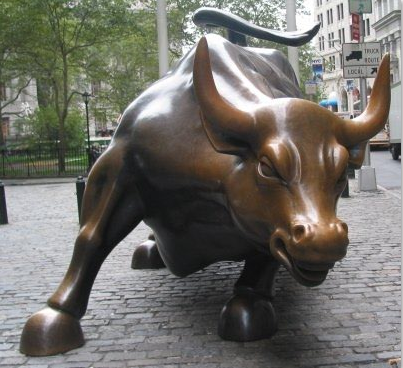

| It’s OK to run with the bulls but make sure you hedge your bets because the market will fall sooner or later. |

That’s why I’m not one bit surprised that we are starting to see huge sums of money flowing into U.S. stocks, especially into the hottest part of the stock market: Technology.

In fact, no area of the stock market has been hotter than tech. Since the election, it has surged by 21%. And it’s clear to me that investors still have a strong appetite for more, with no signs of slowing down.

In one day last week, investors poured a whopping $1.8 billion into the largest exchange-traded fund tracking the sector (PowerShares QQQ Trust Series 1 ETF, symbol QQQ), making it the biggest single-day inflow since September 2010.

That’s right: $1.8 billion in a single day. Massive!

And recent data compiled by Bank of America Merrill Lynch shows that the group is on pace to absorb the most capital since the dot-com bubble 15 years ago.

One reason the large-cap tech sector attracts a surge in new money flows is that the sector has the best profit growth in the S&P 500 — excluding energy — and it’s projected to see earnings expand by 19% for the full-year 2017. That’s more than double the broader benchmark’s expected ex-energy growth of just 9.2%, according to data compiled by Bloomberg.

Now, just because tech stocks have caught fire doesn’t mean you should be throwing all caution to the winds. Stocks are long overdue for a meaningful pullback of 10% or more. This type of pullback would be healthy for the overall market, but you should also protect yourself when the time comes.

So, while my long-term outlook for stocks — and the tech sector — remains positive, it’s time to defend against a downdraft.

Right now on my radar are the out-of-the-money put options on the PowerShares QQQ Trust Series 1 ETF (QQQ) for the tech sector and put options on the SPDR S&P 500 ETF Trust (SPY) for the broader market.

Best wishes,

David Dutkewych

{ 3 comments }

Outstanding info . Thanks

I thought a put option was buying gold. A call option was selling gold. I think we are in for a bull market in the stock market. Usually bear markets only happen during recessions. We are in the middle of a boom at the moment. Nobody knows for sure what’s gonna happen, if we are in for how big a boom that we are gonna to have is the question. A big boom or a small boom. How’s this all gonna effect the solow steady state level of income. What are gonna be the returns to labour and capital. Are there gonna be increaseing returns to labour and c

You were on the GMM, June 5th. I do not recall that you mentioned anything about ‘contrarian’ actions to take at that time.

Plus, why does the company use a NON-SECURED means to communicate??