|

If the past is any indication, we’re in for a good month in the stock market. That’s because over the last 50 years, April has been by far the strongest month of the year for the Dow.

Over the past 20 and 50 years, the Dow has averaged a gain of more than 2 percent in April, beating every other month of the year.

With the first quarter heading to conclusion as I write this, the S&P 500 (SPX) is up marginally for the year and on track to post its fifth quarterly advance.

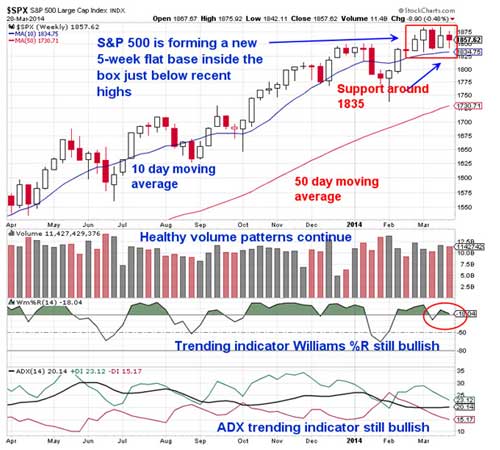

And if you step back and look at the chart below, the benchmark S&P 500 is acting perfectly fine as it builds a new five-week flat base below records.

It is perfectly normal to see the market “rest” here as it consolidates last year’s very strong 29 percent rally. In addition, volume patterns remain healthy on a weekly basis, which suggests we are moving higher, not lower from here.

Investors were reassured Monday by Fed Chair Janet Yellen that the central bank will continue its expansive monetary policy “for some time,” and that “The U.S. economy is still considerably short of the two goals assigned to the Federal Reserve by the Congress” on inflation and unemployment.

You’ll remember that the last time Yellen spoke publicly, on March 19 at her first press conference as chair, stocks dropped when her comments were interpreted to mean that interest rates would rise sooner than expected.

Yellen’s recent remarks come on the heels of mixed economic data releases. The government said last week that 2013 fourth-quarter GDP was revised up to 2.6 percent from an earlier estimate of 2.4 percent. That was in line with the Street’s expectations, but was down from a 4.1 percent gain in Q3. The Labor Department said initial jobless claims fell to 311,000 for the week ending March 22, from an upwardly revised 321,000, easily beating estimates for an increase to 330,000. The Conference Board reported that consumer confidence rose to 82.3 in March, a six-month high.

The latest housing data was mixed as well. The Commerce Department said new home sales slid 3.3 percent in February (largely due to the weather), and the S&P/Case-Shiller index showed that home prices in 20 cities rose 13.2 percent from January 2013.

Looking forward, the S&P 500 is trading in a new five-week flat base with support near 1,834 and resistance near 1,884. Until either level is breached, you should expect the sideways action to continue.

As Sir John Templeton used to tell me, At this point, more damaging evidence is needed before the bull market breathes its last breath.

While the major indices didn’t have too rough of a month in March, it has been a struggle for the market’s 2013 big winners in early 2014. However, the bulls have seasonality on their side in April.

Best wishes,

Douglas