|

The first quarter of 2014 is history, and for the stock market overall, results are decidedly mixed. After a robust year of gains in 2013, stocks are off to a more uneven start so far this year.

The S&P 500 Index is up just 1.2 percent after the first three months of 2014, with plenty of volatility along the way. Dig a bit deeper, however, and you can separate the winners from the losers.

Since the first quarter just drew to a close yesterday, a great strategy for every investor is to review the best performing stocks and sectors so far this year, and the laggards. That exercise can give you money-making clues about how your investment portfolio should be allocated.

First the losers … for the most part consumer and defensive stocks and sectors in the S&P 500 Index, as investors have clearly shifted their preferences toward more cyclical, higher-beta stocks.

For example:

- The Autos Parts & Equipment Index was down 3.5 percent in the first quarter …

- Consumer Durables & Apparel declined 4.2 percent, and …

- Retailers fell 5.2 percent.

Now the winners … almost anything technology or biotech related. In fact, four out of the top-ten S&P 500 industry groups ranked by performance so far this year were technology or health care technology, including:

- Health Care Equipment & Services, up 5.6 percent …

- Semiconductor & Semiconductor Equipment, up 5.2 percent …

- Pharmaceuticals, Biotechnology and Life Sciences, up 5.2 percent, and …

- Software & Services, up 1.9 percent.

There were plenty of individual companies that did much better than average too.

Electronic Arts (EA) shot up 26.2 percent, Akamai Technologies (AKAM) is up 23.9 percent, and Facebook (FB) jumped 11.9 percent, over the past three months. And these are just the “headline” technology names. Many other Nasdaq listed tech stocks, most you’ve probably never heard of … are performing even better in 2014.

Such as:

- Splunk Inc. (SPLK) gained 35.1 percent in the first quarter …

- Silicom Ltd. (SILC) was up 56.8 percent, and …

- Radisys Corp. (RSYS) soared 81.2 percent!

Granted, these are not YET household names. But it makes perfect sense why so many relatively unknown technology stocks are grabbing the headlines today with big gains.

It’s the typical IPO cycle at work.

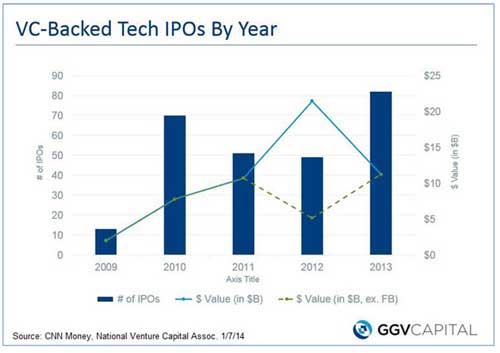

In 2012 and 2013, well over 100 venture capital-backed technology companies debuted with initial public stock offerings (IPOs) raising more than $30 billion from investors. Although there are a few high-profile IPOs each year (like Facebook from the IPO class of 2012), most of them are not household names … at least not yet.

My colleague Jon Markman has developed a winning formula for spotting tomorrow’s technology superstars AFTER the IPO hype has died down, but BEFORE these emerging tech powerhouses become household names.

And you don’t have to be a Silicon Valley propeller-head to follow his common sense tech investing strategy … you just need to carefully do your homework, as Jon does.

You don’t even need to twist your full-service stockbroker’s arm to get in at the IPO price either. In fact, sometimes that’s the worst time to invest in emerging tech stocks. There’s plenty of time to buy the true hidden gems after the IPO date, and typically at a much more attractive price.

Here are some fun IPO facts to keep in mind:

- While 76 percent of all IPOs from 2007 to 2012 were classified as “emerging growth companies” the median annual sales for these stocks was just $105.3 million.

- Nearly 60 percent of these IPO stocks were unprofitable when they first came public.

- IPOs from 2012 and 2013 enjoyed fast-paced growth rates of 44 percent on average in the year they went public!

So what can we learn from these stats? The same thing Jon Markman learned and applies to his own fine-tuned tech investment methodology.

First, most tech IPOs are unknown for a reason: They have top-line sales of only $100 million or so on average … that’s off the radar for most investors, especially institutional investors like mutual funds.

Second, the majority of high-tech IPOs have yet to turn a profit. They’re unproven, and that’s another reason why many investors shy away.

Third, in spite of being off the radar for most investors, IPOs have enormous growth potential. How many proven stocks do you know that are capable of growing 40 percent-plus? Very few!

As Jon will tell you … it’s all about doing your homework ahead of time to separate the best of these as-yet unknown tech superstars from the rest. And that takes more than just hard work. It takes a deep understanding of how technology works as well as the qualities that are required to transform a small, virtually unknown company into one of tomorrow’s tech titans.

Then, it’s critically important to get your timing right.

Jon points out that paying too much for a new, fast-growing stock is a sure prescription for heartburn and sleepless nights as a tech investor. It’s no fun buying at the IPO price, only to watch helplessly as your prized stock gets cut in half when the IPO hysteria dies down.

Timing is everything with emerging technology stocks; you must be disciplined enough to stalk the potential 10-baggger, but be willing to wait patiently for the right time to load up.

Bottom line: These are boom-times for emerging tech stocks after the last two banner years for IPOs. There is a whole new crop of undiscovered technology stocks, some of which will become the superstars of tomorrow. In fact, the average stock from the technology IPO class of 2013 jumped 64 percent through the end of last year, and 15 were up 100 percent of more.

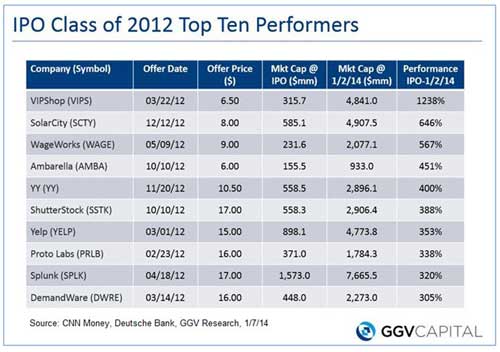

Plus, the average tech IPO from 2012 is up a remarkable 170 percent from the IPO price. Several appear in the table below …

Jon Markman discovered and has recommended many of these stocks to readers including WageWorks (WAGE), ShutterStock (SSTK), Splunk (SPLK) and DemandWare (DWRE). You can find more details in the Money and Markets archive.

Next week, Jon will be joined by Dr. Martin Weiss for a special online video summit: “New Technology Superstars for 2014.” Simply click this link now to claim your Head-of-the-Line Pass and then join Dr. Weiss and Jon Markman for the Grand Premier of this historic summit next Tuesday, April 8!

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.