|

A little over a month ago, gold was deeply oversold.

So I recommended that you either add to your gold positions or start a new position if you were not yet investing in gold.

Well, almost as if on cue, gold headed straight up. It’s still up 4.6% since then, even after its current pullback.

But, it’s not just me recommending gold:

The manager of the world’s largest hedge fund at Bridgewater Associates, Ray Dalio, also recommends owning gold. In fact, he recently said that investors should place 5% to 10% of their assets in gold.

According to Dalio, it makes sense to own gold as a hedge against current geopolitical risks. Two key ones include:

- The chance Congress won’t raise the debt ceiling, causing a technical default and leading to a government shutdown. Plus …

- Dwindling faith in the effectiveness of our political processes.

And I couldn’t agree more.

|

|

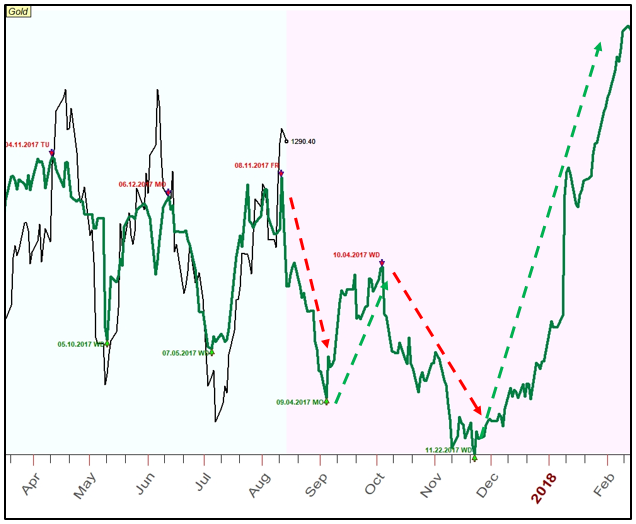

| Gold will probably take investors on a roller-coaster ride before it takes off like a rocket near the winter holidays. |

Gold remains one of the best-performing commodities this year, with its 10%-plus gain. I see gold in the process of forming a long-term base and building energy for a larger move higher later this year.

Ditto for silver, which has also performed well. It’s up almost 5% so far this year.

Political uncertainty has been a key driver behind gold’s rise this year. And I expect that to continue.

Take last week as an example: The escalating tensions with North Korea spooked investors and sent shockwaves across the equity markets. And gold responded, as a safe-haven asset, by surging more than $30 higher.

All told, do these factors mean that gold is at the beginning of a new bull market?

Not yet, but we are getting closer.

Until then, The Edelson Institute’s cycle forecast chart for gold shows volatile times ahead for the yellow metal.

As you can see in the cycle chart above, volatility in gold prices should persist until late November, with an initial downturn in gold prices heading into early September.

That will be followed by a short and sharp rally into the beginning of October, then another leg down heading into the holiday season.

So, I remain cautious on gold, and the rest of the precious metals, in the nearer term.

The multitude of catalysts that I mentioned above should keep gold traders on their toes throughout the third and fourth quarters of the year.

That said, gold is in the process of bottoming.

And, as we get closer to year-end, we will see an excellent long-term buying opportunity in gold as well as silver, platinum and palladium.

Remember, buying ETFs is one of the easiest ways to gain exposure to gold in your portfolio. So, while I expect more volatility in gold prices in the nearer term, it makes sense to continue adding to your gold positions on dips throughout the second half of the year. You can do this by buying ETFs like the SPDR Gold Shares (GLD) or iShares Gold Trust (IAU).

Best wishes,

David Dutkewych

{ 4 comments }

“You can do this by buying ETFs like the SPDR Gold Shares (GLD)”

I’ve been trying to do my due diligence into the SPDR Gold Trust (GLD). Anyone know why there is a clause in the GLD prospectus that states GLD has no right to audit subcustodial gold holdings? Why would the organizations behind GLD forfeit this right and create such a glaring audit loophole? I have not heard a single good reason for the existence of this loophole thus far. It also doesn’t help that GLD claims to be fully backed by physical gold bullion but yet it refuses to give retail investors the right to redeem for any of these ‘claimed’ gold bullion. There are a number of other red flags as well from what I’m reading:

“Did anyone try calling the GLD hotline at 866â–ª320â–ª4053 in search of numerical details on GLD’s insurance? The prospectus vaguely states “The Custodian maintains insurance with regard to its business on such terms and conditions as it considers appropriate which does not cover the full amount of gold held in custody.” When I asked about how much of the gold was insured, the representative proceeded to act as if he didn’t know and said they were just the “marketing agent” for GLD. What kind of marketing agent would not know such basic information about a product they are marketing? It seems like they are deliberately hiding information from investors.”

“I remember there was a well documented visit by CNBC’s Bob Pisani to GLD’s gold vault. This visit was organized by GLD’s management to prove the existence of GLD’s gold but the gold bar held up by Mr. Pisani had the serial number ZJ6752 which did not appear on the most recent bar list at that time. It was later discovered that this “GLD” bar was actually owned by ETF Securities.”

Buy the “hard stuff” and stash it away through all the ups and downs. Then some day…

In terms of numbers, what are we looking at in Nov. 2017 pertaining “….. gold is in the process of bottoming.” Many thanks.

Hi David, is it the right time to buy physical gold in November 2017? Thanks.

Regards,

Phoebe