| MARKET ROUNDUP |

Here’s a quick recap of the important news of the day …

But it’s the action in the emerging markets that I want to focus on today. |

For starters, is there anything more disgusting, despicable, and downright pathetic than these Nigerian terrorists?

The crisis there reached a new phase overnight after the militant group Boko Haram released a video showing many of the 220 schoolgirls the group abducted in April.

The group’s leader Abubakar Shekau has spent the past couple of weeks taunting the Nigerian leadership and the international community in multiple statements, and continuing to preach his ignorant, perverted form of Islam. You know, a version where educating women is “wrong” and selling or marrying off 9-year-old girls is “right.” Personally, I hope and expect that he’ll meet his maker sooner rather than later!

Meanwhile, in Ukraine, separatists in that country’s unruly eastern region held a referendum on independence this weekend. Some 89 percent of Donetsk voters reportedly opted for autonomy, while 96 percent of the voters in Luhansk did the same.

The central government in Kiev naturally believes the vote is a total sham, while Russia’s government has offered qualified support, saying it “respects the will of the population.” So far, no Russian tanks are rolling into Ukraine a la Czechoslovakia in 1968. But considering Russia’s actions in Crimea, would YOU rule out that possibility? I sure wouldn’t!

|

| You have to know the risks involved before exposing your hard-earned money to far-flung markets halfway around the world. |

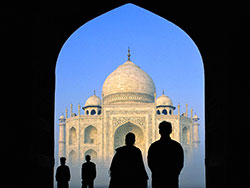

These kinds of examples show the world remains a dangerous place — for citizens in emerging market countries most importantly, but also for investors like you. The risks are the highest in so-called “frontier” markets, the “most emerging” of emerging markets like many nations in Africa, Asia, and South America.

Investors have gained access to those kinds of markets in recent years thanks to ETFs like the (EMFM). The ETF hit the market in November 2013, investing in companies active in African nations like Nigeria, Namibia, and Tanzania, as well as Pakistan, Vietnam, and Mongolia.

Another similar product, the Guggenheim Frontier Markets ETF (FRN) is loaded up with equities from Chile, Colombia, Argentina, and Egypt, among others. It topped out around $25 back in 2010, then fell to as low as $14.25 in February. That occurred even as the major U.S. averages climbed to record highs, showing just how risky frontier markets can be.

| “So far, no Russian tanks are rolling into Ukraine a la Czechoslovakia in 1968. But considering Russia’s actions in Crimea, would YOU rule out that possibility? I sure wouldn’t!” |

But that doesn’t mean you can’t find diamonds in the rough — if you know where to look! Take something like the PowerShares India Portfolio (PIN). It has surged more than 7 percent year-to-date, and just hit the highest level since March 2012!

The reason? Narendra Modi and his Bharatiya Janata Party look poised to win a majority in that country’s parliament. Investors believe Modi would implement market-friendly policy reforms, attracting much higher levels of foreign investment and foreign money.

Bottom line: You have to know the risks involved before exposing your hard-earned money to far-flung markets halfway around the world … especially in this day and age!

So what do you think? Is the potential reward of emerging markets investing worth the risk? Have you invested in so-called “frontier” markets before and if so, are you happy with the results? What about the goings-on in Nigeria, Ukraine, and elsewhere — do they have you focusing on U.S. stocks instead? Let me know at the blog.

| OUR READERS SPEAK |

One of the most popular U.S. stocks, of course, is Apple (AAPL) — and you had plenty to say about its latest strategic moves.

Reader Ed said the stock has become just too darn stodgy, calling it a“big ship that turns soooooo slow it’s dead money. I like smaller ships that move faster.”

Reader Robert also thinks that Apple has lost its way. His comments:

“Correct me if I am wrong but Apple’s biggest successes have come from within. From the Mac to iPod to iTunes to iPhone to iPad; you get the idea. Buying growth is so Microsoft or Oracle it is almost an admission that Apple’s best days for innovation are behind it.

“Will they make a lot of money? Probably. Will they ever define a whole new market? That remains to be seen.”

Robert, I think you’re on the right track. I personally have an iPhone and iPad. But I have no intention whatsoever of camping outside the local Apple store when the next generation of either product comes out!

Finally Reader Fred tends to agree that the U.S. dollar isn’t going to fall off a cliff just yet. His rationale?

“While I agree that the White House has been piling up debt in a fashion that is not responsible … to say the least … I think there is one saving grace. Worldwide there is a sea of debt. And most of that debt is denominated in dollars and must be paid in dollars. So, at least for the next few years … there should be a demand at some level … for dollars.”

Those are good points. But I actually think the dollar’s biggest saving grace is that the major alternative currency — the euro — is in even worse fundamental shape. Anemic growth, deflation pressures, political dysfunction, and the likely impending launch of Euro-QE argue for a weaker currency vis-Ã -vis the dollar, if you ask me!

| OTHER DEVELOPMENTS OF THE DAY |

Merger Monday? Not exactly. But we did get at least one multi-billion dollar deal. Hillshire Brands (HSH) is buying Pinnacle Foods (PF) for $4.3 billion, adding products like Wish-Bone salad dressing and Bird’s Eye frozen foods to its staple of brands.

Darn — I’m getting hungry just writing this! And I’m glad that I’ve been recommending one of the biggest recent winners in the food sector in my Safe Money Report. We’re up more than 13 percent … and counting … on this name in just three months!

The NFL Draft is over! Lots of differing opinions about which team did the best in terms of positioning for near-term and long-term success. My Patriots played it a bit risky by using their first-round pick on defensive lineman Dominique Easley, a former Florida Gator with a history of serious knee injuries. But hopefully it works out in the end.

Meanwhile, I’m still interested in what YOU think about the two possible stock draft picks I mentioned the other day. Let me know what you like — or who you’d rather own instead here.

Former Treasury Secretary Tim Geithner is doing the media rounds, hawking his new book on the financial crisis, “Stress Test.”

Me? I think Geithner was simply one tool of Wall Street amid an administration and Federal Reserve full of them! They bailed out the same banks and bankers who caused the financial crisis, while sticking America with the bill — and no amount of retroactive, reputational whitewashing is going to change that!

Reminder: If you have any thoughts to share on these market events, don’t hesitate to use this link to put them on our blog.

Until next time,

Mike Larson

Â The stock market came into today’s session with a head of steam, and it didn’t disappoint heading into the close! The Dow Industrials hit another record high at 16,705, while the left-for-dead Nasdaq Composite tacked on 72 points. The Dow Transports were also very strong on the day, gaining almost 2 percent.

The stock market came into today’s session with a head of steam, and it didn’t disappoint heading into the close! The Dow Industrials hit another record high at 16,705, while the left-for-dead Nasdaq Composite tacked on 72 points. The Dow Transports were also very strong on the day, gaining almost 2 percent.