| MARKET ROUNDUP |

Here’s a quick recap of the important news of the day …

|

So what’s the “good news” today? The government says there’s no inflation … unless you eat!

|

| While the government says there’s no inflation, egg prices surged 44.3 percent from a year ago last month. |

Or drive.

Or travel.

Or buy health insurance, rent an apartment, and plan to purchase a truck, among other things!

That’s the verdict from today’s Producer Price Index. The report on wholesale inflation was plug-ugly throughout. The overall PPI rose 0.6 percent in April, the biggest rise since September 2012. The “core” PPI that excludes food and energy increased 0.5 percent, more than double the average forecast of economists who never leave their Ivory Towers to shop.

More to chew on: Meat costs jumped 8.4 percent, the biggest rise since 2003. The gasoline additive ethanol rose the most in history. Plane ticket prices climbed almost 5 percent from a year ago, while the cost of renting a car jumped 23.4 percent.

There’s nothing sunny side up about egg prices — they surged 44.3 percent from a year ago last month. And while pork may be the other white meat, it’s going to take a lot more green to buy it. Prices jumped almost 21 percent in ONE MONTH!

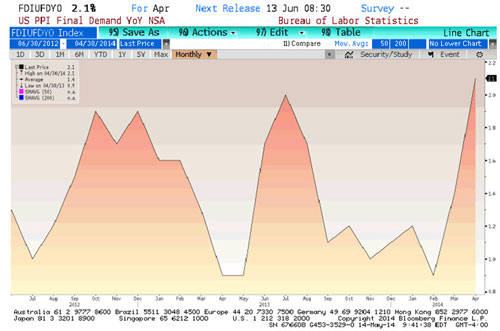

Look, you don’t need to be the world’s best technical analyst to see a trend here in year-over-year wholesale core inflation — the indicator central banks follow closely. It has been climbing recently and just broke out to a fresh two-year high, as you can see here:

Again, this is coming as no surprise to you and me. When my wife and I go to the grocery store, we’re increasingly shocked when it’s time to check out. My 15-year-old stepson lives with us full-time, and he’s a bottomless pit when it comes to eating, like most active teenagers. And when my 8- and 11-year-old daughters are at the house with us, too, costs really add up!

|

“You don’t need to be the world’s best technical analyst to see a trend here in year-over-year wholesale core inflation — the indicator central banks follow closely.” |

Heck, we hosted a barbecue the other weekend and the meat alone was pushing $50! Ground beef packages that used to cost around $4 are now going for $7, while a small slab of my family’s favorite grilled option (baby back ribs) is in the double digits, easy.

We go to our grocer’s website and electronically “clip” coupons before we shop to save some money. We also stock up when our standard items go on sale, so we don’t have to buy during weeks they’re selling for regular price. The store accepts competitors’ coupons, too. So if another area retailer has things like “$5 off $50 or more” coupons in its circular, we’ll clip that out and use it at our neighborhood store.

That helps. But the only thing that will get inflation under control over the longer term is sound monetary policy. We’ll have to see if central bankers get the message from data like this … or if they don’t notice because their “help” does the shopping, cleaning, and cooking!

What about you? Are there money-saving tips YOU can share to make everyone’s weekly outing to the grocery store a little less painful? And how is the rising cost of living affecting your wealth and spending habits?

All you have to do is click to our blog and join the discussion.

| OUR READERS SPEAK |

One of the other topics that has generated a lot of buzz is the ongoing mergers and acquisition wave. Reader Jackie said that “Mergers are great if it’s just about owning the right stock at the right time.”

But for workers? Not so much. She added: “I unfortunately lost my job with thousands of coworkers when Teva Pharmaceutical Industries (TEVA, Weiss Rating: B) bought out Barr. Someone made money and it wasn’t me!”

Reader Jerry F. added: “Mike, thinking people understand that costly Mergers and Acquisitions can be justified only by eliminating competition to raise prices and firing overlapping workers, is extremely damaging to the U.S. economy. But as long as they continue to buy seats in Congress and the White House, the government will not put a stop to the madness.”

You’re on target, Jerry. After all, when the head of a company gets compensated based largely on the value of his or her stock — not the general happiness and financial well-being of his workers — what do you expect to happen? He or she will try to maximize shareholder value, even if that means slashing jobs. Who can forget guys like “Chainsaw Al Dunlap?

As for the euro currency, I think I can hear Reader J.I. W. shaking his or her head all the way from here when it comes to economic policy. The noteworthy comment?

“Wasn’t it Dr. Weiss’s father who warned him not to underestimate the potential for governmental stupidity? It is interesting that the fools in charge of the EU are mimicking Japan and the Fed in attempting to depress the cost of money.”

Couldn’t have said it better myself!

OTHER DEVELOPMENTS OF THE DAY

Mining is a dirty, nasty, dangerous business — but a necessary one if we’re going to have the coal, iron, gold, and other resources the world economy needs to grow. Nothing brings that message home more than a tragedy like the one we’re seeing unfold in Turkey.

Valmont Industries (VMI, Weiss Rating: A-) is one of those “behind the scenes” companies I’ve liked for some time. They make everything from farm irrigation equipment to highway safety barriers.

Today, the stock exploded to a one-year high after jacking up its dividend by 50 percent and announcing a $500 million share buyback. Safe Money Report subscribers have been in this one for a while, and are making nice profits as a result. You may want to check us out to get your share.

The Federal Reserve is making more noises about all the easy money lending that’s fueling the recent spate of takeover deals. But it’s not actually doing anything significant to end the practice. It’s just wagging its finger at the industry.

That’s the exact same thing the Fed did during the housing and mortgage bubble. They issued mealy-mouthed “guidance” to banks that had no regulatory teeth. So banks kept on making high-risk loans until they blew up themselves — and the economy! — Some things never change in Washington!

Reminder: If you have any thoughts to share on these market events, all you have to do is click here and leave your comments.

Until next time,

Mike Larson

Â It’s not every day the bond market steals the show. But it did today! Ten-year Treasury yields plunged more than 8 basis points, spooking stock investors into dumping shares on the assumption that the drop signaled something about the underlying strength of the economy.

It’s not every day the bond market steals the show. But it did today! Ten-year Treasury yields plunged more than 8 basis points, spooking stock investors into dumping shares on the assumption that the drop signaled something about the underlying strength of the economy.

{ 1 comment }

I knew it!