|

Are small-cap stocks doomed in the current environment?

Some investors seem to think so, since they’ve been left in the dust as their large-cap peers take off, pumping up the S&P 500 and the Dow Jones Industrial Average to ever-higher closing records.

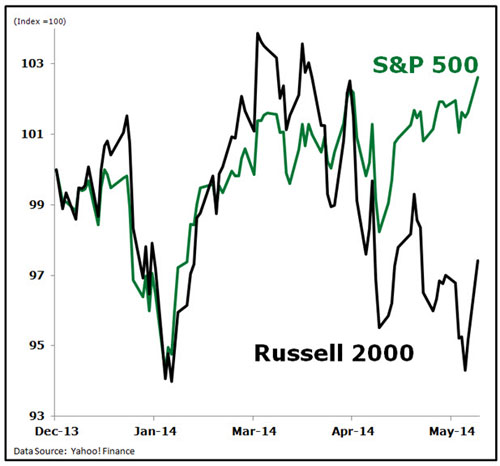

Consider: the S&P 500 (the largest 500 stocks, by market cap) has added roughly 3.4 percent so far this year — as of Tuesday of this week — while the Russell 2000 (composed of small cap stocks) has declined almost 3.3 percent. Proof, analysts say, that investors are losing their taste for the riskier names and hunkering down in the more-proven large cap area.

Some analysts even argue that the absence of a clear bullish bias toward smaller companies implies that the market, as a whole, could be at risk of seeing its current, slightly bullish, bias coming to an end in the very near term.

|

| Small caps have been left in the dust as their large-cap peers take off. |

In any case, the companies I see as up-and-comers are not attracting investor interest. The smaller, riskier stocks are falling in general, which implies that their fundamental growth prospects are not sufficient to offset their inherent riskiness versus established firms that entice bids from investors.

It’s true that small cap stocks are more volatile than large caps, due to the fact that the smaller cap companies are not proven over time, and their financial fundamentals can be far more volatile over shorter periods of time.

As you can see in the chart below, they have indeed underperformed in 2014 so far.

However, when the market as a whole is rising, the small caps can outperform, as they did in 2013 — when the S&P 500 rose close to 30 percent — but the Russell 2000 jumped closer to 37 percent.

In short, investors typically bid up the smaller, more volatile, shares available when the general outlook seems to be expansionary for all firms, regardless of size, as it looked at this point last year.

This makes intuitive sense for an analyst or trader, as the fundamentals themselves — say in terms of absolute revenue or profit levels — are smaller for smaller companies. So any change in absolute numbers (growth in revenue, cash flow or earnings, for instance) is magnified in terms of percentages compared with larger companies. This makes their shares move with exaggerated tenor versus their larger-cap peers. But look, it is clearly just a numbers game at this level, so small-cap stocks are likely to remain more volatile — on average — as a rule of mathematics.

Eventually though, the most successful smaller-cap companies become large caps over time, and we would rob ourselves of potentially outperforming returns by simply ignoring them.

So I took a hard look at the Weiss Ratings of smaller caps in relation to the market as a whole this week, in a quasi-contrarian bid to find any stocks approaching large cap status that have pulled back along with the entire class of investments. What I found was not surprising: the Buy/Hold/Sell profile for the small-cap cohort was clearly lower than that of the whole universe of close to 4,800 stocks I used for my analysis.

Bottom line: The small caps do indeed look less appetizing at the moment than their larger-cap alternatives. That said, I think there are some interesting findings contained in an analysis of just the smaller-cap segment.

First of all, the top-Rated list is dominated by stocks of financials. This does not come as a shock to me, as the fundamentals of small-cap banks and the like have drastically improved over the past few years, and in some cases the corresponding stocks have not moved up along with the fundamentals. Examples of highly rated financials in the current set are:

- Bank of Kentucky (BKYF — Rated A+)

- West Bancorp (WTBA — Rated A+)

- Southern Missouri Bancorp (SMBC — Rated A+)

(To see more examples, go to our Money and Markets Facebook page.)

These small banks have market caps under $300 million, but are worth analyzing further. They have the potential to grow organically, acquire, or be considered takeout bait in the current environment.

All carry the highest Weiss Rating attainable, but not all are created equal. Some have very low average trading volume. So if you think they are good fits with your portfolio, you need to be very careful in terms of entering the names (with lower volume, it is usually advisable to “nibble” your way in to a full position, for example). This is a hurdle in buying something with relatively low supply — if demand is high, the price change from a trade can be exaggerated.

Whether you think small-cap stocks are doomed in the current environment (an extreme view that I do not hold), or if you think that the current pullback is a screaming buy opportunity (another extreme view, but one that I am closer to than the “doom” view), there are a lot of potential investments out there for you.

And we bring to you lists of stocks that could fit the bill in our Heat Maps service. There are also some consumer and tech stocks worth a second look in those Heat Maps lists from the small-cap sphere. And I encourage you to check them out.

Best,

Don Lucek