|

In public statements, Federal Reserve Chair Janet Yellen and her counterpart at the European Central Bank, Mario Draghi, were both singing the same song last week about the lack of global economic growth, despite the unprecedented easy money policies that the American and European central banks continue to promote.

And the tune Yellen and Draghi were singing was music to Wall Street’s ears.

In her testimony before Congress on Wednesday about the state of the U.S. economy, Yellen said,

“Many Americans who want a job are still unemployed, inflation continues to run below the Fed’s longer-run objectives (of 2 percent) and work remains to further strengthen our financial system.”

In fact, Yellen referred to the same chart that I presented in my Money and Markets column last week that showed that the U.S. Labor Participation Rate had dropped to its lowest level since 1978.

Then, almost on cue, on Thursday Draghi said,

“The recovery in Europe is proceeding but it is proceeding at a slow pace, and it still remains fairly modest, and there are some downward risks now. The risks have to do with the possible weakening of global demand, geopolitical risks that are of serious significance and the euro’s exchange rate.”

Indeed, inflation across the 18-nation euro zone currently stands at 0.7 percent, but the financial markets expect it to fall closer to zero when the flash estimates of the May cost of living are published on June 3.

|

| Low inflation that borders on deflation can be just as destabilizing as runaway inflation to the global economy. |

“There is consensus about being dissatisfied with the projected path of inflation,” Draghi said. This means that Draghi and his team of bankers fear European inflation is too low.

These statements probably leave you asking: Does this make sense? Why are the Fed and ECB concerned that inflation is too low? Isn’t low inflation a good thing?

Of course, run-away inflation is a bad thing as the price of goods and services rise rapidly and lead to economic instability. Yet, on the other hand, low inflation that borders on deflation can be just as destabilizing to the global economy.

That’s because low inflation means slow economic growth and without growth there is no economic progress. Making matters even worse is the huge global debt overhang that remains in place after the 2009 financial crisis, since growth is essential to pay off that debt.

Through lowering interest rates and buying bonds, the Fed and ECB can try to stimulate the economy by making it cheaper for businesses and consumers to take out loans. Low interest rates can also boost the housing market by making mortgages cheaper, and fuel stock market gains by making equities a more attractive option than bonds with measly returns.

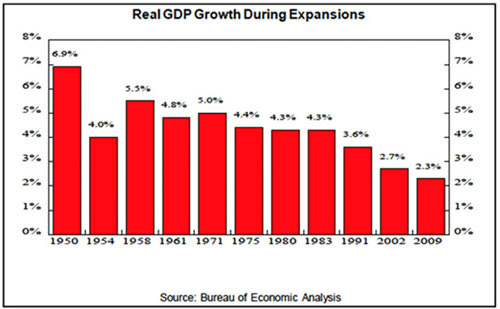

But as I explained in a previous Money and Markets column, there is little or no evidence that the wealth effect is actually working, because the chart below shows that economic growth, after the recession of 2009 ended, is the slowest since the 1950s.

That’s why — without any signs of inflationary pressures on the horizon — both Yellen and Draghi are recommending the same course of action, with Yellen saying that short-term rates would remain near zero for a “considerable time.” And then Draghi followed with his own hints of future European interest rate cuts, possibly backed by the start of a new euro-zone quantitative easing program.

With Yellen and Draghi committed to maintaining low interest rates and propping up economic growth for the foreseeable future, it’s obvious that the plan is to get the global economy moving again or bust.

Or said another way: They are following my lead and singing Risk on Regardless, because a deflationary environment devoid of any economic growth leaves no hope to eliminate the massive debt overhang that continues to plague the developed world.

In this environment, if your risk profile allows for it, large dividend-paying, blue chip companies should form the core of your portfolio.

Best wishes,

Bill Hall

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 2 comments }

Generally,actual inflation is approximately 2.5-3 times govt figures.Bill Hall has to start paying attention to actual prices and/or do your own spending.With most of the central banks devaluing their currencies,in a race to the bottom,there will be severe negative consequences.You can't get something for nothing,no matter what politicians tell you.

You elect socialists, make wealth seem like a crime, 55% of the nation only votes for a living,

civil servants are the top earners, remake a Constitutional republic as a socialist/communist

disaster by following the exact formula of Adolf Hitler, this is where it ends up without fail, all. Politicians are parasitic. Socialism is just a leadership infestation of low lives. Socialists have killed more humans than any other political system. When politicians start denying you the right to protect yourself it's time for them to be taken out. Obama wants your guns, but his henchmen shoot a woman dead in her car outside the white house. Your kids don't need protection at school but his have 4 armed guards. You can't have a semi-automatic weapon yet department of agriculture has just raised a tender for full body armour & fully automatic

machine guns. Who are they going to kill, Homeland security has ordered millions of hi impact ammo, armed vehicles, assault rifles, Obama's Fema private army is better armed than the marines. Who wants to pay taxes to a totalitarian lying cowardly government. Level the playing field, force congress to enact Kennedy executive order 11110 and enforce his non debt Kennedy silver dollar. An official legal currency instead of the bankrupt federal fractional reserve system and you pass the debt back to the people who illegally incurred it. President Woodrow Wilson took a bribe, to enforce legal tender an illegal currency.