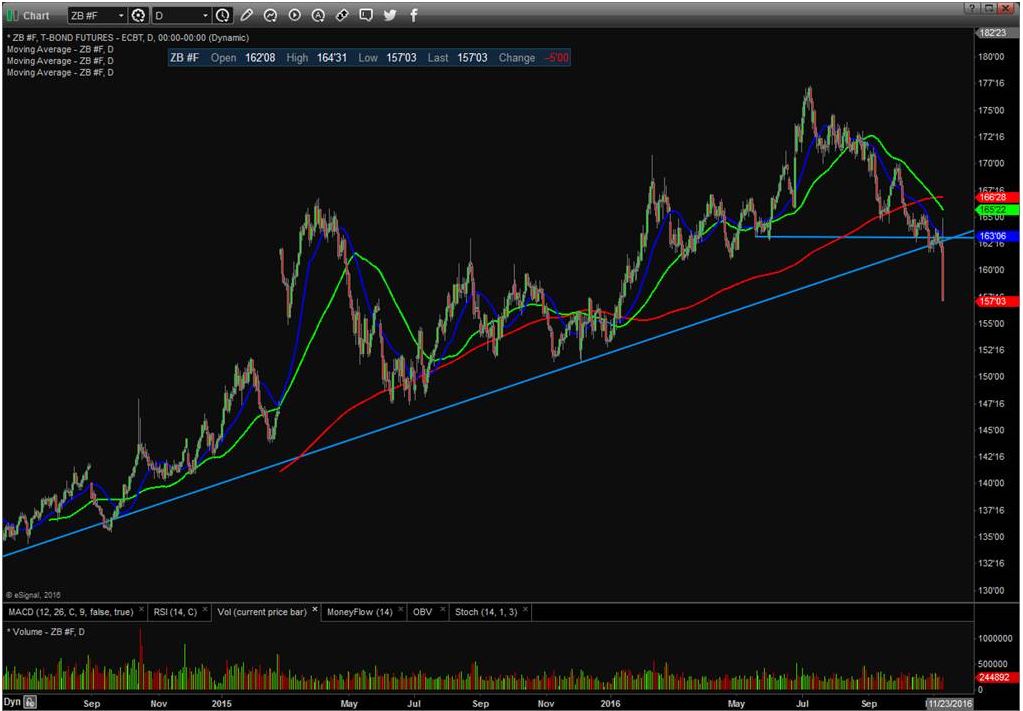

It’s hard to overstate the degree of carnage we’re seeing in the bond market here. Treasuries are getting absolutely murdered, with long bond futures plunging five ponts in price.(see chart)

The yield on the benchmark 10-year Treasury Note, for its part, is soaring 21 basis points to 2.07%. This is the bond market’s way of saying that seven long years of interest-rate repression, never-ending QE, and overly experimental monetary policy is coming to a close. That’s bad news for things like real estate prices and REIT shares. But the money coming out of bonds could rotate into “Trump-derivative” sectors like defense and infrastructure.