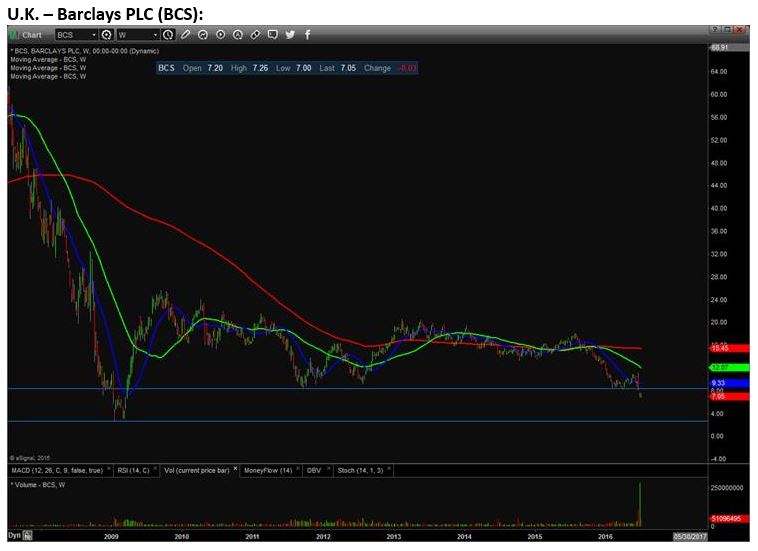

Looking for evidence of the “success” of central bank activism? Here are three examples of just how great QE, ZIRP and NIRP have been. The first is a chart of Barclays PLC (BCS), one of the leading British banks, which must have been a beneficiary of Bank of England QE, right? Oh wait, it’s about to fall to its 2009 credit-crisis low.

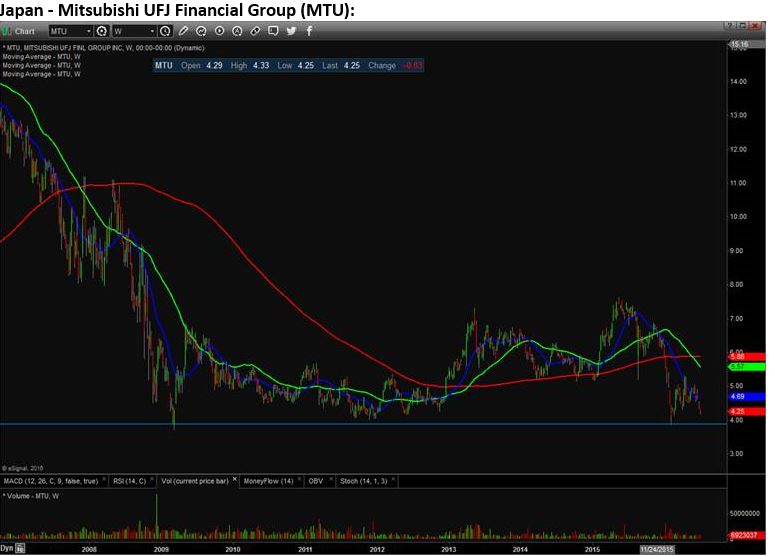

Maybe I’m just being unfair, what with Brexit and all. So let’s look at Mitsubishi UFJ Financial Group (MTU) of Japan, a country whose QE has been more aggressive than any other on the planet. Oh wait, it’s about to fall to its 2009 credit-crisis low.

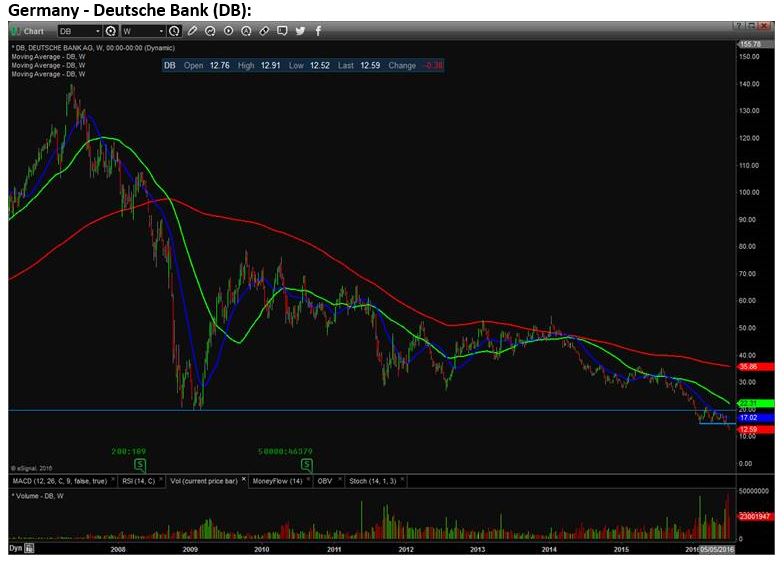

Surely, all is well in Europe then, where European Central Bank President Mario Draghi is buying up everything and anything as part of his “whatever it takes” plan. Oh wait, Deutsche Bank (DB) is crashing to an all-time low.

All told, the Wall Street Journal reported earlier today that the 20 biggest banks in the world have lost a combined $465 billion in market value just this year. If that doesn’t prove that Janet Yellen and her counterparts overseas have a firm hand on the till, then I don’t know what does! Ahem.