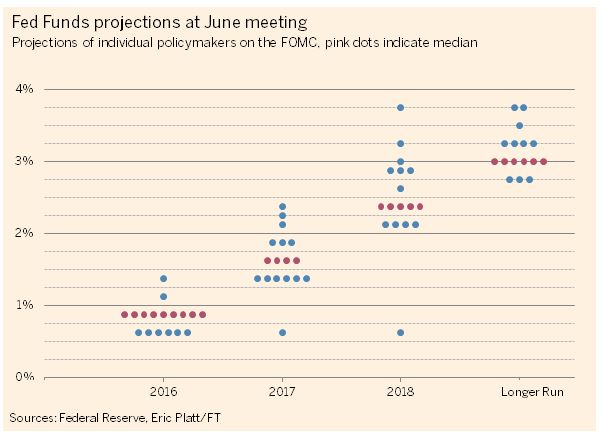

The Fed keeps cuttings its estimate of the “terminal”/long-run federal funds rate. In other words, it is slowly but surely giving up on the optimism it had previously. See this note from the Financial Times – noting the median, long-term funds rate dropped to 3% this time from 3.3% in March and 3.5% in December …

“Federal Reserve policymakers once again trimmed their forecast for the long-run federal funds rate — the latest indication that this rate rise cycle may deviate from the past.

“The Fed’s median long-run forecast for the federal funds rate, the central bank’s benchmark interest rate, clocked in at just 3 per cent, down from 3.3 per cent in March and 3.5 per cent in December.

“Goldman Sachs said in a note to clients ahead of the report that such a move may ‘signal that the Fed is gradually losing confidence in the kind of tightening cycle that history demands.’

“The long-run rate is significant as it indicates the level of interest rates the Fed expects will be needed in the long run to keep the economy growing at a stable rate — not too fast, and not too slow.”

{ 1 comment… read it below or add one }

this could also push a recession further down the road. not such a bad thing.