Earlier today, I noted the significant weakness in autos and credit card companies.

Check out SYF if you want to see an ugly, ugly breakdown – one precipitated by the private label credit card company’s warning that consumers were increasingly having a tougher time paying their card balances off.

But it’s more than that. For instance, falling interest rates and collapsing spreads are crushing the European banks (DB, CS, SAN, HSBC, etc.), with many at or near all-time and multi-year lows.

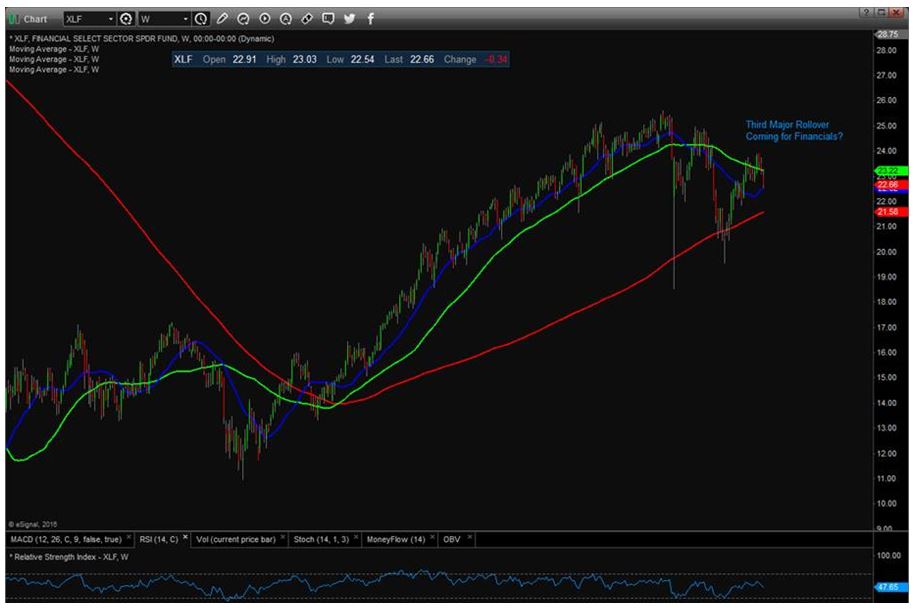

As a result, the U.S. Financial Select Sector SPDR Fund (XLF) is dangerously close to rolling over for the third time since last summer. We’ll get a lot of news on the central bank policy front in the next few days, so I don’t want to jump the gun here. But if this XLF break extends to the downside, I don’t see how the broad averages hold up.

{ 1 comment… read it below or add one }

Hey Mike, Rob here Weiss Elite member. Thanks for the brief articles you publish frequently about different sectors of the market. They are brief enough to read without getting bored yet full of enough info to get the point across. Thank you Rob Florence