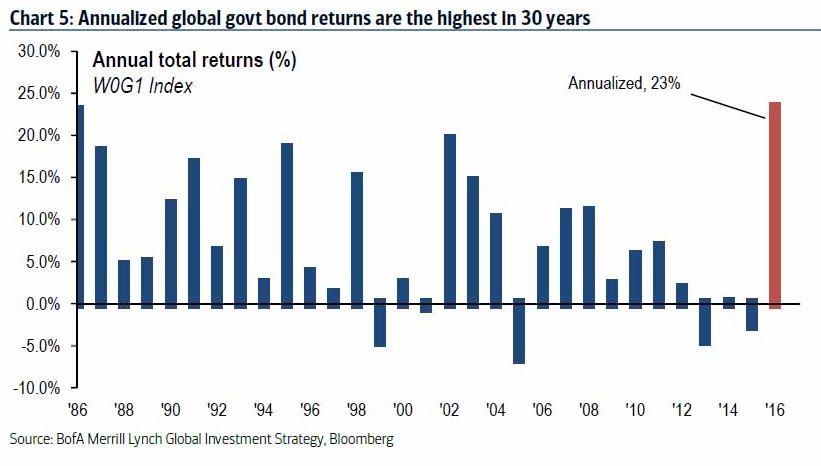

This year, it’s all bonds, all the time. As a matter of fact, a benchmark index that tracks global government bond returns is up an annualized 23%. That compares with a year-to-date gain of a percentage point or two for the S&P 500.

To use a technical term, that’s totally NUTS. Government bonds are supposed to be a nice, quiet, safe backwater of investing. They aren’t supposed to trade like dot-coms. But that’s what happens when you have a combination of: 1) Out of control central bank policy 2) Rising recession/deflation risk 3) “Quantitative Failure” spreading from Japan to other corners of the world and 4) Short-term fears of Brexit.

Bonds have come so far, so fast, that I just bagged some profits on a long bond position in All Weather Trader. I may bag some more shortly given the toppy technical action. But my point isn’t to push bonds as a “Buy” here. It’s to point out how crazy this market environment is, and how when that’s the case, the risk of major market “accidents” is high.