Good morning – I know that with stocks, it seems like nothing will ever send prices down. But I would keep a close eye on the currency markets. The Japanese yen is flying against the dollar again this morning, breaking above the 1 level (yen futures) as shown below. The buck is also getting creamed against the Swiss franc, euro, and virtually every other currency. The catalyst was a new essay from the San Francisco Fed Governor, who basically admitted Fed policy isn’t working and that interest rates may need to stay lower for longer than thought previously.Â

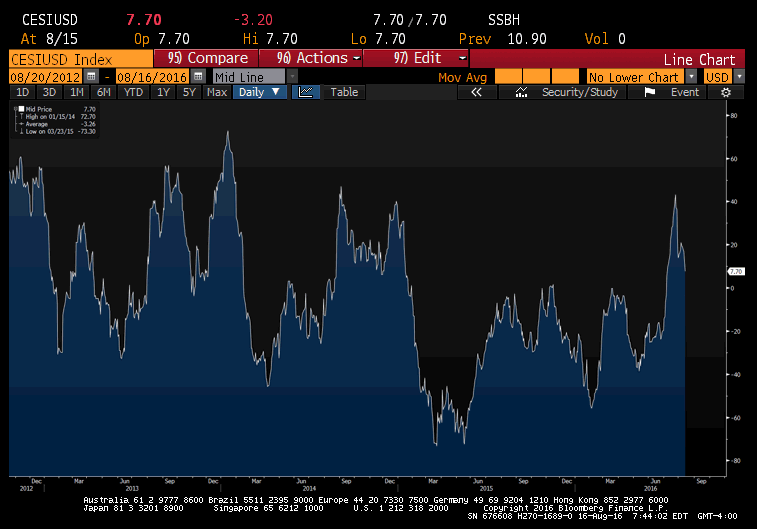

Gold is loving this move, up around $12 at last check (though still not breaking out of its recent range). But what I would really keep an eye on is the attached chart. It shows Citigroup’s economic surprise index. Every bull on Wall Street made a huge stink about its recent surge, saying that proves happy days are here again. But now that it has fallen from those highs to a one-month low? Crickets. There’s still time for the breakout to hold, depending on what the economic reports due out in the next couple of days show. But I figured I would flag this since no one else is.Â

Cheers!