|

The U.S. economy has definitely taken a turn for the worse in recent months, and just about everyone on Wall Street and in the media seems to be pointing the finger of blame at old-man winter.

Corporate CEOs may be most responsible for this weather-related blame game. During fourth-quarter reporting season, hundreds of chief executives from across the country cited bad wintery weather as an excuse for poor sales or profit results. According to data compiled by Bloomberg, the word “weather” was mentioned 322 times this year in CEO comments about the economy through March 14. That was more than four times the number of citations made during the same period last year.

|

| Cold temperatures aren’t a convenient excuse for poor sales or falling profits. |

Cold temperatures may bear some of theblame, but you simply can’t use that as a convenient excuse to explain away the slumping data.

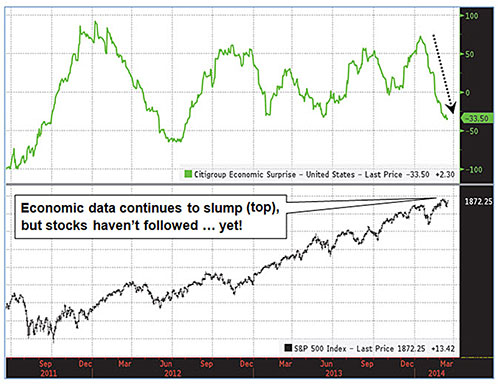

The chart below plots the Citigroup U.S. Economic Surprise Index (upper panel) and the S&P 500 Index (lower). It’s a key barometer for the economy I watch closely that measures the number of positive surprises among incoming data compared to negative disappointments.

More negative than positive surprises cause the index to fall, and in the past, stock prices often follow suit.

And you can clearly see that negative surprises began outnumbering positive data in early January, but that doesn’t mean the Polar Vortex is solely responsible for sending us hurtling toward recession.

The business optimism index published by the National Federation of Independent Business (NFIB) declined in February to its lowest level since March 2013. Granted, bad weather may have contributed somewhat to souring sentiment among business owners last month. However, one of the survey questions that dragged down the NFIB index focuses on business expansion plans three months from now, in May, when blizzards aren’t likely to pose a threat to businesses.

In fact, the NFIB Index is not much higher now than it was at the depths of the last recession during 2008, so clearly something more fundamental is troubling business owners than forecasts from the Weather Channel.

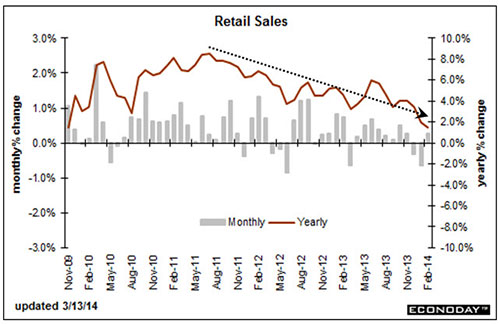

Poor retail sales in January were widely blamed on snowstorms that blanketed the U.S., and investors were relieved last week when February retail sales rebounded with a 0.3 percent gain after slumping -0.6 percent in January … even though wintery weather persisted last month too.

The fact is, as seen in the chart above, U.S. retail sales have been in a clear downward trend for the past three years, which you can’t blame on this winter’s unseasonably cold weather.

Dig even deeper into the retail sales data and you’ll find a category near the bottom of the report called “Nonstore retailers” which essentially includes Amazon, eBay and other online merchants.

You might think all of those snowed-in consumers would have simply done their shopping online instead, giving nonstore retailers a boost in January and February … but you’d be wrong.

In fact, according to the data, online retail sales expanded just 1.2 percent in February, after dropping 1 percent in January. The two-month total of just 0.2 percent growth in online sales isn’t even close to the 10-year average of 1.8 percent for these two months combined.

The downtrend in consumption and business activity has been dropping along with temperatures in recent months, but not because of them. Taking a closer look at all the data reveals too many inconsistencies, including weak online sales, that tell me the economy is slowing for more fundamental reasons.

What will companies and the media use as a convenient excuse if growth is still slow in June?

I know … hurricane season!

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 1 comment }

Good article.I believe there is a major change happening.The U.S. economy has been 70% dependent on consumer spending.China has been dependent on exports for a major part of it's economy,while it's people saved their money.Now the U.S. is moving towards more exports,more savings and less consumer spending,while China does the opposite.Wouldn't want to invest in U.S. retail,today.