|

We’ll give you our answer soon.

But for now, let me say this: If you think it’s time to throw all caution to the wind, accept high risk and go for high yield, just take one quick look at what’s happening in the world’s biggest economy: Europe.

The GDP of the European Union (EU) is nearly $17 trillion, making it about $1 trillion larger than the U.S. economy.

Its population is more than 500 million, also far larger than the U.S.

Its half-dozen megabanks have far more assets than all U.S. banks put together.

And it’s sinking.

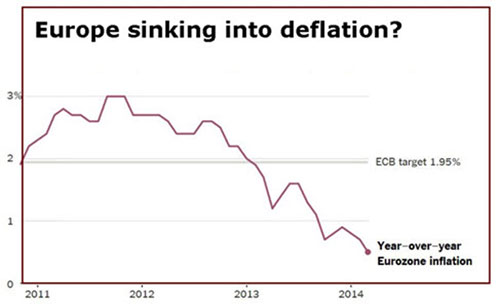

Just this week, European Central Bank president Mario Draghi finally admitted it: He declared bluntly that the EU is at risk of sinking into deflation, a downward price spiral that can destroy banks, destroy corporate profits, and make it impossible for companies to hire.

Also this week, Europe’s leaders were dealt a painful blow to the gut, as the majority of voters rose in rebellion against the European establishment.

|

| Click here for larger image |

| European inflation falls far below the central bank’s target level. |

And we haven’t even started talking about the potential damage to a region that’s caught in the middle of a new, emerging cold war between global superpowers. (See what I said about this last week.)

I warn you. Don’t write this off as something far away or irrelevant. Nor can you say it’s just another Eurocrisis that comes and goes.

Quite the contrary: What you see happening today is the convergence of all recent European crises in one time and place — a currency crisis, a deflation crisis, the debt crisis, the banking crisis, the unemployment crisis, and the long, smoldering popular movement for European disintegration.

It’s the Grand Convention of Ghosts Past and Present, returning to haunt all advocates and apologists for a united Europe.

And just by its sheer size, it’s likely to have a major impact on the entire world.

For starters, consider the sudden, dramatic rise of anti-establishment, anti-EU, populist movements in this week’s landmark European Election, sending shock waves up the spine of virtually every head of state on the continent.

In Great Britain, the UK Independence Party swept to EU Parliamentary victory — the first time in a hundred years that BOTH the Conservative Party AND the Labour Party lost an election. These folks want England to withdraw from the European Union entirely. They want to scrap the free movement of people within the EU. And they’re not exactly members of the good ol’ boys club: UK Prime Minister David Cameron once described the party’s members as “fruitcakes, loonies and closet racists.”

|

| France’s National Front leader Marine Le Pen |

In France, the National Front won for the first time in history. They want to get France the heck out of the euro zone and reintroduce national border controls.

Just this past Wednesday, party leader Marine Le Pen vowed to form a bloc in the European legislature to restore the power of individual member states.

In the Netherlands, victory went to the Dutch Party for Freedom, also campaigning for a Dutch withdrawal from the European Union and the reintroduction of state border controls.

Germany’s Alternative for Germany, a newcomer to the country’s politics, won a surprisingly large share of the vote. Its manifesto: “A careful and organized dissolution of the currency union.” In other words, an end to the euro and euro zone.

We see the same trend in Hungary, Denmark and Finland. We see it happening in local elections and national elections. We see it on the streets and even among some elites.

In all of these countries I’ve cited so far, the rebellion comes within a tradition of right-wing politics, with oft-heavy overtones of anti-Semitism, anti-Arab and anti-immigration rhetoric.

Meanwhile, in at least five European countries, including Spain, Greece and Portugal, the revolt came mostly from the left. They’re rebelling against austerity. They want jobs. They want to keep or restore their pensions. But like the right wing, they’re fed up with the European establishment.

Deflation and Disintegration

Now, put it all together, and what do you have?

You have the largest economy in the world, sinking into a deflationary spiral … careening toward possible dismemberment … inviting social chaos.

Will this drag the U.S. economy into the same gutter? Or will it drive massive amounts of scared money from Europe to U.S. markets?

What about the impact on gold and silver? Will the latest dip in prices set off panic selling in the precious metals? Or will it attract a new wave of buying by Europeans and others seeking safe havens?

Stand by for our answers here in Money and Markets.

And in the meantime, hop on my blog to help answer the big question of the day: Will Europe sink the U.S. economy?

Good luck and God bless!

Martin

|

EDITOR’S PICKS

Want a House? Be Rich and Pay Cash by Mike Larson If you want to own a house today, you can. Just make sure you are A) Rich and B) Can pay cash! That’s my not-so-tongue-in-cheek summation of the state of the housing market, based on all the data I’m seeing. How to Profit from the “Stealth” Market Correction by Mike Burnick A “stealth” market correction has been underway on Wall Street the past few months. If you blinked, you might have missed it. Techs go sideways, but look upward by Jon Markman Tech shares inched higher last week, recovering some of the losses suffered in the first four months of this year. |

THIS WEEK’S TOP STORIES

Stocks’ sweet spot could turn sour without growth by Bill Hall In recent Money and Markets columns, I have been saying that we are in the sweet spot for U.S. stocks and investors should consider pursuing a “risk on regardless” strategy in their portfolios. Volume deficit disorder: A trend in your favor by Don Lucek Three trillion dollars. It’s not chump change, and it’s the most recent figure I’ve seen of investor cash sitting in money-market mutual funds (Investment Company Institute estimate). Digging Deep to Find the Right Mining Stock by Larry Edelson As I’ve mentioned in the past, mining shares will soon be a major buy, but importantly, not all mining shares. |

{ 2 comments }

Serious questions. Chaotic forces are at play at home and abroad, with unpredictable consequences.

the U S economy is already sinking. Its only life preserver is the printing press. The euro zone troubles will expose the real economy.