|

Last week’s big, potentially market-moving event, turned out to be a snooze fest, just as I expected.

The annual Woodstock for central bankers at Jackson Hole, Wyo., ended with no surprises.

After all, when your headline acts are Janet Yellen and Mario Draghi, it’s time to pass out the NoDoz!

Still, there exists a glaring disconnect between what the Fed is saying about the path for monetary policy over the next few months and what the market believes that path will be.

Markets are a bit too complacent about monetary policy. And, something’s got to give, which is bound to lead to unexpected volatility ahead. Here’s why …

First, the odds of another Fed rate hike this year have been falling fast, with only a 1-in-3 chance of an increase in rates by the end of 2017, according to the latest data. That’s down from better than 50-50 odds of a rate hike just a few weeks ago.

Meanwhile, public comments by Federal Reserve officials — other than Janet Yellen — have consistently mentioned risks to financial stability if the Fed doesn’t continue to raise rates from our still extraordinary low levels.

Second, the Fed is prepared to start unwinding its $4.5 trillion bloated balance sheet of Treasury and mortgage-backed securities — perhaps by as much as $10 billion to $50 billion a month.

Details could come as soon as the September policy meetings, just a few weeks away. But in July, several Fed members were already prepared to start shrinking the balance sheet.

And nobody really knows what impact the unwind will have on fixed-income markets, once the Fed becomes a seller of bonds, after nearly a decade of being the buyer of last resort.

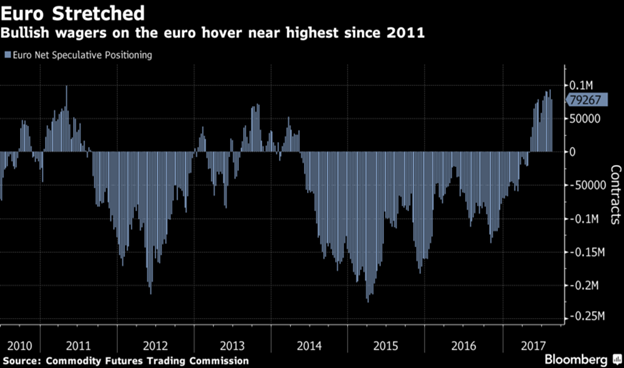

Third, two of the most crowded trades on Wall Street right now are to be short the U.S. dollar (long the euro) and long U.S. Treasury bonds.

These trades are wagers that the Fed doesn’t raise rates as aggressively as expected and/or doesn’t begin unwinding their balance sheet.

|

|

| Wall Streeters have been lulled into a false sense of security about the plans of Janet Yellen’s Fed. |

I’m willing to take the other side of those bets because sentiment is completely at odds with what the Fed itself has telegraphed to the markets. Talk about excessive complacency!

Adding to my conviction, our own E-Wave cycle model is forecasting both a sharp reversal to the upside for the dollar, plus a selloff in Treasury bonds during the months of September and October, which lines up perfectly with the next Fed meeting.

How to profit from it: If you’re willing to take the other side of these trades too, consider these two ETFs: PowerShares DB U.S. Dollar Index Bullish Fund (UUP) and ProShares Short 20+ Year Treasury (TBF).

UUP is designed to rise in value along with the buck, meaning a euro decline. And TBF is designed to move up as long-term Treasury bond prices go down and yields rise.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 8 comments }

Another question no one is asking, just who is going to be willing to buy bonds in the amounts mentioned? 50-80 billion per month? Not that many fools around me thinks.

How about gold? You forecasted gold would go Down to $1175 by Step 4. However it looks it will go to highest point by that time. How do you think about it? I am looking forward to hearing from you.Thanks.

Marina

I agree with your thinking. I also think that gold has peaked, and is now on its way to $950 and silver on its way to $10.

What will happen to US Treas. Bills (3-9 Months) if depression?

What if US Govt goes bankrupt? Will Bill still trade at almost full price?

If NOT, where should investor put such funds?

The U.S. govt has been operating in bankruptcy for years.Like a company in chapter 11 bankruptcy.Watch the value of the common stock of the U.S. govt,the Dollar.When it goes,game is over.

What happened to the August report ?

The Fed says all kinds of things,making people think they are some independent body,that can do whatever it wants.In reality,they are just enablers of govt deficits.They aren’t going to do anything that might cause the Titanic to sink faster.The real thing to watch is the Dollar’s purchasing power.As long as the Dollar doesn’t go into freefall,the Fed can and will monetize govt deficits.If the Dollar starts a major decline,then the Fed will have some major worries.I wouldn’t have more than 5-10% of your assets in risky holdings,like Dollars and other fiat currencies.Better to have more invested in money(AKA gold).

Mike where are you gold gold gold::))