|

When investors started freaking out in January about the U.S. economy and U.S. markets, my approach was to take a deep breath, remain calm, and counsel a “Steady as She Goes” investment approach. Sure enough, the sell-off petered out and the Standard & Poor’s 500 Index hit a fresh, all-time intraday high this week.

Many of the stocks I’ve identified that actually benefit from rising equities (and rising interest rates) — and the stocks I’ve highlighted that are virtually impervious to rising rates — are doing very well. A couple of specific names rose more than 80 percent last year, and there’s still time to learn about them in my “How to Profit from Changing Interest Rates” course.

But one key market is sending out warning signs — the kind you should be paying attention to. That market is China.

|

| China is sending out warning signs that you should pay attention to. |

A lot of the economic data and information coming out of the country is opaque, confusing, and in some instances, of questionable validity. But you can observe market prices in the interest rate and interbank markets there, and get some clues on how things are going from them.

With that in mind, we’ve seen a real blowout in something called the two-year swap spread over in China. Without getting too deep in the weeds, suffice it to say this is an indicator of financial industry stress. It started going haywire here in the U.S. before the great credit crisis, stock market collapse, and recession of 2007-2009 — servicing as an excellent early warning sign.

In China, that spread just surged to 121 basis points. That’s the highest level for the seven years Bloomberg has been tracking.

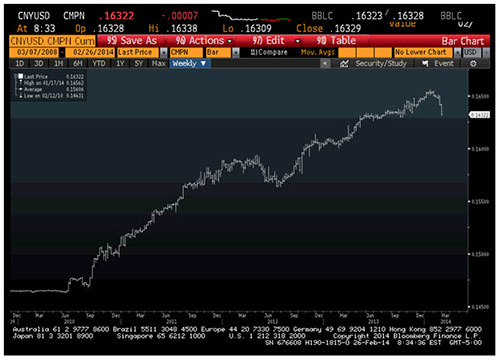

Meanwhile, the value of the Chinese yuan currency just dropped more in one day than it has in any day since November 2010. The cumulative declines seen in the past week or two were also the largest since 2007, and they ended a nearly non-stop period of steady strengthening over the past few years (as you can see in this chart).

Two other troubling indicators: Bad loans in the Chinese banking system just jumped to 592 billion yuan ($86.4 billion) — the highest in five years. Plus, the spread between yields on corporate bonds and on underlying government securities is widening steadily to levels we haven’t seen in the past couple of years.

I’ve been avoiding emerging market bonds, currencies, and stocks for a long time now out of fear that the tapering of QE and the gradual normalization of policy in the U.S. could hurt their value. Instead, I’ve been focused on investing in select stocks and sectors here in the U.S. that have a strong tailwind — sectors like domestic energy, aerospace, and more.

That plan has worked out very well. The question going forward is whether or not the weakness in select emerging markets — and the emerging credit market tremors I’m seeing in China — will be enough to upset all global markets.

I don’t think we’re at that point yet. But you can bet your bottom dollar that I’m remaining vigilant. I’ve learned in my past 17 years of following the financial and interest rates markets that you can’t ignore some of these more esoteric indicators — or they’ll come back and bite you when you least expect it.

Until next time,

Mike