|

One of the little understood qualities of tech and biotech stocks is that they can prosper even when the broad market is undergoing a lot of stress.

There are many reasons, but they all boil down to the fact that information technology is not a discretionary item in the lives of most individuals or the prospects of companies. It is integrated so deeply into their lives at this point in the 21st century that you might as well ask someone to go without food and water as to ask them to spend a week without their digital connections to the outside world, the world of entertainment, the world of education, friendship, commerce and health.

|

| With biotechs and other medical technology, there is simply no alternative no matter what sort of financial crisis is endured. |

Indeed, information technology is in many ways more of a consumer staple than the items currently categorized that way by the market, which are things like processed food, detergent, carbonated beverages and over-the-counter drugs.

Ask yourself if you would sooner go a week without Kleenex or a smartphone; without a can of Diet Coke or your iPad; without a package of cheese or your computer? ‘Nuff said, right? The old Revolutionary War slogan, “Give me liberty or give me death,” could be modified to, “Give me a place to recharge my phone, or just shoot me.”

And the same goes for biotech.

Modern life is almost inconceivable without the advances made by enterprising, dice-rolling scientists who have bet that they can turn a $10 million investment in lab equipment and ingenuity into a billion-dollar product that saves lives, or at least prevents acne.

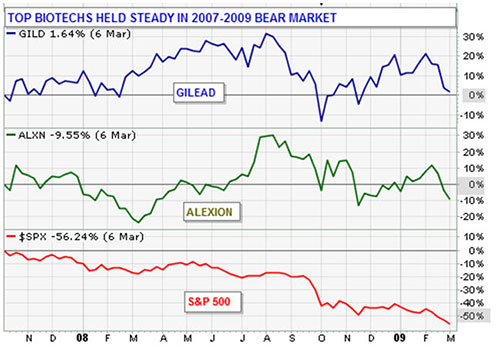

Even in the worst of the financial crisis of 2007-2009, many of the top biotech companies, such as Gilead Sciences (GILD) and Alexion Pharmaceuticals (ALXN), held steady while the broad market fell by as much as 56 percent, as shown in the chart above.

It’s not just financial crises that techs and biotechs can survive with grace. It’s also the sort of crisis of confidence in government and central bank activity that can lead to the decline in the value of the dollar. In fact, an erosion in the value of the greenback can even be a plus for techs and biotechs, as it makes their products less expensive overseas, a phenomenon that leads to higher sales, increases in market share and improved profit margins.

|

Meet Money and Markets’ JON MARKMAN!

Jon began his career as editor, investment columnist and investigative reporter at the Los Angeles Times. As news editor, his staffs won Pulitzer Prizes for spot-news reporting in 1992 and 1994. In 1997, Microsoft recruited Jon to help launch MSN’s finance channel, where he served as Managing Editor. In that capacity, Markman became the co-inventor on two Microsoft patents. From 2002 to 2005, Jon served as portfolio manager and senior investment strategist at a multi-strategy hedge fund. Since 2005, Mr. Markman has specialized in helping everyday investors buy tomorrow’s technology superstars BEFORE they skyrocket. Mr. Markman is the author of five best-selling books, including Reminiscences of a Stock Operator: Annotated Edition; New Day Trader’s Advantage, Swing Trading and Online Investing. |

As an example of the latter, imagine a world in which the value of the dollar were to decline 20 percent vs. the euro. A French company considering spending $10 million on an installation of business-management software might consider products and services from both the German giant SAP (SAP) and U.S. giant Oracle (ORCL). All other things being equal, such as the functionality of the software, the French firm would be more inclined to pick Oracle because its euros will stretch 20 percent farther with the American brand.

With biotechs and other medical technology, there is simply no alternative no matter what sort of financial crisis is endured. Consider products from the recently public company Pacira Pharmaceuticals (PCRX). The firm is focused solely on the development of non-opioid products designed to ease the pain in post-surgical patients. Post-surgical pain is a direct response to tissue damage that occurred during the surgery, with the severity of that pain determined primarily by the type of surgery, duration and the pain treatment choice.

According to many recent studies, nearly 50 percent of all post-surgical patients report inadequate pain relief, which is where Pacira changes things. The company’s flagship product is Exparel, a local analgesic that utilizes bupivacaine, more commonly known as Marcaine, in combination with its proprietary delivery platform, DepoFoam.

Drugs like Marcaine and the like are typically administered by injection directly to the surgical wound site, which can reduce pain for up to 20 hours after the surgery. Pacira, however, has been able to demonstrate that Exparel can be given as a single injection at the close of surgery and deliver pain control for up to a full 72 hours, all while reducing the need for supplemental opioid medications, which are drugs derived from potentially addictive opium extracts.

What kind of a doctor or hospital is going to deny this sort of treatment to a post-op patient just because there is a financial crisis? None, it would be irresponsible. No wonder the $2 billion company, which received FDA approval in October 2011 for Exparel, has surpassed $20 million in quarterly sales after just two years on the market.

My researcher spoke to a surgeon familiar with Exparel and other post-surgery pain alternatives. The doc mentioned that opioids such as Vicodin and Percocet are great for treating severe pain such as that common with surgeries, but come with a litany of risks. Common non-opioids such as Tylenol do not carry the same side-effects, but are also not as effective in severe pain cases.

Even in a crisis, a treatment like this will flourish. Analysts estimate that 75 million inpatient and outpatient surgical procedures are performed annually in the United States alone. Pacira estimates that over 40 million of these are opportunities where Exparel could be used with DepoFoam to treat patients as well as enhance hospital economics, which becomes even more important in a global economic setback. Just a 10 percent share would represent a $1 billion revenue opportunity.

Another set of tech upstarts that could survive a U.S. financial crisis would be ones based overseas. One of my favorite in the past two years is NXP Semiconductor (NXPI), whose chips are the brains behind everything from automobiles and commercial lighting systems to smartphones. Its biggest customers are the kinds of companies that will survive anything short of a nuclear holocaust, such as Apple (AAPL), Hewlett Packard (HPQ), Bosch of Germany and Samsung of South Korea.

NXP was spun out of the Dutch conglomerate Phillips and went public in late 2010. Despite being domiciled in the Netherlands, only about 3 percent of NXP’s revenue is generated in its host country. China, which generates 36 percent of sales, is the biggest revenue generator, followed by Germany at 12 percent, Singapore at 9 percent and the U.S. at 8 percent.

NXP focuses on high-level solutions across eight functional areas: automotive, identification, mobile, consumer, computing, wireless infrastructure, lighting and industrial. The company holds the No. 1 or 2 market position in most of the areas in which it competes. For instance, it is the leading supplier for automobile radios and keyless entry systems, government identification systems and near-field communications, which is the super-cool technology in smartphones that let you bump them against a pay terminal to pay, or against each other to transfer music or photos.

The company has a huge patent portfolio and spends more than $550 million per year on research and development, with 3,200 employees in 19 different locations dedicated to improving and creating new technologies. This is how a company fends off the deprivations of a crisis — not by burying its head in the sand, but by developing new products that will make its customers more efficient, more exciting to end users and cost less.

In short, I have a lot of confidence that even if another financial conflagration were to sweep across the globe, companies like Pacira and NXP — and others like them in the biotech and tech industries — will thrive.

Best wishes,

Jon Markman

P.S. Let’s talk tech stocks! Here’s your chance to ask me anything you like about technology stocks: Simply click this link to jump over to the Money and Markets Blog. I’ll check in during the day and give you my best answers to your questions.

I won’t be able to do this forever, so be sure to join the conversation right away:

Just click this link and let’s get the conversation going!