|

You’re the witness to some amazing history.

You’ve seen the Federal Reserve abandon a full century of Fed tradition … throw every book about monetary policy into the Potomac … and print over $3 trillion in paper money.

You’ve watched as they’ve sacrificed the future of our currency on the altar of expediency.

But are you aware of the true consequences?

Have you sat down to contemplate the potentially far-reaching impacts on your money, your income and every aspect of your life?

My recommendation: Don’t be persuaded by the theory that the dollar is invulnerable … that inflation is dead … or that none of this really matters.

Above all, don’t let anyone talk you out of protective investments. Indeed, the same investments that can help shield you from the consequences of the Fed’s folly also have the potential to deliver some of the greatest profit bonanzas of this era.

For specific examples, be sure to read every issue of Money and Markets. Our editors are continually scouring the globe for the best opportunities at the best time.

Today, I want to set the stage by taking you on a tour through time — to help you experience the consequences of central bank money printing … and to see the fortunes that can be lost, or made, as a result.

Unimaginable Is Not Impossible

Imagine a central bank that prints so much money that the nation’s currency falls to one billionth of its value — in just two and a half decades.

Imagine another currency that plunges five times further in the same time frame.

Or worse, imagine a currency that’s so thoroughly smashed and decimated that it’s left with just one hundredth of a billion of its original value after just 23 years.

Unimaginable? Perhaps. Impossible? Absolutely not!

In fact, I’m not talking about the hyperinflation that swept Germany after World War I. Nor are these examples taken from pre-modern times.

Rather, the examples I just gave you are from modern economies, the last of which is the eighth-largest in the world — Argentina.

|

Just to match the buying power of a single peso in the year 2000, you’d need 100 billion pre-1983 pesos (called the peso ley).

If you stacked those old 1-peso bills on top of each other, you’d have a pile that’s 6,896 miles high. And if you laid them end to end, they’d go around the earth at the equator, loop from pole to pole, and reach all the way from our planet to the sun.

The cost of the paper alone was thousands of times more than the money’s current value. Even the speck of ink used to engrave the letter “B” in “Banco Central de la República Argentina” cost more than that peso is worth today.

And with that destruction of the money came the demise of the country as well — not only the structure of its economy … but also the fabric of its society … the ethos of its culture … the core of its psyche.

|

Not long ago, during the climax of its post-inflationary collapse, it went through three presidents in 11 days.

Its National Congress was ransacked by rioters.

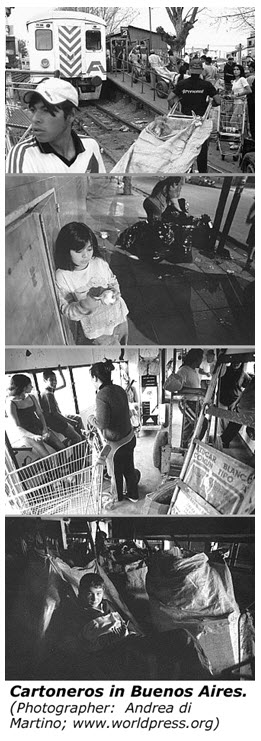

In Buenos Aires and other major industrial centers, professional, middle-class citizens — plus their children — could be found at rat-infested dumps, collecting bottles, cans, paper and cardboard.

So many trash pickers, or cartoneros — including young adults still dressed in work clothes — were sitting on the sidewalks throughout Buenos Aires that tourists said they had to be careful not to step on them when walking down the street.

As the crisis spread, street riots resulted in hundreds of deaths. The suicide rate soared. Banks closed. The economy virtually shut down.

Unlike Syria today, there was no civil war. But for many long months, Argentina virtually ceased to exist as a cohesive nation.

The Impact of Currency Collapses on the Wealthy Can Also Be Severe

Let’s say you were a well-to-do Argentinean industrialist. Your family grew its assets over many generations. You built factories and office buildings.

But about three decades ago, you sold your vast empire and retired, netting $50 billion Argentine pesos. Do you know how big your fortune would be worth today if you kept it in cash? Not even enough to buy a cheap cup of coffee!

I Personally Witnessed the Devastating Impact

of Currency Collapses Growing up in Brazil …

I was living in Piracicaba, an industrial town in the interior of the state of São Paulo, and one day stands out in particular — November 6, 1964.

At the time, Brazil’s central bank had been printing money at breakneck speeds, much like the U.S. Fed has in recent years.

I was at school, in the middle of Biology 104, when my high school classmates and I heard a loud, thundering sound from downtown.

We rushed to the window just in time to see the city’s largest building, under construction for two years, crumbling to earth.

|

| Martin Weiss, 1964, near site of skyscraper collapse in Piracicaba, Brazil. |

Several died. Our Portuguese teacher’s wife, who lived behind the building, was crushed and barely survived.

The apparent cause: To cope with rampant inflation, the contractor skimped on the cement and added some extra stories; while government officials, struggling with devalued salaries, took bribes to look the other way.

In other Brazilian cities, similar projects collapsed for similar reasons, with even more casualties.

Directly or indirectly, highways, bridges, dams and railroads were equally gutted by the falling currency.

The education system, once robust, went to hell in a hand basket.

Crime and corruption swept the nation.

Other Examples of Currency Chaos Abound …

The currency collapse in Germany in the 1920s was also driven by massive money printing by its central bank. End result:

- When people went to buy food, it doubled in price every 48 hours.

- When thieves encountered a wheelbarrow of cash, they took the wheelbarrow and left the cash behind.

- When the collapse finally climaxed in 1923, a loaf of bread that had cost one mark was going for 726 billion marks.

The currency collapse in Russia after the fall of the Soviet Union provides another illustration:

- In 1992, when post-Soviet Russia abandoned price controls, the inflation rate hit 2,520%.

- The value of the currency plunged from 100 rubles to the U.S. dollar in 1994 to 30,000 rubles to the dollar in 1999.

The currencies of other East European republics got slammed even more severely, again due mostly to money printing:

- In the Ukraine, if someone had robbed a bank and stashed 2 million of their currency in 1992, ten years later the most they’d buy with the loot was a candy bar. And last week, after the fall of the pro-Russia government, even a candy bar would be unaffordable.

- In Belarus, Yugoslavia, Romania, and other countries, the currency collapses were similar — or worse.

Not long ago, we also saw disastrous currency collapses in Turkey and Zimbabwe … and before that, in Thailand, Malaysia, the Philippines and Indonesia.

In each and every case, when the currency fell, international capital fled. The value of local debt instruments was obliterated. People’s lives, whether rich or poor, were shattered.

Some People Seem to Think This Is Strictly

the Fate of Developing Nations. Not So.

France suffered a series of currency devaluations in the years following World War II, also largely due to the central bank’s excesses.

Then, in 1981, it happened again. The French government began implementing nationalizations and economic reforms. But international investors didn’t like that. So they dumped the franc and took their money elsewhere.

At first, the French made some futile attempts to support their currency. But soon they were forced to devalue — three consecutive times between October 1981 to March 1983.

Eight years later, nearly all of Western Europe was swept up in a sweeping currency crisis in 1992.

Five years after that, currency collapses hit nearly all of East Asia.

In short …

This is No Game. Nor Is the United States Immune.

Let’s review the history.

President Nixon’s moves to devalue the U.S. dollar in 1971 set off a decade of rampant inflation.

President Carter’s neglect of the dollar in the late 1970s culminated in surging interest rates and the collapse of the U.S. bond market.

Not to be outdone, President Reagan let the dollar fall in early 1987, which set the stage for the worst single-day stock market crash in American history.

And now, here we are, with the greatest money printing-press extravaganza of modern times — $3 trillion and counting.

Right now, the U.S. dollar isn’t collapsing — yet. But that’s not because it’s strong. It’s strictly because the measuring sticks we use to value the dollar — other major currencies — are just as weak, or even weaker.

Our advice: Get ready to invest in the many instruments that inevitable rise when the dollar (or other paper currencies) falls.

Stand by for specific examples in these issues. Then, decide what you want to do.

Good luck and God bless!

Martin

|

EDITOR’S PICKS

Investors, Enjoy the Sweet Spot While It Lasts by Bill Hall As I pointed out in last week’s Money and Markets column, a state of stable economic disequilibrium is just what the market needs to maintain its lofty level and perhaps even move higher in these uncertain times. Investors Imperiled by Easy Money That’s Too Big to Remain Stable by John Ross Crooks, III Our policymakers in Washington, D.C. have indeed sown the seeds of economic destruction. I think the threats all boil down to the liberalization of U.S. and global monetary policy. Zeroing in on Stocks That Could Generate Ten-Fold Gains by Jon Markman When it’s time to dream big in the stock market, you need an action plan. You can’t just buy shares in companies with services and products you like — that’s a chump’s game. |

THIS WEEK’S TOP STORIES

Five Most Highly Rated Energy Companies by The Money and Markets Team The price of oil is on the march again, prodded upward by concerns about disruption in supply because of unrest in Africa and the Middle East, but also by optimism that growth in the U.S. economy will boost demand. The New Investment Game Plan for Technology Stocks by Douglas Davenport Mark Zuckerberg, the CEO of Facebook, just spent $19 billion to buy a company called WhatsApp. That’s seriously amazing. He’ll be 30 on May 14. Can you name one person under 30 who spent that much on anything? You probably had never heard of WhatsApp before last week. Don’t Be Tricked by Worst-to-Best Turnarounds in Investing |

{ 1 comment }

Really excellent article.In fact,a Fed member,just yesterday,not only thinks the Fed hasn't created enough fiat currency,he wants more,to get the inflation rate up.This is the same thinking in Europe and Japan.These central banks,think,they haven't created enough fiat currency.They think more inflation,is good.It wouldn't surprise me,if all fiat currencies crash,at the same time.