|

On March 28, I wrote an article about The Telltale Tale of (Falling) Tax Payments. In it, I told you:

“We’re talking about a huge drop in corporate tax collections, not the type of news you’d expect to hear during periods of strong economic growth. In fact, that type of drop suggests that a serious economic downturn is around the corner.”

Well, our government’s financial statement continues to deteriorate:

The federal budget deficit grew by $176.2 billion in March, significantly higher than consensus forecasts of around $160 billion.

These $100-billion-plus per month deficits aren’t unusual; there was a $192 billion deficit in February.

For the first six months of the government’s fiscal year, the year-to-date deficit has climbed to over a half trillion dollars ($526.8 billion). That’s a 14.7% increase from last year’s six-month total of $459.4 billion.

When the numbers get that large, it isn’t easy for us mere mortals to keep them in context. But here is what I think really matters: Government income has dropped by 0.2% over the last year while government spending has increased by 3.2%.

Don’t try to make that a partisan political issue; Trump AND Obama get to share these results.

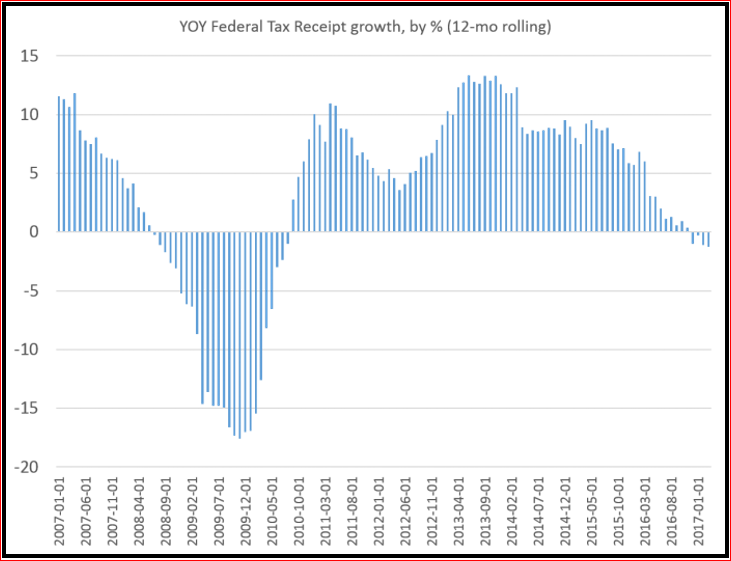

Washington, D.C. has always had a spending problem. But the deficit is getting worse because the federal government now has an income problem. Year-over-year federal tax receipts have declined for four months in a row.

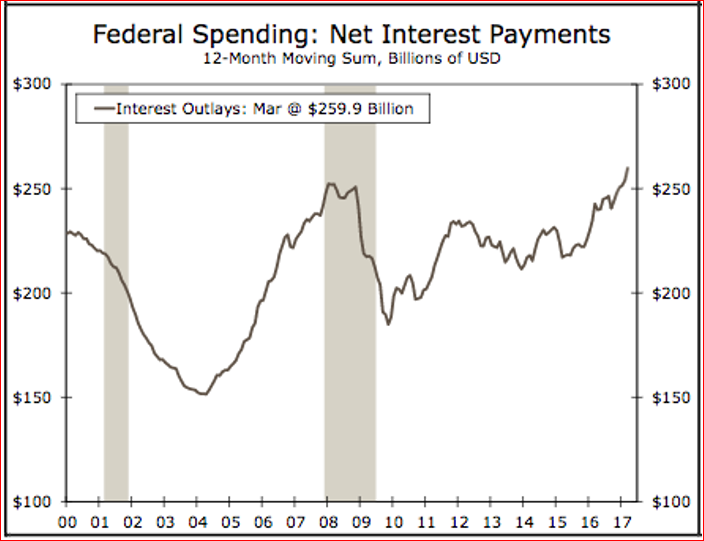

Moreover, President Trump has prioritized tax reform and fiscal stimulus. If he’s successful, those programs will push the deficit sharply higher, especially when you consider the impact of the last two Federal Reserve rate increases on the cost of servicing our $19.85 trillion national debt.

By the way, American individuals are racking up a mountain of debt too. Total credit card debt hit $1 trillion this month. Total outstanding consumer debt — credit cards, student loans, auto loans, and other non-revolving credit — now stands at $3.8 trillion.

The above doesn’t include mortgage debt. But Americans are starting to treat their homes like ATM machines, like they did at the height of the last real estate bubble.

Freddie Mac reported that 45% of all home-loan refinancings in the final three months of 2016 were cash-out type loans. That was the highest percentage of cash-out loans since 2008.

In a cash-out mortgage, borrowers end up with a new mortgage that is larger than the one they’re replacing. The borrowers pocket the difference between the old balance and the new mortgage. Just like an ATM machine!

Debt, debt everywhere. What’s does all this mean for investors? Lots!

First, the end result of any type of debt is that of consumption being pulled forward. Today’s debt is robbing tomorrow’s consumption. That will have a chilling effect on our already sluggish economy and will become a millstone around the stock market’s neck.

So, you need a strategy other than “buy, hold, and pray” to protect your portfolio during the next bear market. For example, if you had purchased the inverse ETF, ProShares UltraShort QQQ (QID) on March 28, you would be sitting on a 4.3% open gain (through last week’s closing price) even though the Dow Jones Industrial Average lost over 200 points.

Second, the bullish sentiment that the U.S. dollar has been enjoying is in danger of disappearing amid this mountain of debt. The problem for the overwhelming majority of Americans is that almost everything we own — our homes, our 401ks, our stocks, our bonds — are priced in dollars. Most investors desperately need to include international diversification. For example, there are rock-solid Asian and Latin American stocks with low valuations and fat dividends.

Third, all reckless government spending roads lead to precious metals. If you haven’t made precious metals a part of your investment strategy … you should. Take a look at Mike Burnick’s April 10 column, Is It Time to Back up the Truck on Mining Shares?

The most important strategy of all is to clean up your own balance sheet. If you have any outstanding debt … make it a priority to pay it off as soon as you can.

I am proud to say that I don’t owe a penny of debt to anybody. That’s right; no credit card debt, no auto loan, and no home mortgage. I cannot begin to tell you the peace of mind that being debt free brings me.

It’s too bad that nobody in Washington, D.C. feels the same.

Best wishes,

Tony Sagami

{ 6 comments }

Keep up the good work Tony! You are right on!

Coy that! our tome issues identifieable points that mark the accumulation of debt and that follow each unnecessary expenditure.

I hope that your readers are giving it attention, eapecially in the halls of congress.

from,

Tony, Blue Springs MO

Yes, I agree I have no debt

Tony,

The charts don’t lie. Good article, a picture is worth a thousand words. And I like the idea of being debt free. But what will happen if you own QID and the gove devalues the dollar. Wouldn’t that make the price of everything increase and the price of QID drop?

“Don’t try to make that a partisan political issue; Trump AND Obama get to share these results.”

Right on!

Presidential administrations are always undeservedly blamed or credited economic disasters or successes. Congress approves spending, not the President.

What has Congress accomplished to benefit you in the past eight years? Affordable heath care is a plus for some. Otherwise NOTHING. What has Congress accomplished since the election Again, NOTHING.

In the meantime, the Fed, a consortium of private banks, has been running the show. The U.S. currently is a corporate-driven anarchy whose only vision is profit and greed, thanks to the 92 million who didn’t bother to vote.

“… there are rock-solid Asian and Latin American stocks with low valuations and fat dividends.”

That’s funny.

low valuations + fat dividends = HIGH RISK, as in lose your shirt…rock-solid as quicksand.

How stupid do you think we are?